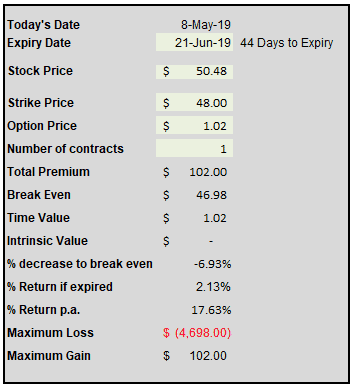

Today’s trade idea is on INTC which is a bellweather Dow stock that has been beaten down lately. The stock is trading at $50.48 and is holding above the 200-day moving average which currently sits at $48.72.

INTC is currently the 6th most oversold stock in the Dow behind MMM, DWDP, XOM, WBA and BA and it is also a high dividend payer which makes it a great addition to any long-term portfolio.

The current yield is around 2.47%.

Selling a Jun 21st Cash Secured Put at $48 would bring in around $1.02 in premium per contract.

The breakeven on the trade would be 6.93% lower than the current price at $46.98.

If the put expires worthless, the return over 44 days would be 2.13% which equates to 17.63% per annum.

If INTC drops below $48 and the put gets assigned, I would hold the stock, collect the dividends and sells calls at around $50.

In terms of a stop loss, if INTC dropped below $46, I would rethink the position. The maximum potential loss is $4,698.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.