When markets crash there is always a significant flight to safety. We’re currently in a correction, but if you were to watch CNBC you would think we’re in a full blown bear market.

The reality is we’re only about 5% from the recent highs.

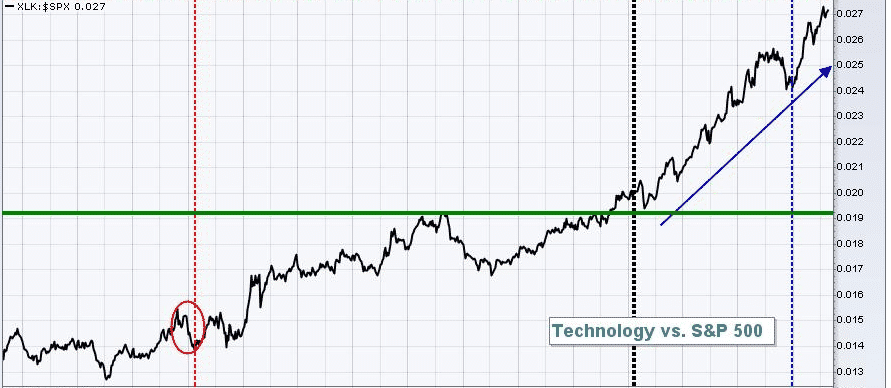

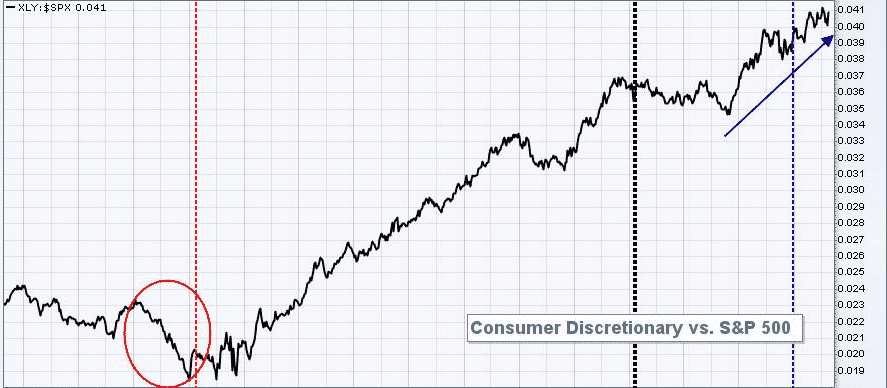

The fact that the tech sector and some other aggressive sectors are holding up well might mean the correction will not be too severe.

Let’s take a look at a few charts that were shared by Tom Bowley:

TECH HOLDING UP WELL ON A RELATIVE BASIS

CONSUMER DISCRETIONARY ALSO HOLDING UP WELL

S&P 500 REMAINS WITHIN THE TREND CHANNEL

While we might be in for a bit more short-term pain, I think it’s a little early to call for a bear market.

DIS is another chart of interest that Tom shared. DIS is currently also showing relative strength and is holding above gap support.

According to Tom:

“There’s been a lot of consolidation since the huge move higher in April, but that’s simply establishing a nice base. DIS continues to trade fine on a relative basis and its peers are performing well. It’s likely just a matter of time before we see further strength here.”

For DIS, the $127.50 level is a pretty important line in the sand. Traders looking to get exposure to the stock could enter a bull put spread with a stop just below $127.50.

The January $115-$105 put spread is currently trading at $1.11 which would generate a 12.5% return if it were to expire worthless.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.