Contents

Have you ever put on an iron condor and saw that the payoff diagram is not centered even though you have selected the short strikes both at 15-delta?

We are going to learn how to fix that.

The Initial Setup

Suppose we initiate a 5-point wide iron condor on SPY with short strikes at 15-delta.

Date: October 15, 2020

Underlying: SPY

Price: $347.54

Buy 1 Nov 20th, SPY 310 put @ $2.295 (delta = -0.1232)

Sell 1 Nov 20th, SPY 315 put @ $2.845 (delta = 0.1506)

Sell 1 Nov 20th, SPY 370 call @ $1.465 (delta = -0.1459)

Buy 1 Nov 20th, SPY 375 call @ $0.855 (delta = 0.0949)

Delta: -0.0236

Delta Dollars: -0.0236 x 100 x $347.54 = –$820.19

We have a negative dollar exposure of –$820.19.

We can change the strikes of our iron condor to make the trade more neutral.

Off Centre Iron Condor

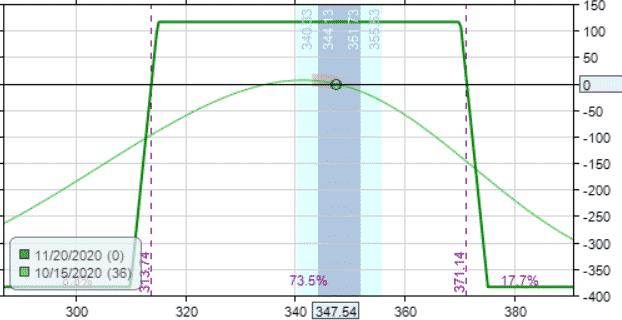

We see that our current price is a bit off-centere in the payoff diagram:

The dot is too far to the right.

It is closer to the call side than to the put side.

Good thing we checked the payoff diagram before committing the trade.

Final Setup

To fix this we can move the call side further away from the underlying price.

Moving the calls 5 points further away from current price, give us the following trade:

Buy 1 Nov 20th, SPY 310 put @ $2.295 (delta = -0.1232)

Sell 1 Nov 20th, SPY 315 put @ $2.845 (delta = 0.1506)

Sell 1 Nov 20th, SPY 375 call @ $0.855 (delta = -0.0949)

Buy 1 Nov 20th, SPY 380 call @ $0.505 (delta = 0.0609)

Delta: -0.0066

Delta Dollars: -0.0066 x 100 x $347.54 = –$229.37

While we still have a slight negative dollar exposure of –$229.37, it is much less than before.

This is a more “delta neutral” position.

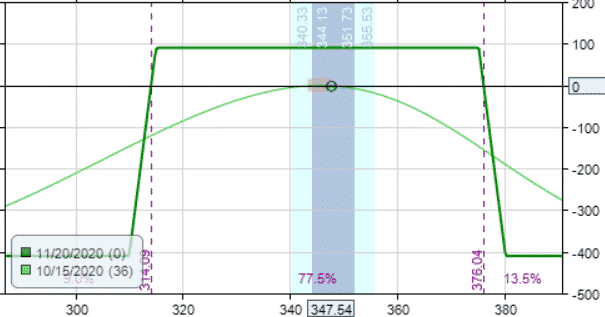

The price in its payoff-diagram is now centered…

This looks better and we commit the trade.

While in this example, we made an adjustment prior to initiating the trade; this same adjustment can be made mid-trade if you notice that your iron condor has become uncentered.

Another way to get your iron condor centered is to use unbalanced iron condors.

We discussed that in another post.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.