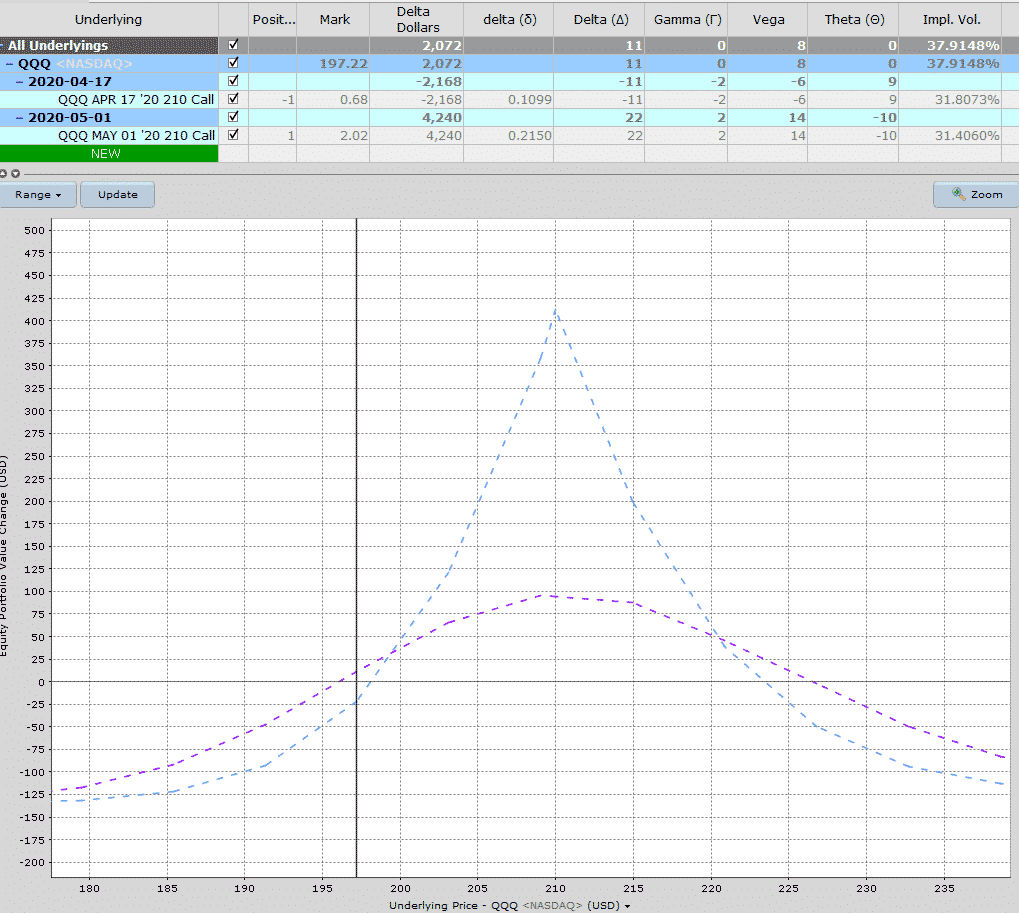

Markets are bouncing and the Nasdaq is the strongest index at the moment.

The idea with this trade is that the bullish momentum might carry the stock higher and I think $210 is a reasonable target for 10 days time.

Selling the April 17th 210 call and buying the May 1st 210 call costs around $135 per spread and that is the maximum risk on the trade.

Ideally, QQQ grinds higher and finishes around $210 at expiry on April 17th.

Let’s see how it goes. You can learn more about calendar spreads here.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.