Contents

-

-

-

-

- VIX – The Definition

- VIX – The Formula

- What Does The VIX Number 45 Mean?

- What Is The Forward One-Day Expectation Of Volatility?

- Is Volatility The Same As Uncertainty?

- Are Option Premiums Higher In A High VIX Environment?n

- In That Case, Should I Sell Iron Condors To Collect Higher Premiums?

- Final Thoughts

-

-

-

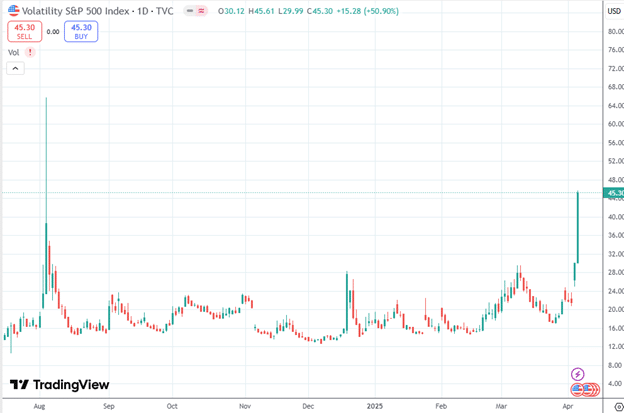

On August 4th, 2024, the VIX was at 45.30 as the trading session closed for the week.

In a general sense, we know that the higher VIX goes, the greater the fear in the marketplace and the greater the volatility of price movements.

Hence the nick-name, the fear index.

In today’s article, we will take a deep dive to explain what this number actually means.

After this understanding, we will come to realize how rare it is for the VIX to reach the 45 level.

VIX – The Definition

VIX is the symbol for the Chicago Board Options Exchange’s CBOE Volatility Index – that’s the official name for the VIX.

It is an index.

That means it is a measurement tool and is not a tradable product.

Just like you can not buy shares of the SPX index, you can not buy shares of the VIX index.

However, the derivative options (both call and put options) of the VIX can be bought and sold.

The CBOE started publishing VIX levels in January 1990.

Disseminated on a real-time basis, it calculates the stock market’s expectation of 30-day forward-looking volatility based on S&P 500 index options (SPX).

Since VIX is a forward-looking expectation of volatility, it is a measure of “implied volatility”, as opposed to “realized volatility” or “historical volatility”.

Therefore, VIX is the implied volatility of the SPX.

CBOE performs this VIX calculation by looking at the prices of both the put options and the call options on SPX that have expiration around 30 days.

Because the prices of puts and calls are not the result of one person’s opinion – they are the aggregate results of all the market participants – it can be said that the VIX is a crowd-sourced estimate of volatility 30-days in the future.

An estimate is only that. It is an estimate.

It does not say that this will for sure be the volatility in the future.

However, academic papers with graphs comparing the VIX with the subsequent realized volatility show that the shape of the curves are similar, indicating that there are practical predictive powers to the VIX.

They further showed that the VIX actually tends to overestimate the realized volatility by a little. This is due to greater demands for the insurance-like protections that options can provide and that options buyers are willing to pay an extra “premium” for.

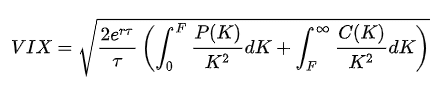

VIX – The Formula

Source: Wikipedia

Where…

tau is the time to expiration (30 days)

r is the risk-free rate

F is the 30-day forward price on the S&P 500

C(K) is the prices of call options with strike K and 30 days to expiration

P(K) is the prices of put options with strike K and 30 days to expiration

We warned you that we are going to deep dive into what the VIX number means.

Seriously, you don’t really need to know the formula.

For most investors and traders, it is sufficient to know that …

When VIX is under 15, markets are calm.

When VIX is between 15 to 20 there-abouts, markets are normal.

When VIX is between 20 to 30, there is elevated fear or uncertainty.

There are slight differences of opinions as to what constitutes high VIX and low VIX.

Brent Osachoff’s article and video explains why VIX of 15 is “normal” even though the average VIX is 19.46 (using data from 1990 to 2020).

This is because the average can be skewed up due to a couple of extremely high VIX (such as reaching to the 80’s in the 2008 financial crisis and 2020 pandemic).

The most commonly seen value of VIX is between 12 and 13 in a frequency distribution histogram.

Where is VIX of 45 on this frequency distribution?

It is on the extreme tail end.

A VIX of 45 is rarely seen. The last time it reached that level was on August 5th, 2024, but it did not close above 45.

The last time it closed above 45 was during the Covid pandemic.

What Does The VIX Number 45 Mean?

While VIX is estimating the volatility 30-days from now.

Its number is reporting that value as an annualized percentage of how much SPX can move.

A VIX of 45 means that on an annualized basis, SPX is estimated to move 45% in one year.

In statistical talk, it would say that 45% is the one-standard deviation percentage move of the SPX.

Realistically, SPX is not likely to move 45% in price in one year.

It is only saying that at that one moment in time (30-days from now), SPX is estimated to be moving at that speed.

That is a very fast speed – a speed that is not sustainable.

A VIX value of 45 can not stay at that level for an extended period of time.

At some point, it will come down and “revert back to its mean”.

This is why people say VIX is mean-reverting and short volatility traders are likely going to fade this high VIX.

What Is The Forward One-Day Expectation Of Volatility?

On a more practical level, traders who see a VIX of 45 on Friday want to know what will happen on the following Monday.

No one can know what will happen Monday.

But we can calculate the one standard deviation expected move of SPX on Monday.

This forward one-day expectation of volatility is computed by taking the VIX and dividing that by the square root of 252.

There are 252 trading days in a year.

One day volatility = 45% / 15.87 = 2.8%

The SPX has the potential to move plus or minus 2.8% on Monday.

That is plus or minus 142 points from Friday’s close of 5074.

This formula is not saying that SPX will move that much.

The market participants are so uncertain of how it will move that the options are pricing in a potential move of a wide range between 4932 to 5216.

For the mathematically inclined readers: Since 45% represents the expected move of one year, we have to split up that 45% into what it would be for individual trading days.

That means division.

We divide by the square root of 252 because volatility doesn’t scale linearly over time; it scales with the square root of time.

For confirmation of this formula, use the “rule of 16” and you will get the same results.

Is Volatility The Same As Uncertainty?

In a sense, it is. Some say the VIX is the level of volatility; others say the VIX is the level of uncertainty in the market.

They are saying the same thing.

If there is high volatility, the range of price moves are large.

And we are uncertain where price will be within that range (or it can even be outside that range).

If we were certain as to where SPX will be, then there would not be such a huge range.

Are Option Premiums Higher In A High VIX Environment?

Yes, they are. VIX is a measure of the implied volatility of SPX.

The SPX options prices are higher when its implied volatility is higher.

In That Case, Should I Sell Iron Condors To Collect Higher Premiums?

Only you can answer whether you should or should not.

The better question to ask is…

Is your iron condor able to handle a 2.8% move?

Final Thoughts

A VIX of 45 means extreme volatility and uncertainty.

It means that SPX is moving at a rate of 2.8% per day (which are very large moves).

And if it can not sustain that speed, then VIX will likely have to drop.

We hope you enjoyed this article on the VIX Index.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.