I get emails all the time from traders who have made mistakes trading options. Here are some of the top mistakes that I see retail traders making and how to avoid them.

Not having a plan

Most newbies to options trading don’t have a written down trading plan. It’s either “in their head” or worse, they just make it up on the fly.

Getting in to a trade is the easy part. Knowing when to take profits, when to adjust and when to exit is much, much harder.

Emotions can get on top of you in this game, and when they do, you’re toast. The market will eat you up and spit you out.

Having a written down trading plan will put you ahead of 80% of the other traders out there. You can download a sample iron condor trading plan below.

Buying cheap OTM options

Some newbies get sucked into the idea of making a quick buck. Marketing hype doesn’t help…

Options can provide amazing leverage, especially out-of-the-money options.

Who wouldn’t want to control 100 shares of a stock for only a few hundred dollars?

Yes, buying out-of-the-money options can make significant gains.

The problem is you have to be spot on in terms of both the direction, and the timing of the stock movement.

As you know, this can be quite hard to do….

To make a profit, the stock needs to move in your direction, and do it quickly.

Time decay is not your friend.

In all likelihood, your out-of-the-money options will expire worthless and you will lose 100% of your investment.

So, in order to profit with OTM options, you need to seriously outwit the market, have insider knowledge, or just plain get lucky.

Trading Illiquid Options

Slippage is a term that refers to the cost of getting in to and out of a trade. SPY is the most active underlying for option traders. Option chains for SPY have really tight bid-ask spreads, sometimes as low as 2 cents. Trading SPY will not result in a great deal of slippage.

Trading something that is less liquid means a larger bid-ask spread. Compared to SPY, the ETF TUR has a spread of around $0.30.

Traders won’t always be able to get filled at the mid-point so there will be much larger slippage trading less liquid options. Five or ten cents might not sound like much, but if you’re trading 10 contracts that means $100 both on the entry and exit, so you are up against it right from the word go.

Not paying attention to earnings

If you decide to trade options on a stock, please, please, please, check the earnings date before making the trade. There would be nothing worse than you opening a trade, only for the stock to gap down 10% the next morning on a bad earnings announcement.

There are certain strategies that are designed to be traded around earnings announcements and that’s fine. But, if you don’t want to be impacted by a big move in a stock, then make sure you check the earnings date first.

Letting short options go in the money

I see it all too often with newbies, I’m not sure what it is, but they refuse to cut losses quickly enough. They’ll then email and ask what they should do once their credit spread has gone in-the-money. Unfortunately, by that point, there is not much they can do other than hope and pray which is not a great strategy for financial markets.

A good rule of thumb is to adjust or close if the delta of the short option hits 30. That way you can’t get yourself in to too much trouble.

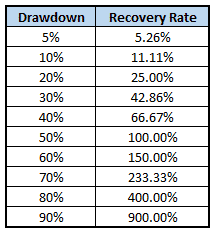

Traders should never let a small lost turn into an account blow up scenario. The chart below shows just how hard it is to recover from a big loss, and that’s just the financial side of things. The emotional side of things can be just as hard to recover from.

Not Having Enough Knowledge

Everyone has to start somewhere and sometimes the only way to advance is to pay “tutition” to Mr. Market. But, in this day and age of technological advances, there really isn’t much excuse for not having enough knowledge. There are numerous websites and free resources to help you gain the knowledge you need.

You’re reading this, so you’re on the right path.

Trading Too Big

Earlier in the article, I talked about big losses being hard to recover from. Another cause of big losses is trading too big. Trading big is fine when things go your way, but when things don’t you can be in big trouble really quickly.

Trading a correct position size is a crucial component of successful trading.

Another method for making sure your exposure doesn’t get too out of line is setting rules in terms of your Delta / Theta Ratio. That is something that I cover in detail in this 4-part video series.

Not understanding the assignment and exercise process

As an option trader, it is fundamentally important to understand how option assignment and exercise works. Some traders I know have suffered big losses due to a lack of understanding in this area. You can learn more here.

Sticking with one strategy for all market conditions

Markets are constantly changing. Sometimes we’re in a high volatility environment and other times we’re in a low volatility environment. There are very few strategies that will perform well in every market environment.

It is unwise to always stick to one strategy and use it no matter what the market is doing. Iron condors are a very versatile trading strategy, but you don’t want to trade just iron condors.

A better approach is to have a core set of 5-6 strategies that you can use. Determine what you market outlook is, and then choose the strategy that best fits.

Trade safe!