Patience is the name of the game at the moment, I actually only have 1 position on currently as I sit and wait for the market to either break out or break down. Seems like I’ve been waiting a while too with SPX only moving from 2165 to 2182 since mid-July.

Feels like somethings gotta give and we’ll either shoot higher or lower very shortly. Usually after a continuation like this, the consolidation resolves itself in the direction of the primary trend (up), but we are quite extended from the major moving averages here and a little overbought on some indicators.

Here are 5 charts I’m currently watching

3-Part Long Strangle Video Series

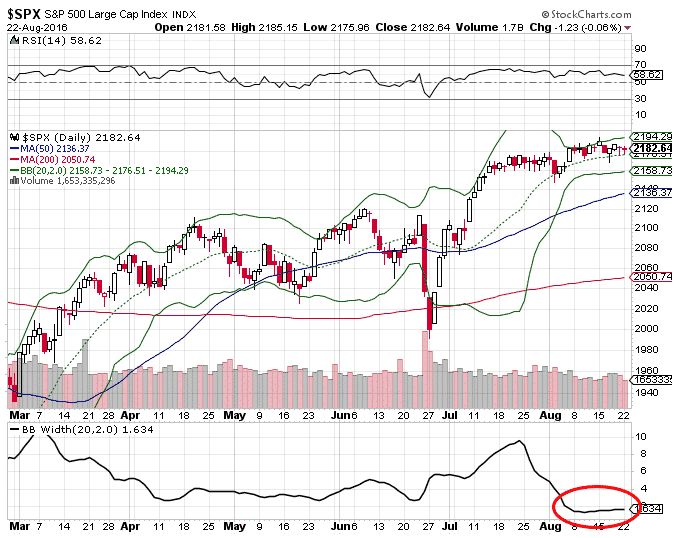

SPX – Waiting for the Breakout

Very tight range over the last month and the Bollinger Bands are as tight as we have seen them this year. We’ll break out one way or the other eventually.

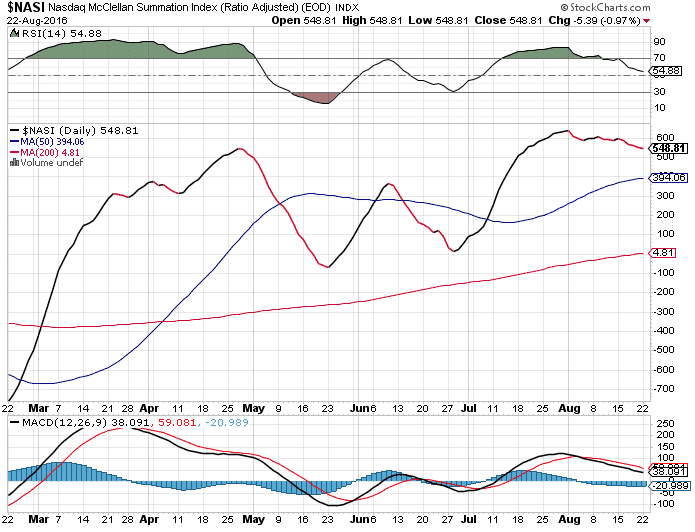

NASI – Overbought Conditions Worked Off Through Time

Coming into August, the Nasdaq was looking very overbought, but those conditions have been worked off now even though the index hasn’t dropped much. Room to go higher potentially??

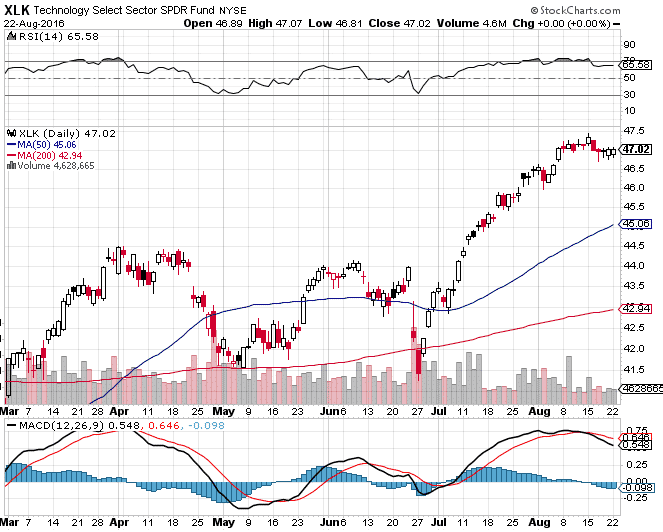

XLK – A Long Way From the Moving Averages

While not currently in an overbought reading, tech stocks are pretty extended here and a long way from the 50 and 200 day moving averages. One thing is certain, XLK will test those averages again at some point. When is the question….

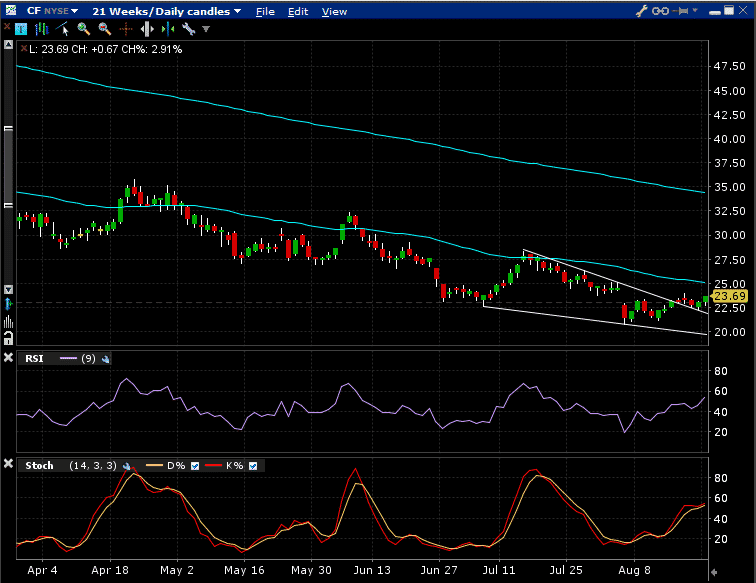

CF – Breaking Out of a Wedge and Trying to Base

Hat tip to Mark Yusko for pointing this one out. Currently breaking out from a wedge pattern that has been retested. Looks like it could potentially head higher, but always tough being long a stock that is below its 50 and 200 day moving average. If it breaks $20 it could head much lower.

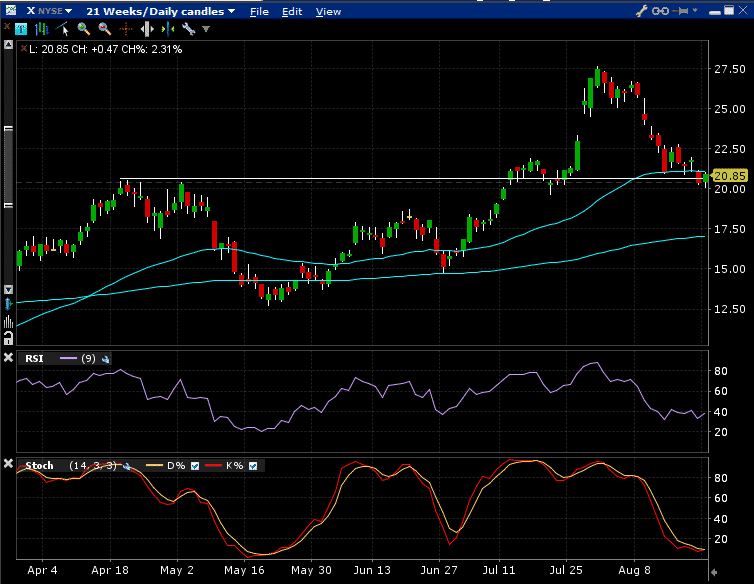

X – Support From the Recent Breakout Being Tested

Looks as though $20 is holding as key support so far. Oversold on Stochastics and has potential to base. However, it could also put in a right shoulder for an inverse head and shoulders pattern.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

What’s your feeling on SPX? Does it still have another leg up?

Hey Hugh, yeah it feels like there is another leg up coming, but I wouldn’t be playing it aggressively because a decent down move is overdue as well. I prefer long strangles right now so you’re covered either way as long as we get a big move one way or another.