So, it’s turns out stocks can go down afterall, who would have thought? While some may have been caught unawares by Friday’s downturn, many of us have been expecting something like this for a while. In fact, a decent pull back and a reality check for the perma bulls out there is possibly just what the doctor ordered.

Markets can’t keep going up forever, and this particular market had become a bit too far disconnected from it’s major moving averages.

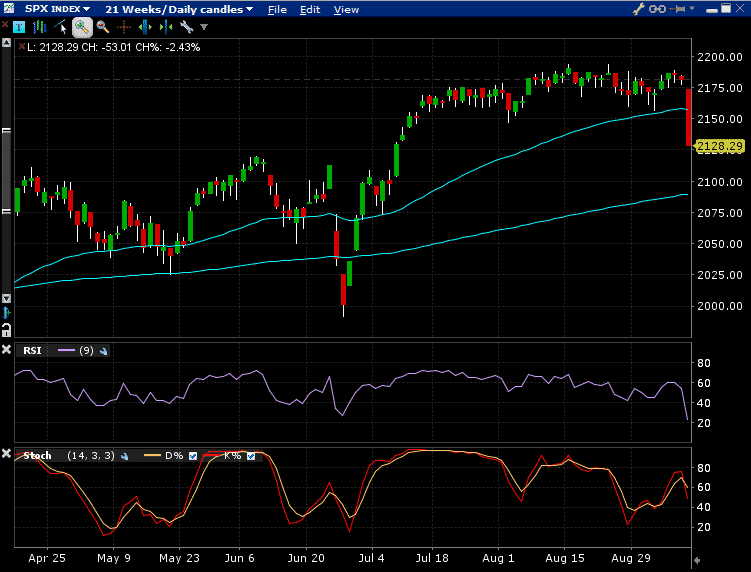

Take the S&P500 for example. We hadn’t had a touch of the 50 day moving average since early July. That’s a situation that eventually become untenable. Sure enough, in one fell swoop we have crashed back through the 50 and it’s looking like we could potential test the 200 day average as well.

It’s interesting that some people are attributing the selloff to comments made by DoubleLine’s Jeff Gundlach suggesting that the the Fed might raise rates sooner than we expect. Generally, those sort of comments come out all the time, so to suggest that was the cause of a 2-3% drop is a bit absurd. Market internals were starting to weaken following the Post-Brexit rally as most of the easy money had been made. Traders used these comments as an excuse to start unwinding long positions and then the selling was exacerbated once stop losses were hit.

There are two probably ways this plays out going forward. People see this as a buying opportunity / overreation and we get a big bounce on Monday. Or, we get some sustained selling that plays out over the next 2-4 weeks. I favor the later for what it’s worth. This is a seasonally weak time of year and I wouldn’t be at all surprised if we hit the 200 day moving average over the next week.

The 200 day moving average is generally the line in the sand for a lot of traders, so it we lose that level, all bets are off. Most severe market meltdowns have occurred below a 200 day moving average.

The Fed meets on Sept 20-21 so keep those dates in mind when working on new or existing trades. We could see some volatility over the next few weeks. Personally, I’m very happy to see some volatility finally return because that’s when you can find the best opportunities.

Happy Trading!