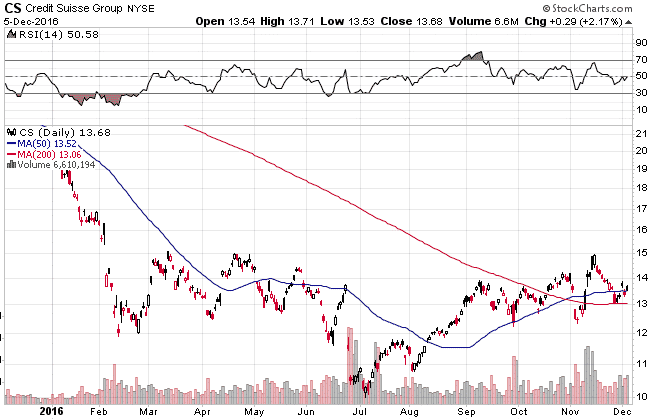

CREDIT SUISSE

This beaten down stock has been in recovery mode since July. It recently broke above the all important 200 day moving average before pulling back to successfully test that level. CS is up 7% today and looks like it wants to move higher, if it breaks above $15, it could reach $17 in pretty quick time.

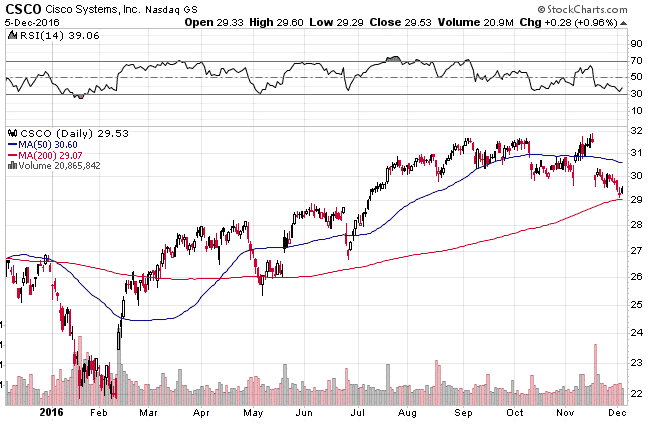

CISCO SYSTEMS

Cisco has been a really strong stock this year, rising from $22 in early March to $32 in mid-November. The stock has since pulled back 10% to provide an attractive entry point. RSI is oversold and the stock is holding above the 200 day moving average. Pays a healthy 3.56% dividend.

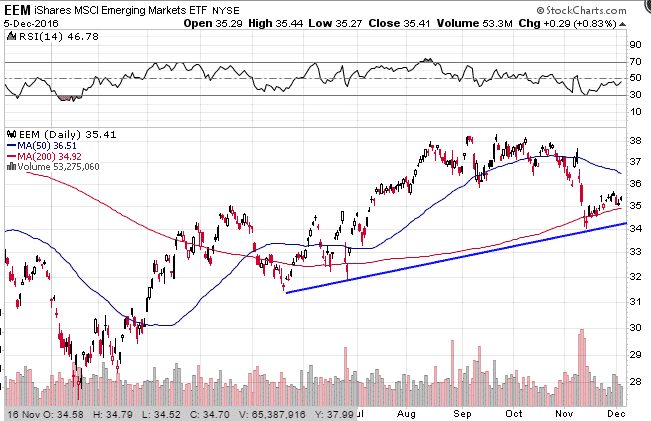

EMERGING MARKETS ETF

Another one that has had a nice 2016, but has since pulled back to the 200. Holding above that and above support.

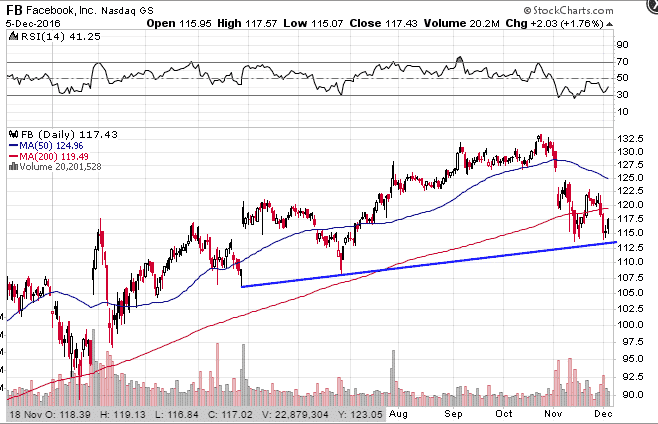

FB is oversold on a daily timeframe and holding above support. The concern is that it is below the 200 day moving average which is a no go zone for some investors. I wrote an article recently talking about this stock.

Another stock that has been trending higher this year. There was a massive pullback recently when the buyout was hit on the head by Google and Salesforce. Still holding above the trendline and the 200. The 200 has flattened and is trying to move higher.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.