The era of zero-commission transactions appears to have arrived and both investors and traders are analyzing the implications that this price war will have on the performance of their portfolios. So far, TD Ameritrade, Charles Schwab, E*TRADE, Ally Invest, TradeStation, Fidelity and Interactive Brokers are among the major players who have taken a step forward in this ground-breaking industry shift that has everyone both excited and, for some reason, a little bit worried.

Let’s start by tackling some of the most frequently asked questions and we’ll end up answering what zero commissions mean for options traders.

Can A Brokerage Firm Operate Profitably With Zero Commissions?

Yes, they can. This is perhaps one of the most common questions and it is definitely a valid concern. Brokerage firms can earn money on a trade essentially from three different sources:

- Trade commission.

- Bid-Ask Spread.

- The sale of order flow.

Even after removing the first item from the list, there are still two other income sources that brokers can rely on to earn their paychecks.

On the other hand, the question remains, is it possible for them to remain as profitable as they were? As for Charles Schwab, its founder said that they are confident that the business will continue to grow through their remaining paid services including financial planning, and fixed income trades.

What Would Be The Impact On The Performance Of Your Portfolio?

At first glance, definitely positive. The reason for this is that, for traders, commissions take a big chunk of the profits earned on the trade. Even more, if you have a small portfolio of say $10,000 or less. A $1,000 trade that paid $5 in brokerage commissions had to produce 0.5% before being considered as profitable.

As long as brokerage firms don’t expand their bid-ask spreads significantly or start throwing in some hidden fees or transaction costs, this news brings nothing but joy, particularly to retail investors.

How Will Zero Commissions Affect Option Traders?

All of the brokerage firms mentioned above have decided to implement this zero commission feature to stocks, ETFs and options. This is great news for those who are actively engaged in options trading, as your returns will see a significant increase considering that you don’t have to pay for each trade you make anymore.

Keep in mind that option traders will still have to pay a per contract fee. For example, Schwab charges $0.65 per option contract, which would mean a $13 cost for someone trade 20 contracts.

Let’s illustrate this for a moment so you can understand how big the impact will be for your portfolio. Let’s say you make 1,000 option trades per year on your Charles Schwab account.

If you previously earned a net return of 7.5% a year from a portfolio of say $10,000 (a $750 return), you will now save $4,950 in trade commissions ($4.95 * 1,000). These savings will boost this hypothetical portfolio’s return from $750 to, wait for it… $5,700! A 57% annual return.

Before this news came in, most of the arguments involved in rejecting day trading as a profitable activity would point to the significant effect of commissions in the performance of the portfolio. Now, in this zero commission environment, traders have gained an edge they never had in the history of the United States. This is definitely a good time to be an options trader.

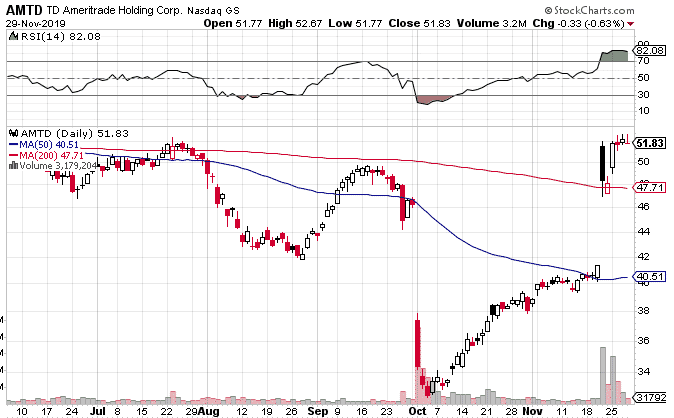

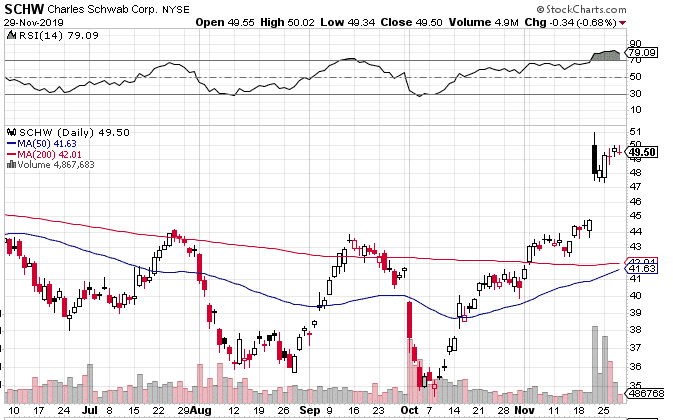

How Has AMTD And SCHW Stock Performed Since The Announcement?

Initially, the market reacted negatively to the news and sent the stocks down, particularly AMTD which sold off hard.

Since then they have bounced back, so clearly the market see a bright future for the brokers despite the drop revenue from commissions. You have to wonder what that means for us as traders? Are they making more money now by selling the order flow and widening the bid-ask spreads?

Interesting, Schwab recently announced they are acquiring TD Ameritrade in a $26bn deal.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.