The following is a guest post from Martize Smith.

Wouldn’t you like to know the best financial tips to start using now while your young that will lead to super big pays off if you stay consistent?

The good news is that these tips are simple and can be used immediately after learning about them. The three best financial tips for young adults are to:

-Raise Income

-Set Financial Goals to Save

-Invest in Income-Producing Assets

1. Raise Income

Raising your income is critical for financial success. The foundation of wealth creation is to earn money, save it, and invest it. To learn about the different types of income read this.

For a complete guide to wealth creation that is more in depth check out this article. Also, feel free to look into these 6 ways to make money and learn how average people are becoming millionaires.

For some people they may think what happens if I don’t make enough money to save or can only save very little?

It is still possible to save even if your bills exceed your income. Here you would simply pay your self first regardless and don’t touch the money you save.

People who experience this will have some challenges but there is still good news for those in this situation.

In this scenario you can either decrease your cost of living so you can save more or increase your income.

The problem with decreasing your income is that it may work for some but there is a limit to how much a person can decrease their expenses.

On the other hand, if you increase your income that is unlimited because you can earn as much as you want. I recommend both but I strongly emphasize increasing your income over your entire life.

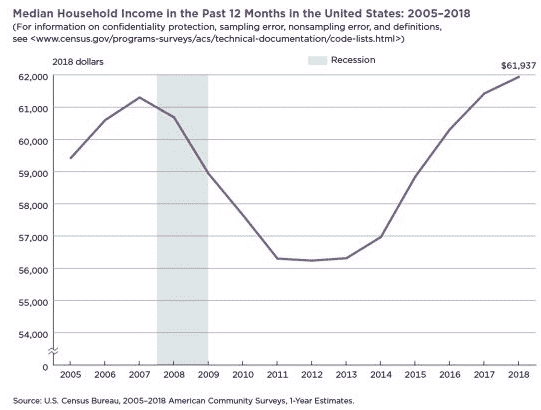

The average household income in the USA from the year 2017 to 2018, according to the USA Census Bureau, was $61,937, which was a 0.8% increase from the previous year. I don’t know about you but this household income average is not impressive. You will be able to save but it can be easier to save more if you are earning more.

You can increase your income in many ways but I will discuss a few ways to do it. The exercise I will share is a well know high power brainstorming method that has been proven to work.

You can increase your income in many ways but I will discuss a few ways to do it. The exercise I will share is a well know high power brainstorming method that has been proven to work.

It is called many things but lets call it the 20 idea method. Take a sheet of paper out and label the top of the page 20 ideas to increase my income.

List 20 different ideas that would make you more money over the next year.

Once you finish circle one answer of the 20 that would have the most impact on your happiness then you make a plan to accomplish it in stages from beginning to end.

Once you make your plans in stages or steps then begin working on your idea until you have succeeded at increasing your income. So here is how it would look like but in a short form and the highlighted idea represents the idea that would be circled in exercise.

20 Ideas to Increase My Income

- Change Jobs or Professions

- Start a Business, Freelance, or Retail Arbitrage

- Work longer hours

Next Steps:

Step 1) Obtain a pen and paper

Step 2) Complete the 20 Idea Method

Step 3) Circle the one that would make you the happiest

Step 4) Make plans in writing and in stages to accomplish the idea you circled

2. Set Financial Goals

Setting goals is the single best thing to do when it comes to personal finance. There are studies to show that people who set goals are more likely to accomplish them compared to those who do not.

When you set goals they have to be put in writing as this shows you understand fully and in a clear manner what your target is. A brief example of setting goals is to do the following:

-Write out on paper your financial goals for a 12-month period range as your deadline.

-Take the total amount of money you are trying to save in a year and divide it by 12 which is the months in the year

The example below shows the break down of a person who has a goal of saving $5500 a year.

Annual Savings Goals: $5500

Annual Savings broken up per month: $458.33

If a person gets paid once a month then saving $458.33 will get you to your target if you get a pay check every 2 weeks then saving around $229.16 or so would get you to or higher then your $5500 annual savings goal.

Issues and challenges do come up while you are trying to save like a car break down, flat tire, or any such unexpected expense.

It is good to plan for that and if possible save more then what you are expecting to save originally so every paycheck whatever your save increase it by another $20 or $40 in case you have to use it.

Tracking your savings during the year is just as important as setting financial goals because if you are not tracking your savings it would be much harder to see if you’re hitting your monthly milestones and eventual your annual goal.

Tracking also may lead you to adjusting your savings amount like if your not reaching your monthly savings goals because you realized you are eating out more then you should you can simply reduce eating and use what would be money to go out to eat and put that in your savings.

When you track your money, you are simply ensuring you know where the money is coming from and where it is going.

When your young you can have a lot of thoughts like “I don’t make enough to save”. For those people who think you have to make a lot or even be rich to save consider this study showing you don’t have to be rich to start saving.

Another tip when setting financial goals on paper is to have your savings in a different account from your checking account which is like a no brainer right.

Next Steps

Step 1) Write out on paper your annual financial or savings goals

Step 2) Break down your specific annual financial goals into monthly goals

Step 3) Set a tracking system in place for you progress

Step 4) Monitor your activity with scheduled times to check everything

3. Invest in Income-Producing Assets

Investing is the cream of the crop in wealth creation. Investing is what separates the wealthy from other socioeconomic groups. To master how to build wealth start with reading books on building wealth.

Here is a list of books that can help you get a quick start or continue to improve your ability to build wealth.

A well-known wealthy business man once said “Poor people spend all of their money, the middle class save their money, and the wealthy multiply their money.”

The wealthy also save money but the distinction between the wealthy and other groups is that they invest skillfully.

Investing is simply putting money or resources into an idea, project, or venture that will yield a return on the money used to invest in it.

Investors have different ways of investing but here we will focus on investing in income-producing assets.

An asset is something that puts more cash in your bank account.

An example of an asset is solely based off what it is doing for you.

For example, an investment real estate property being rented to a tenant puts $500 in your bank account after all expenses is a asset but if tenant leaves and the property is costing you money then it is considered a liability.

It is important that as you earn money and save that you find income-producing assets to invest in.

Choose income-producing assets that you are excited about and don’t just choose ones because other are doing it.

A few Income-producing assets are but not limited to: Real Estate, Buying other businesses or websites, franchises, etc

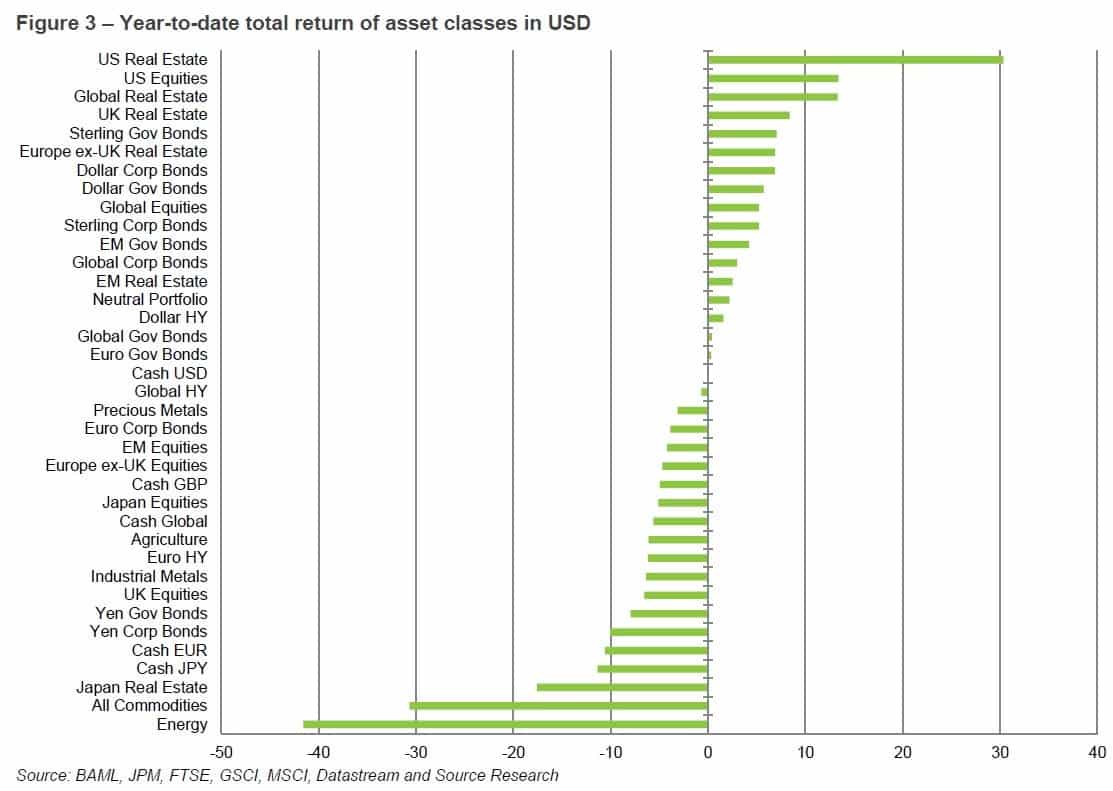

Below, sourced from the Datastream Global Database, is a list of the performance of different asset classes in the USA from the year 2014. Consider examining this data as you choice what asset classes to focus on for your investments.

Here is a recommended process to help guide you in finding income-producing assets:

Here is a recommended process to help guide you in finding income-producing assets:

Next Steps

- Explore Income-producing assets in business magazines, legitimate investing groups, personal research, etc

- Decide on only one income-producing asset to focus on before looking into other ones

- Spend 50 to 100 or more hours reading about the income-producing asset you are focusing on

- Understand what needs to be done before investing in it

- Invest

If you thought this article was valuable leave a comment on what helped you the most or what other subjects you would like to learn about.

Don’t forget to claim your FREE Ebook on the Secrets of Wealth plus a BONUS FREE online course get it NOW.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.