Sunday nights are great for doing research and I spent a bit of time this past Sunday going through some data and charts.

There are definitely a few things going on in the market that concern me right now. Take a look and let me know what you think.

While all of these charts have bearish sentiment, I’m sure there are arguments that can be made on the bullish side too. As I said, these are the things that are concerning me right now and warrant further attention.

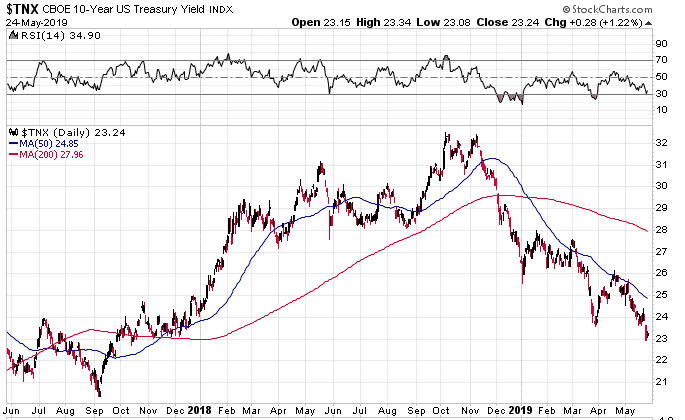

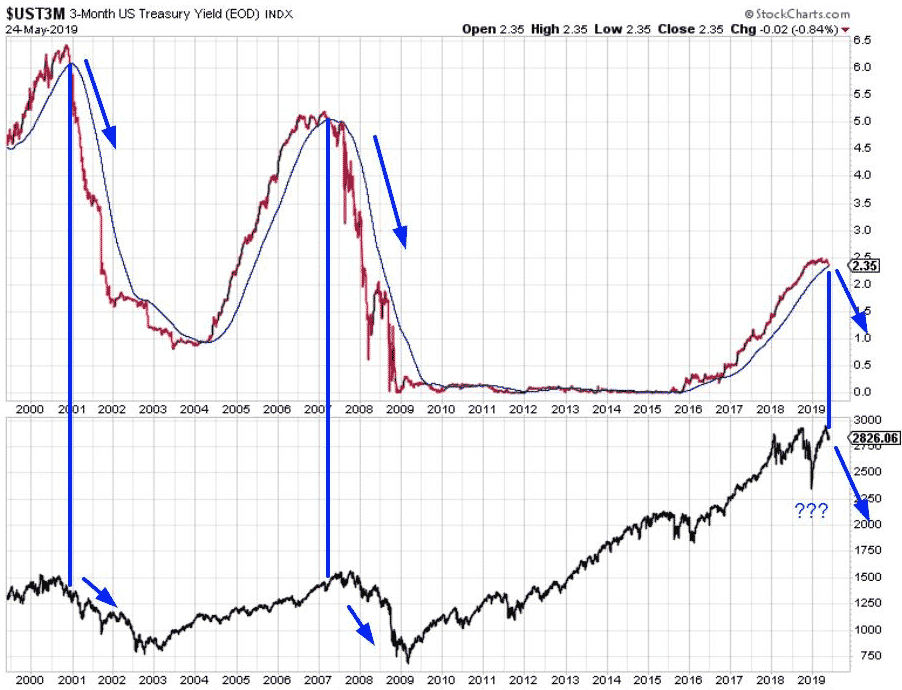

If the economy is so great, why are yields tanking?

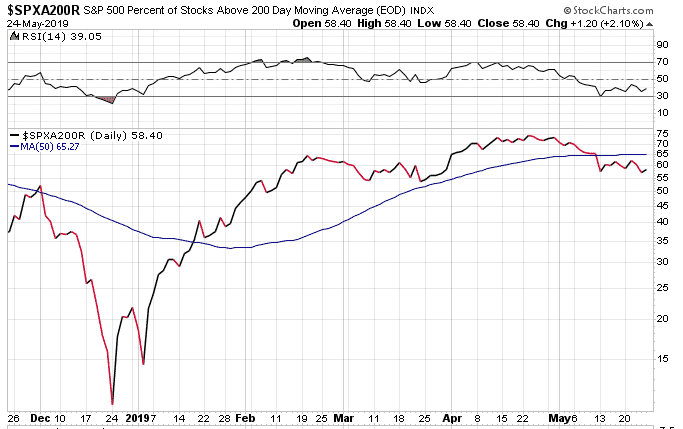

The number of stocks above their 200 day moving average is getting dangerously close to breaking 50%.

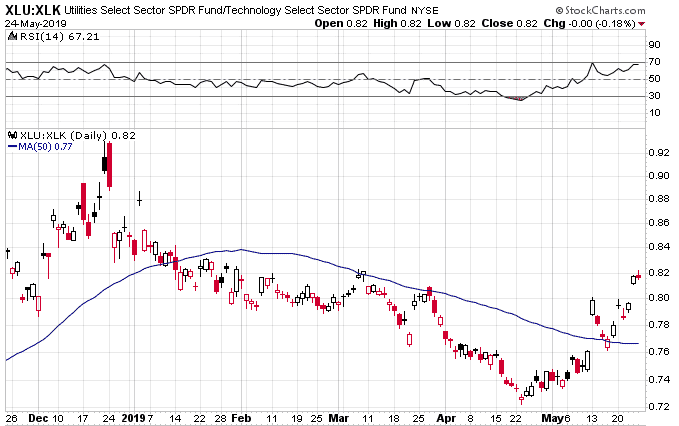

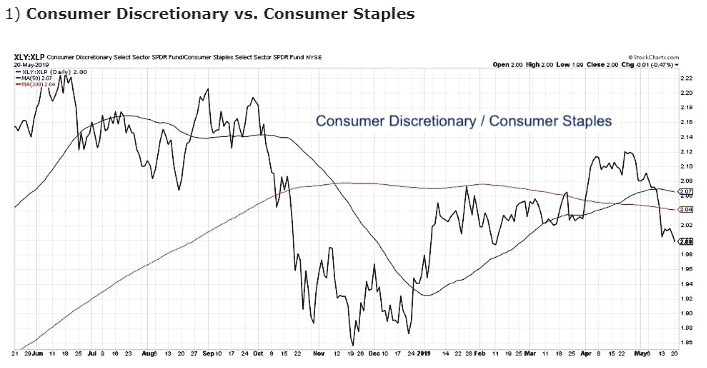

Seems like there has been a big flight to safety since late April with defensive sectors such as Utilities, REIT’s and Consumer Staples Outperforming.

Is the small cap under performance indicative of a weak US economy?

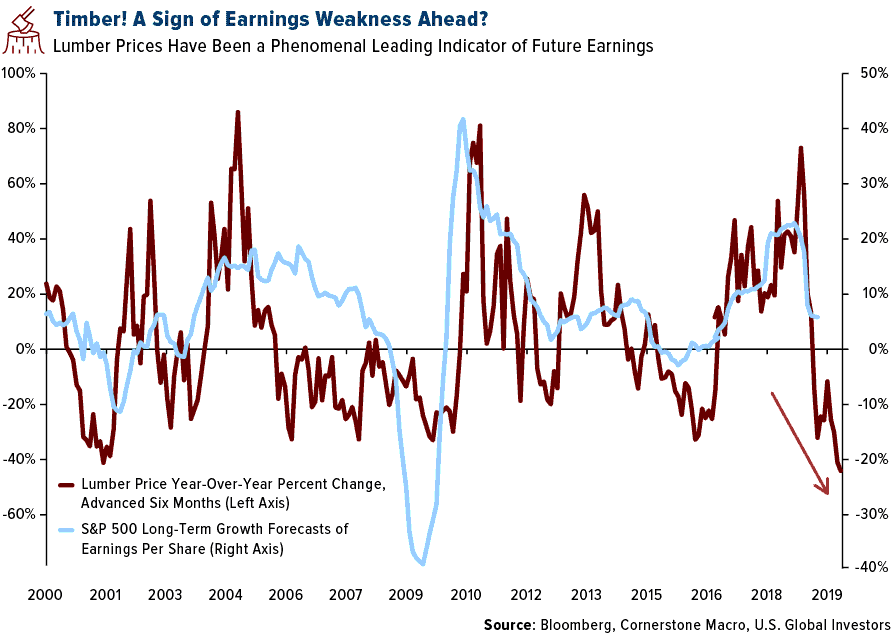

Are lumber prices giving us a clear warning?

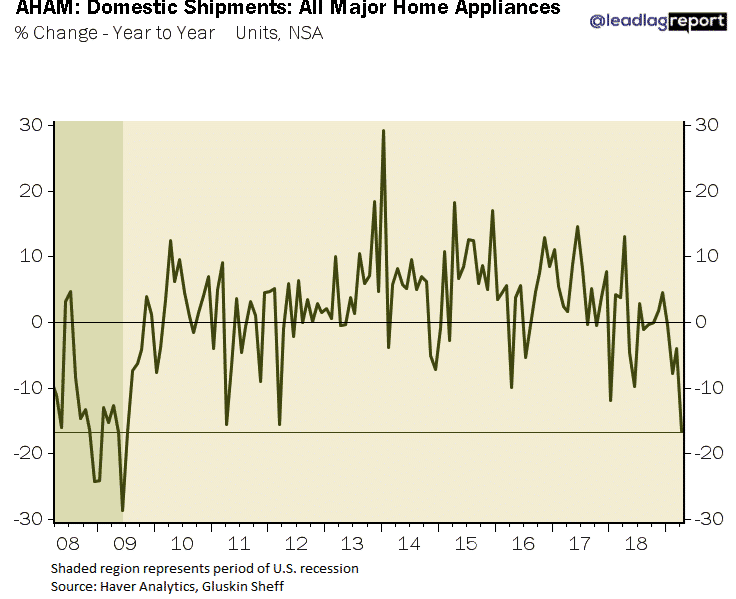

Shipments of home appliances falling off a cliff.

3 month Treasuries about to break below it’s 200 day moving average. It wasn’t great the last two times that happened….

I would be happy to hear some bullish arguments, so let me know below why you think the market is going higher.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.