Options liquidity gets talked about as if it is some savior of the markets.

Futures are called “Liquidity markets” in the investment media, there is always talk about Illiquid investments, and more recently, in the GME debacle, the term “exit liquidity” has been thrown around.

But what exactly is liquidity, and how does it relate to options traders?

Contents

Options Liquidity

In basic terms, liquidity is how much buying and selling can occur before the price of an asset materially moves.

This is especially important in options markets because there is yet to be a market maker stepping in to help you get filled.

Options are a complete market, meaning that in order for you to buy, someone has to sell the contract to you; there is no middleman in the trade.

Options liquidity has a slightly more specific definition: how much can I buy or sell before I am the one moving the market?

On some stocks, like AAPL or SPY, many people are looking at the options, so the markets are said to be highly liquid.

There is almost no shortage of people sitting on the bid or the offer for you to trade into.

Others will have a widespread and have almost no one there. These are considered illiquid.

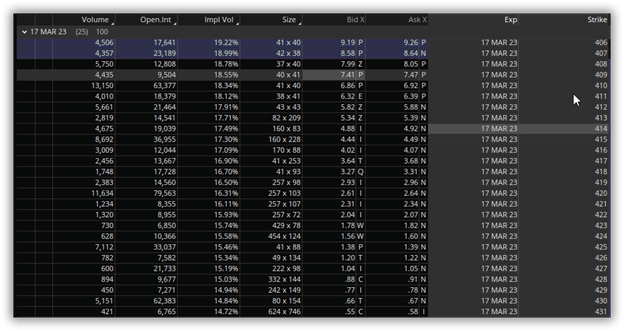

The be is a good example of a liquid chain; each strike has a tight bid/ask spread, and plenty of contracts are in open interest.

How To Measure Liquidity In Options

Now that we know the basic definitions let’s look at the multiple ways we can measure liquidity in options.

Depth Of The Bid / Offer

There is no really simple way to just look at a chain and know if it’s liquid or not, but there are some easy indicators to look at.

First up is the size of the bid and the ask on an individual contract.

An easy way to do this is to have whatever your platform has for “size” on your trade screen.

This will show you how many people are lined up to buy or sell at the current bid / ask.

The higher the numbers, the more people are willing to do business at each price, and this is a large contributing factor to liquidity.

Volume

Next up in volume, this one is mostly self-explanatory.

This value represents the total number of contracts traded for each strike.

This number is not the total that will stick overnight, so a lot could be day trades, but that does not matter when it comes to liquidity.

The goal is to see that there is plenty of action at each strike.

Open interest

Volume is a close relative of open interest.

Simply put, open interest is the number of contracts that “stick” past the overnight settlement period.

These contracts were bought or sold to open and are maintained as positions; in other words, they were not day trades.

This is important for a few reasons; first, if there is a large number of open contracts, then there is a deep pool of potential people to buy or sell with at that strike.

This will increase the odds of being able to fill an entire position without having to worry about moving price too aggressively, if at all.

The second reason open interest is important is that it shows you what strikes are attracting the most attention on a long-term basis.

If a position hits open interest, it’s being held, and that means there could be sustained appetite for that strike.

Or, as discussed above, at least the ability for you to buy or sell when you desire it.

Total Liquidity

Now that we have an understanding of how all of the elements work let’s take a look at tying everything together.

Let’s assume you are going to trade something like the SPY, which is, by all definitions, an incredibly liquid instrument.

You want to take out a long call and want to know if the options are liquid enough for you to fill your complete size of 10 contracts.

Let’s take a look at the below screenshot to find out!

You have identified that you are going to target 420 around the March monthly expiration.

First, you would want to look at the Open interest.

Is it fairly high compared to the rest of the strikes?

We can see that the 420 strike has almost 80K in open interest, so this checks out.

Next, let’s look at volume to see if the daily amount traded can withstand our trading needs.

With 11k +/- traded on the daily volume, this will more than handle our 10-lot trade.

Finally, let’s take a look at the size of the bid/ask.

We can see that at 257×103, there will be plenty of other people we can buy from right off the ask ( if we so choose).

This is perfect, so we can see that this is a good strike to select.

Through that little example, you now know how to evaluate and measure options liquidity.

I wish it was as simple as equities, but with all the variables around options and the expansive number of strike prices, liquidity is not so cut and dry.

Expectations

Just as some good housekeeping, we should discuss some minor expectations to have when measuring and using options and options liquidity.

First and foremost, as previously stated, there is no middleman for options, so it’s always possible that the bid/ask gets pulled, and it becomes more difficult to trade the contracts you desire.

That is why open interest is so important; at least if there are a lot of open contracts, there is a better possibility that bid/ask depth will not dry up.

The second is buying/selling off the bid/offer.

Occasionally, spreads will widen, and you can still replace the order that you have to hit the bid/offer and close the position immediately.

If you choose not to, then you will become the top of the book and have to wait for someone to take the price you have offered out.

Lastly, and perhaps most importantly, it’s possible for your order to get skipped.

Assuming that you are not selling into the bid or buying off the offer, it’s possible that your order could get leapfrogged if the underlying moves in a substantial way.

This has happened on rare occasions, but it’s still a little bit possible all the same.

No amount of liquidity in the derivative can make up for a huge move in the underlying.

All of a sudden, market makers need to create a new market, and if your price is not there, then it will drop down the order line.

Again this is INCREDIBLY rare, but it is something that should be stated.

Concluding Thoughts

In conclusion, liquidity is a crucial aspect of the options market, and understanding how to measure and evaluate it is important for options traders.

The depth of the bid/offer, volume, and open interest are all essential factors to consider when evaluating options liquidity.

While liquidity in options is not as straightforward as in equities, assessing these variables can help traders determine the best strikes to target for their trades.

However, reasonable expectations are necessary when measuring and using options liquidity, as the bid/ask depth can dry up, spreads can widen, and orders can get skipped in the event of a substantial move in the underlying asset.

Overall, a thorough understanding of options liquidity is a valuable tool for options traders to maximize their potential for success in the market.

We hope you enjoyed this article on options liquidity. If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.