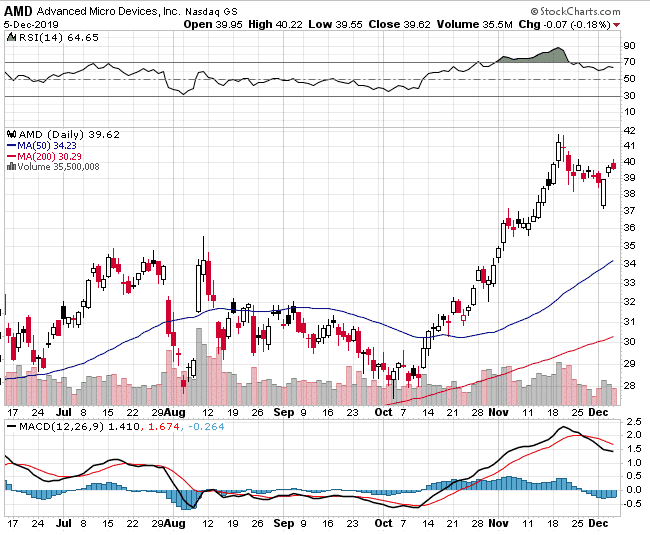

The US stock market has started the month in red as some of November’s top performers moved lower. Certain stocks, such as AMD (NASDAQ: AMD), hit multi-year highs in November just to pull back lower at the start of the current month.

Katie Stockton, founder of Fairlead Strategies, believes that the chipmaker may continue to drift lower in the coming weeks and months.

“AMD cleared its summertime highs and also long-term resistance from prior to that. The breakout saw great follow-through, ran up about 12% in November, and of course now there’s room to [fall to] support based on that breakout point, which was roughly $34 to $35,” said Stockton told CNBC.

The stock hit a new 12-year high of $41.79 on November 19th before it retreated 11%. If Stockton is right, AMD would need to fall more than 18% from its November peak. The stock has, in the meantime, recovered to $39.69.

“A pullback to that support level would actually be welcome from a technical perspective and that would increase the risk-reward ratio following that breakout so I do think some of these stocks that have run up following breakouts are prone to pullbacks, more so than the broader market or major indices, but I would see them as opportunities to add exposure,” added Stockton.

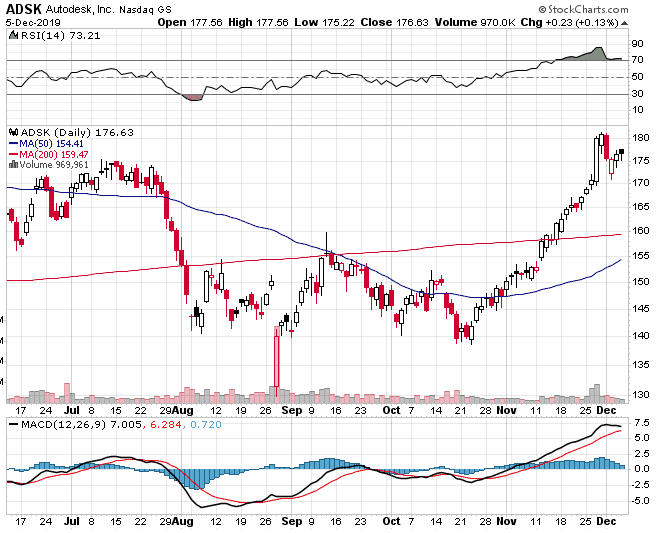

Similar to Stockton, Mark Tepper, president at Strategic Wealth Partners, also believes that AMD is at a risk of a pullback. In addition, he also believes that Autodesk (NASDAQ: ADSK) will pullback as well.

“It’s also a stock that’s highly correlated to architecture and construction, so if those things start to look ugly, or the global economy looks to be weakening, the multiple is going to pull back,” Tepper said.

Major Bond Research Firm Lists 10 Bonds From Companies That Should Underperform

Gimme Credit, a major bond research firm, has listed high-yield bonds from 10 companies that should underperform compared to the rest of the broader “junk” market. According to MarketWatch, the list includes major names such as J.C. Penney (NYSE: JCP) and U.S. Steel (NYSE: X).

The list is as follows:

- AK Steel AKS (NYSE: AKS), which according to Gimme Credit, has “a bit cloudy [outlook]” for 2020.

- Cedar Fair L.P. (NYSE: FUN) is seen as “expensively priced” by bond research firm.

- Extended Stay America (NASDAQ: STAY) is taking actions that will lead to “fewer assets and lower Ebitda,” according to Gimme Credit.

- Frontier Communications (NASDAQ: FTR) suspended its dividend on common shares in February 2018, while debt restructuring negotiations with its creditors are ongoing.

- J.C. Penney is included in the list due to an “unsustainable level of leverage”.

- Realogy Holdings (NYSE: RLGY), similar to J.C. Penney, is experiencing issues with leverage, which probably won’t be reduced until 2021.

- Revlon (NYSE: REV) is included in the list as “business visibility has decreased”.

- Rite Aid (NYSE: RAD) is expected to have a “break-even free cash flow this year and minimal debt reduction”.

- United States Steel is also expected to have a “free cash flow shortfalls over the near to medium term.”

- Whiting Petroleum (NYSE: WLL) found itself on the list as “forward progress has stalled due to near-term infrastructure constraints and softer oil/gas prices,” according to Gimme Credit.

Due to a high number of negative-yielding bonds and declining interest rates, the “junk” bond market has gotten more popular in the US as institutional investors continue to search for securities that generate high income.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.