There are a few sites out there claiming to achieve 80%, 90% and even 95% success rates on their trades.

First of all, I would be wary of anyone claiming to have such a high success rate, but that’s another story.

Secondly, a 90% win rate, does not necessarily guarantee that you will be a profitable trader.

To have a 90% win rate, a trader would typically have to be selling deep out-of-the-money spreads. That will work well for a while (roughly 90% of the time), but it is the losing trades you have to watch out for.

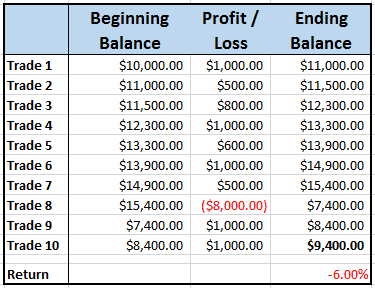

Let’s look at a theoretical example:

Here we can see the trader has made 9 successful trades and 1 losing trade.

That losing trade has wiped out all the gains from the other 9 trades. The trader spent 10 months trading and has a -6% return to show for it.

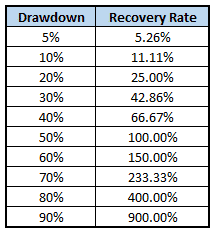

Let’s look at it another way. Simple math shows us that big losses can be almost impossible to recover from. Take a trader that loses 50% of his account. He now needs a 100% return just to get back to break even. Not an easy task!

Does this mean that selling 10 Delta iron condors is not a valid strategy? Not at all, but there are risks that traders need to be aware of.

This also highlights the need to cut losses early.

In the first example, if the trade had cut his losses at $4,000 (still a big loss) instead of $8,000, he would still be profitable by year end.

SUMMARY

OTM credit spread traders can have a very high win / loss ratio and still not be profitable. Just because someone says they have a 90% success rate does not mean they have made money.

Cutting losses early is crucial to long term success.

Trade safe!

But isn’t the argument flawed because you don’t take into account you might close a losseing trade early which would have been profitable.. so you may have two losses of $4k not one.

Hi Joel, if you monitor your trade history you will have a database of winning and losing trades, then you can use the data to come up with an expectancy ratio for each strategy.

Great article, Gav, as always. What do you think is the best way to monitor and cut losses?

Recently, I’ve been experimenting with an Excel spreadsheet that has live data coming from ToS, and it graphs out my equity curve on each trade I’m in, and for my entire account balance (aggregating the status of all trades). I’ve been looking at what would be the best time to cut a losing trade.

What do you think?

Thanks Doug, good to hear from you as always. In terms of cutting losses, it depends on your risk appetite. I have defined % loss for all strategies where I will take the loss. In the last few years I have been trying to be much more ruthless with cutting losing trades.

You can manage the losses when the market goes up/down slowly, but when it gaps up/down overnight or rapidly you can take a total loss, unless you have some hedge at work.

Umm.. i am sorry.. I fail to believe this. The reason i fail to believe this is that you dont have to take loses in options. You can roll and keep rolling until you either can scratch the trade or take a profit in it. I don’t understand why a person would even take a loss trading options. Roll it until to makes sense to take it off. Losing trade can be paid for by longer duration rolls.. so if your losing in a trade 3k due to a wide spread.. Roll it to the next month and the next and the next until the loss is absorbed in time premium. Its not hard to understand..

Agree with you in theory, but how do you think that would have worked out in 2008? I was subscribed to a trade service at the time (won’t name which one) and the guy followed that strategy and ended up losing 95% of his capital. Very sad as he had a huge amount of auto-trade followers who lost their life savings.

Very insightful and very important to manage your losses. I use tech analysis but I only sell call verts or put verts using 10 delta and I have learned especially in a bull move that the market can keep going up so I manage my losses and get out at 20 delta. If I have put them in properly I rarely hit 18 delta. Selling premium is the best way to trade because theta decay is your friend not the enemy. Be smart and keep learning

Awesome Dennis, you’ve hit the nail on the head. This is a great way to trade.