While Peter Lynch did not coin nor specifically use this metric for evaluating the value of a company, it got this name because others have created this quantitative measure based on his investment principles.

Peter Lynch is a well-known successful investor and the former manager of the Fidelity Magellan Fund.

His investment principles are to understand the company’s fundamentals of a business and its growth potential.

He favored companies with consistent and sustainable earnings growth, ideally in the range of 20-25% annually for fast-growing companies.

In particular, the Peter Lynch Valuation Score centers around the PEG ratio.

Contents

What Is The PEG Ratio?

Before we get to the PEG ratio, first, let’s review the P/E ratio.

The P/E ratio is the ratio of the stock’s price per share to its earnings per share.

PE ratio = Price per share / Earnings per share

If the price is high in relation to its earnings, it has a high P/E ratio, suggesting that the stock may be overpriced or above fair value.

If the price is low in relation to its earnings, it has a low P/E ratio, suggesting that the stock may be undervalued.

Whether the P/E ratio is considered “high” or “low” is relative.

It is relative to the stock’s historical P/E and also to its industry peers.

It is normal for certain stocks and industries to have a higher P/E ratio than other stocks and industries.

Peter Lynch, being a value investor, likes undervalued stocks.

He also takes into account the company’s growth rate.

The PEG ratio captures this.

This price-to-earnings-to-growth ratio is the P/E ratio divided by the earning growth rate.

PEG = price per share / Earnings per share / Earnings Growth Rate

If the P/E ratio of a stock is low (meaning undervalued) while its earning growth rate is high, then it will result in a lower PEG ratio, which is what Peter likes.

What Is The Fair Value Price Per Share?

We can rearrange the above formula to get the price per share:

Fair Value (Price per share) = Earnings Growth Rate * Earnings per share * PEG

Although some fair value models like to say that a company is fairly priced when its PEG is 1, this is unrealistic for certain companies and industries that tend to have a historically high PEG.

It could take a long time to wait for the price per share to decline to that “fair value” where PEG = 1.

Therefore, other fair value models like to consider the companies/industries’ historical PEG when calculating fair value.

Conclusion

We have just given you a general basic intuitive understanding of how the Peter Lynch Fair Value Score is calculated.

The actual calculation and modeling get more complicated as they involve various nuances, such as whether it is basic EPS or diluted EPS.

Do the earnings include or exclude non-recurring items (NRI)?

What time frame is considered?

Is it trailing twelve months (TTM) or forward EPS?

Is EBITDA being used or not?

That is “Earnings Before Interest, Taxes, Depreciation, and Amortization”.

And so on.

Therefore, it is not as simple as looking up a number and plugging it into a calculator.

It is best to leave it up to the financial gurus and online fair value models.

As an example, one such model of using Peter Lynch Valuation can be found on forecaster.biz:

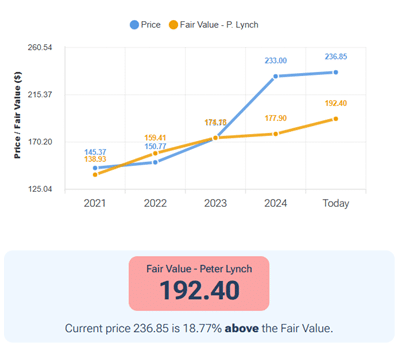

Source: forecaster.biz

It gives the Peter Lynch fair value price per share and charts it out over time in relation to the actual stock’s price.

This example shows that this stock is currently priced above the Peter Lynch fair value score, suggesting that the price may be overvalued.

We hope you enjoyed this article on the Peter Lynch valuation score.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.