With all this market craziness of the past few weeks, and talk of oversold conditions, I thought I would step back a bit and take a look at the bigger picture. In the US, interest rates are currently at 0-0.25%, economic growth is stagnant and unemployment is high. Things are generally not good and a lot of families are doing it tough, as I’m sure many US citizens can attest to.

As stock market mavens, we need to be students of history. One particularly eventful stock market crash occurred in Japan in the early 1990’s, so I decided to take a look at what happened during this period. As some of you may know, Japan experienced what is referred to as the “lost decade” following a very intense stock market and real estate bubble. After they experienced their crash in 1990, interest rates fell to zero, and there was little to no economic growth (sound familiar??). Below is an extract from a Wikipedia article on the topic. I have highlighted some relevant points:

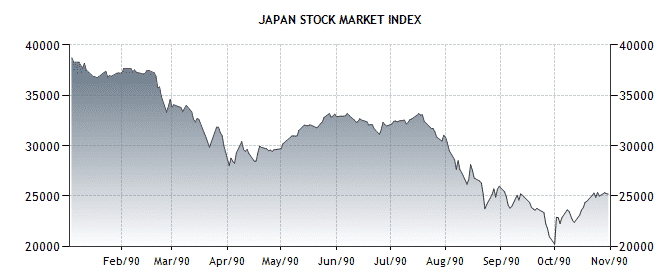

So much money readily available for investment, combined with financial deregulation, overconfidence and euphoria about the economic prospects, and monetary easing implemented by the Bank of Japan in late 1980s resulted in aggressive speculation, particularly in the Tokyo Stock Exchange and the real estate market. The Nikkei stock index hit its all-time high on December 29, 1989 when it reached an intra-day high of 38,957.44 before closing at 38,915.87. Additionally, banks granted increasingly risky loans.

The easily obtainable credit that had helped create and engorge the real estate bubble continued to be a problem for several years to come, and as late as 1997, banks were still making loans that had a low probability of being repaid. Loan Officers and Investment staff had a hard time finding anything to invest in that would return a profit. They would sometimes resort to depositing their block of investment cash, as ordinary deposits, in a competing bank, which would bring howls of complaint from that bank’s Loan Officers and Investment staff. Correcting the credit problem became even more difficult as the government began to subsidize failing banks and businesses, creating many so-called “zombie businesses”.

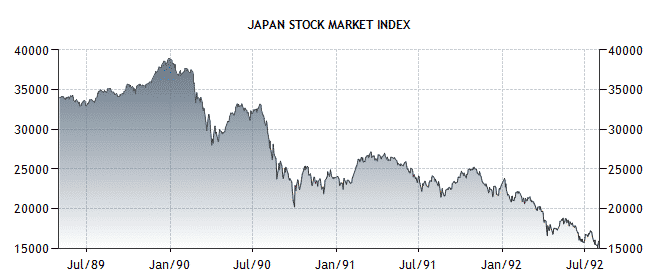

After reading this I wanted to take a look at the actual performance of the Japanese stock market during this time, to see if I could see any similarities between it and the current US market. You can see that during the initial decline, there were very few counter-trend rallies and the bulk of the damage was done within the first month. During that time the market fell by around 19% before retracing around 6.3%. As of this morning’s low, the S&P 500 had lost about 19% and has since retraced 6.3% from the low. So, what happened next for Japan?? After the initial 6.3% retracement, the Nikkei fell another 12% within a week or so and eventually lost 60% of its value.

I’m not saying this is what will happen in the US, but it is interesting to note the comparisons. So beware, just because the market may be oversold and has had a bounce today, that does not necessarily mean everything is right with the world and the markets will continue upwards. As always, you should be on your guard and the number rule of the game right now should be CAPITAL PRESERVATION.

Happy Trading!