This is a guest post by Henrik Santader, aka “The Lazy Trader”. I hope you enjoy, let me know what you think about this strategy in the comments section.

Hello fellow traders.

I recently talked about the Box Spread, which is an interesting technique that allows you to lock in profits on an existing Spread position but eliminating the potential for more gains.

Today, I want to mention another technique that also allows you to lock in existing profits but unlike the Box Spread it also offers the opportunity to achieve unlimited potential profits.

Let’s go with an example to make it easier to understand.

Let’s say I’m long a Bull Call Spread on symbol XYZ.

XYZ is trading at $100 and I buy the 100 strike Call (for $4) and sell the 105 strike Call (for $1) to reduce my costs.

BUY 1 Strike 100 Call @4.00

SELL 1 Strike 105 Call @1.00

Initial investment: $3.00 (Debit)

The instrument (XYZ) moves up to 103 and now the spread has some profit. Let’s say the 100 Strike Call went up to 6.00 and the 105 Strike Call went up to 1.50.

Strike 100 Call = $6.00 (Which I am long)

Strike 105 Call = $1.50 (Which I am short)

My spread is now worth $4.50. With an initial investment of $3.00 this represents a $1.50 gain. I want to protect part of that gain, but stay in the position at the same time.

I can consider buying the 105/110 Put spread. This would create a Box Spread, for a guaranteed profit but, no more potential gains. (Visit the article about the Box Spread for more details).

The other alternative is to create a Three Legged Box. If you buy a Put at the higher strike of the Bull Call Spread (105), and that Put’s cost is lower than the temporary profit in the existing Bull Call Spread, you are locking a guaranteed profit.

So, back to my initial 100/105 Bull Call Spread where I had a temporary profit of $1.50…

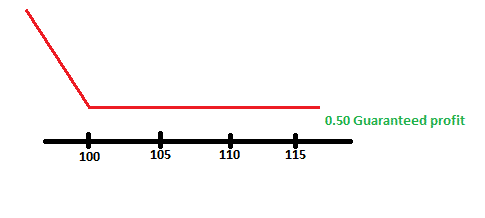

Now, if I can buy the 105 strike Put for less than $1.50, I would be locking a profit. Let’s say I can buy the 105 Put for $1.00 (This Put is cheaper now because XYZ moved up from 100 to 103). This action locks a guaranteed 0.50 profit (1.50 temporary profit in Bull Call Spread – 1.00 Cost of 105 strike Put) and it also gives me the nice scenario of unlimited gain if the instrument decides to tank to less than 100.

The final profit picture would be something like the following:

You can leave your position open until expiration now, with a guaranteed profit of 0.50 and potentially more than that. There is nothing to lose, why not leave it?

The example illustrated here was based on a Bull Call spread that makes profit first, and then a protective Put is applied. But using the same idea, if you are bearish on a stock you can enter a Bear Put Spread. If your spread makes some profit you protect it with the purchase of a Call option. The stock went down and you made money on your Bear Put Spread, and now you protect it by buying a Call which also gives you unlimited profit potential should the instrument start to move up. The final profit picture would show unlimited profit in the upside and a guaranteed horizontal profit in the downside.

On a final note, you don’t necessarily need to start the Three Legged Box using a Spread. You could start for example with a single option. For example let’s say you are bull and purchase a Call option. Your Call makes money and then you do two things at the same time: sell an Out of the Money Call (which just became more expensive) and combine it with the simultaneous purchase of a Put at the same strike. For example:

– BUY 100 strike Call

– Stock moves up and the Call option makes some profit

– SELL 105 strike Call (whose premium just increased) and BUY a 105 strike PUT simultaneously.

The result, in terms of profit picture, is the similar to the first example. You end up being long a lower strike Call (100), short a higher strike Call (105), and long a Put at a strike price which is equal to that of the Call option you are short (105).

The disadvantage of the Three Legged Box is that you need to be initially correct in your bias, because in order to form the Three Legged position and lock profit, you need to make a significant gain.

Also, like any multi-legged position, you must check out the commissions schema offered by your broker as it could negatively impact your results.

I hope you enjoy this article and that it helps you in your trading.

If you liked this article you can check out The Lazy Trader blog for similar free content.

The thinking behind this is excellent. Paper trading the 3 legged box is the best way of checking costs etc. If your view of direction changes during a trade then locking in your profit would be the safest strategy.

Let’s see … the index at 103 and the 105 put only $1 ???

The put’s worth $2 to begin with, and a few pennies more for time premium … right or wrong … LOL !!!

I know I’m right, but the strategy’s not bad.

Good, concise explanations of the investment strategies, easy for all to understand. Excellent post. It’s valuable information for anyone interested in options trading.

I see the other Mike’s comment about it being impossible for put at 105 to be worth only $1, so I guess what one would “really” do in real life instead is to buy a put nearest strike to current price/profit zone. Therefore, if put available at $103 AND cost (including commissions) is less than profit, then I do not see why this wouldn’t be an ideal approach to locking in profit. Makes sense once you think it through completely. Very good article (IMO). Thanks Henrik

That’s exactly right successmike. Thanks for your comment.

Hey, I sent a blog to you concerning the 3 Legged Box (3-LB) Spread. I found a video that shows how to trade the 3-LB without any loss (PROFIT ONLY). ARBITRAGE 3-LB. Click on video below & Explain.

https://youtu.be/nJmZy3gFrLE