Two stocks made massive moves today, but on opposite ends of the spectrum. TSLA blew away earnings estimates and popped 17.67% while Twitter slumped nearly 20%.

So, what happened?

Tesla’s earnings result included a surprising profit and a much higher than expected free cash flow. Earnings came in at $1.86 per share, well above the expected loss of $0.42. Free cash flow came in at $371 million compared to estimates of $32 million.

Deliveries are anticipated to exceed expectations this year and the Model Y is tipped to launch by summer 2020.

All that adds up to put owners taking a beating today. leading in to today, some of the largest open positions in TSLA options were in the deep out-of-the-money puts.

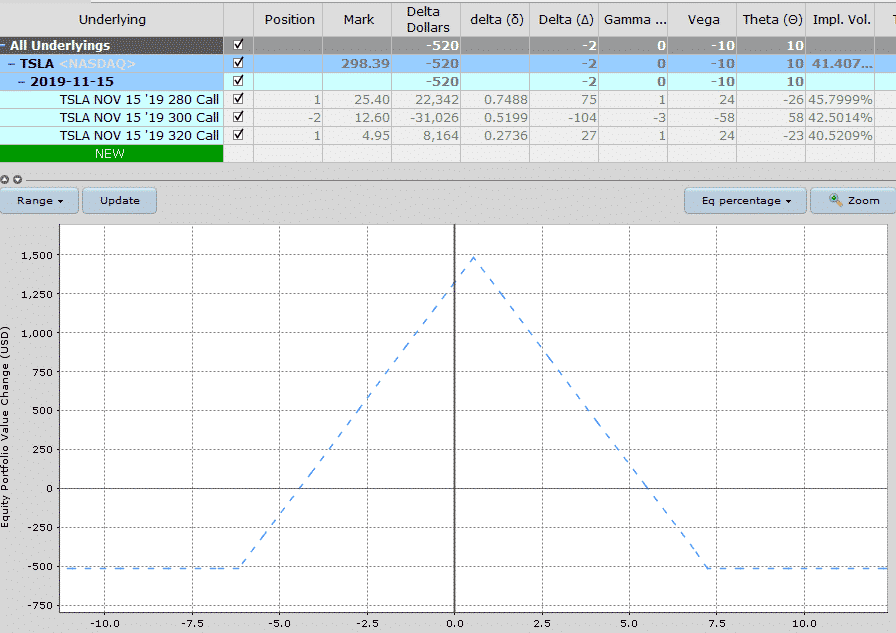

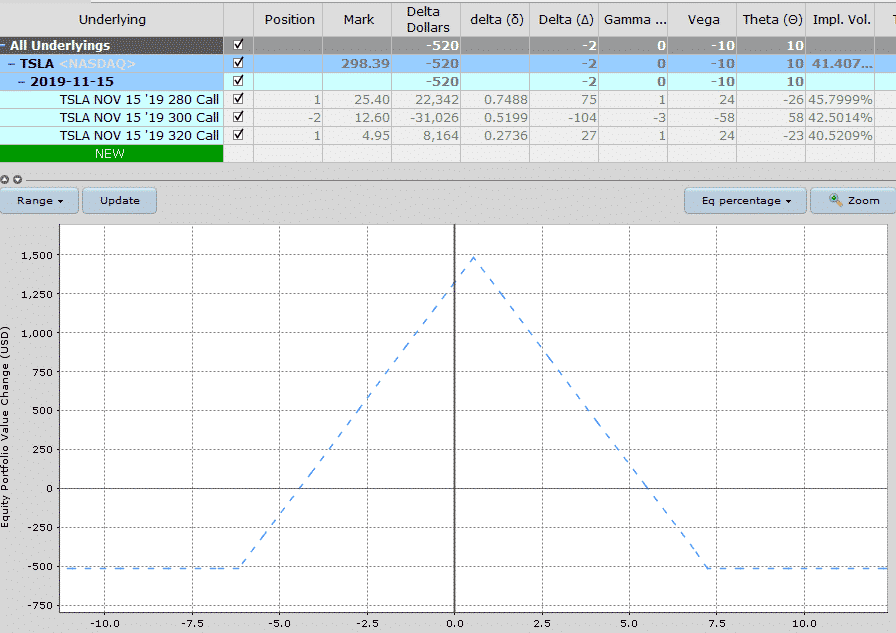

Tesla has historically been a tough stock to trade, but a lot of times when you see an earnings gap up like this, the stock tends to trade sideways over the next week or so. In that case, butterfly spreads would do well.

Join the 5 Day Options Trading Bootcamp.

It was a different story for Twitter with the company reporting worse than expected third quarter results.

Twitter reported revenue of $824 million, up 9% year over year which was at the low end of the guidance range of between $815 million and $875 million.

Analysts were expecting earnings per share of $0.20 but they came in at $0.17.

Forward guidance was also below expectations.

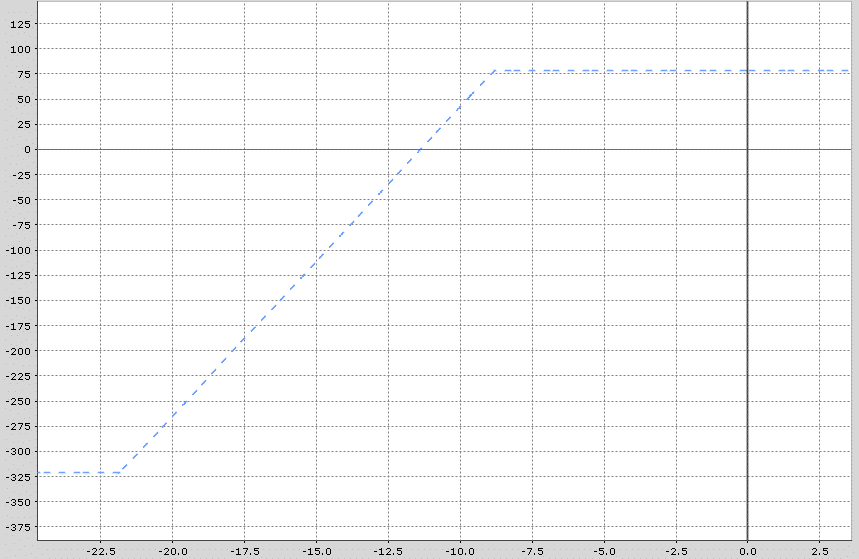

Contrarian investors can achieve high returns (albeit with high risk) by selling a bull put spread.

A January 2020 Bull Put Spread using the $28 strike as the short put and the $24 strike as the long put.

As of October 24th, this trade offered a 24.61% return on risk over the next 86 calendar days.

The maximum profit on the trade would be $80 per contract with a maximum risk of $320. The spread would achieve the maximum profit if TWTR closes above $28 on January 17th in which case the entire spread would expire worthless allowing the premium seller to keep the $80 option premium.

The maximum loss would occur if TWTR closes below $24 on January 17th which would see the premium seller lose $320 on the trade.

The breakeven point for the Bull Put Spread is $27.20 which is calculated as $28 less the $0.80 option premium per contract.

As always, do your own due diligence and trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.