With every stock increasing in value during this historic bull market, opportunities to find naked put writing investments are scarce. You just have to spend more time finding the right opportunity to sell puts and at the right time.

With the recent run up in stock prices, a number of investors have been thinking about and planning for ways to protect downside risks. Selling naked puts is usually a scenario where you think the stock price is going to go up, but you are not entirely sure. If the stock stays the same price or increases, you collect the option premium. If the stock does not increase and comes down, you may be assigned shares of common stock.

Given the lack of opportunity to find value, I did some of the dirty work for you to find two ideal dividend stocks primed for selling naked puts. I’m a big fan of building a dividend portfolio that enables you to collect income in a variety of ways.

Personally, I think that is the most effective way to generate the most effective total return over the long-term. Come follow along with our progress on our dividend stock portfolio and dividend investing. If you add option strategies to your dividend portfolio, the benefits can be massive. Compound interest is our friend.

Let’s get to two of our favorite dividend stocks for selling naked puts.

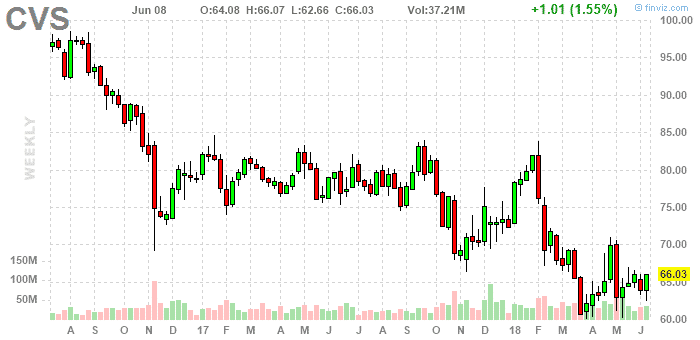

CVS – CVS Health Corporation

Ever since the recent announcement of the merger with Aetna, CVS has fallen out of favor with Wall Street. The large debt burden to effect this massive merger has made investors wary of how the stock will perform on a combined basis. However, I am a big fan of the deal. I believe this was one of the last opportunities to get in on some cheap debt to acquire a strong free cash flow generating business. The synergies of the combined business will be extraordinary.

As you can see from the chart above, the stock has hit ~$60 twice. I don’t think it can go much lower than that.

I suggest that you sell the Aug 17 ‘18 puts for ~$0.95. If you take a look at the weekly chart, I believe there is steady support at $60.

I think the stock moves around to $69 or stays around $65-$70 trading range.

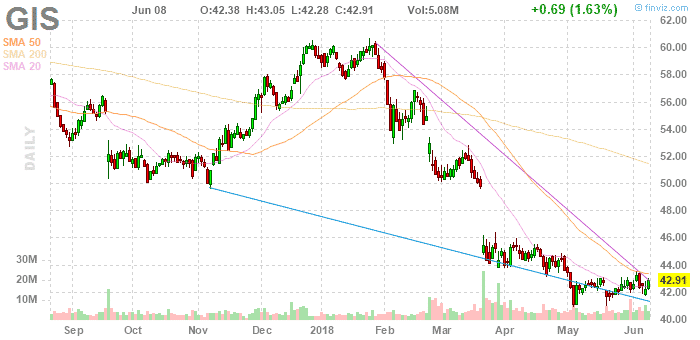

GIS – General Mills, Inc.

Consumer goods stocks have fallen out of favor in the stock market as investors continue to pour into FANG stocks as this bull market continues to rip.

General Mills has made a few high-priced acquisitions in the past few years. I believe that has caught up to them a bit in the recent quarters.

On a monthly basis, the General Mills stock was on a tear consistently outperforming results. As you can see from the below, the stock has retraced significantly from ~$70 mark hit in mid-2016.

Isn’t this a falling knife? Why would I want to take this type of risk? I think this is a great opportunity where if you end up owning the stock this is a great long-term opportunity. In addition, option premium is highly inflated from the recent decline, making a great opportunity to earn some option income if the stock increases or even stays the same price.

There are some great reasons why to believe that the stock will turn it around:

- The CEO just purchased 6,000 shares at the end of May

- Sales trends are improving

- The stock is trading at ~14x forward earnings projections. That’s below the five-year average of 18 times,

- The dividend yield is currently 4.57%

Given how bullish I am on the stock, I am comfortable moving a little closer to the strike and moving closer to the expiration. I suggest that you sell the July 20 ’18 $42.50 strike for roughly $1.38.

In the event of a market pullback, consumer goods stocks tend to be somewhat resistant from pullbacks as investors seek safe-haven stocks. GIS has some of the most reputable food brands in the country and I can’t see the stock going down much further. If it does, I will be there to buy more.

Do you have ideas on dividend stocks perfect for selling naked puts? Let us know in the comments below. I’d love to hear from you. Follow along with our dividend portfolio as we try to achieve financial freedom. To keep you motivated, here are some of our favorite quotes about financial freedom.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.