Earlier this week I had a trade recommendation come through on email for a cash secured put on IBM.

Here is the recommendation:

Trade: IBM currently at $153.40 Sell 1 IBM July 28 Expiration 150 Put at $2.00 (Short Put is 34 Delta and IV 22)

Analysis: Stock has been in a range over the last 12 months of 147.79 and 182.79. By selling the 150 Put at $2, you are committing to buy the stock at expiration at $148, if the stock is under $150 . You would be buying the stock at about the lows over the last 12 months. Because IBM Earnings are coming during the week of July 17, we get a little more premium than usual for selling a 21 Day Put that is about 3 ½ dollars out-of-the money. The 34 Delta of the short put simply means that there is only a 34% probability we will be below $150 in IBM at expiration. What if you don’t want to buy the stock at expiration under $150 because of the big capital outlay of owning the stock? Then I would just have an order in to buy the put back for $ 4 ½ if IBM has big down move. Since my credit is $2, I would be trying to limit my loss to not much more than I would of made. If I sell the put for $2 and IBM doesn’t go under $150 at expiration, I keep the entire credit. If IBM declines and I get out of the put at $4 ½, I limit my loss to 4 ½ minus my initial credit of $2 or $2 ½, not much more than my potential gain. That’s what we call Risk Management.

I typically don’t trade stocks over earnings but IBM is definitely oversold and the trade does make a bit of sense.

However, it’s not so much the trade setup I want to talk about, it’s more the risk management.

Get Your Free Covered Call Calculator

Getting out of the put at $4.50 is all well and good in theory, but sometimes if a stock declines post earnings, the value of the put could blow out by more than that.

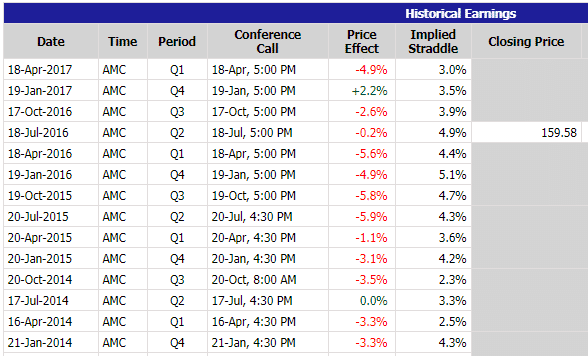

Below you can see the recent past moves that IBM has made post earnings. It’s not uncommon for IBM to make a 3% move, and there are even a couple of 6% moves.

With IBM trading at $153.40, let’s assume there is a 6% move lower after earnings. The stock would be trading at $144.20 and the put would be worth at least $5.80.

In this case your loss is going to be more than the recommended stop loss.

I guess that comes with the territory when trading earnings and as long as traders understand the risks, that the important thing.

I’ve talked about stop losses in a previous article – Are You Shark Bait – and how they do not work quite so well with options.

Chance are this recommended trade will work out fine, and / or IBM will have a smaller than 6% move following earnings, but I feel like it’s important to understand all the risks with these types of trades.

Personally I prefer put ratio spreads in this type of setup, but I also tend not to hold them though earnings.

Any questions, let me know.

Gav.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Put credit spreads are even better. Limited risk and no stops required (although soft stops should still be used), lower margin requirement and price could drop to zero without killing your account.

That’s right Dave. Using a credit spread protects your account from a meltdown. Think Lehman Brothers, Bear Stearns etc.