Stock Market Day Trading. What is it exactly? Let’s look at that in a bit more detail and see if we can come up with some tips for day trading stocks and options.

A lot of people hear the term day trading and think it is a ticket to immense riches. I’m sure you’ve seen all the ads that promise you’ll make millions if you’ll just spend $99.99 on the latest day trading system or software. You tend to find that you’ll hear a lot more about day trading online when there’s a bull market too. Serious online day trading is a very risky business and you should do appropriate research before deciding if it is for you.

To me stock market day trading can be done in many ways, but the technical definition is “the practice of buying and selling financial instruments within the same trading day such that all positions are usually closed before the market close for the trading day.” Now that the definition is out of the way, we can delve into the mechanics of day trading.

TREND FOLLOWING

These types of day traders follow the trend of the market and look to buy stocks that are rising and sell stocks that are falling. They will use multiple time frames to determine the trend. Eg. 1min, 30min, daily and weekly.

CONTRARIAN

This is also a market timing strategy, but unlike trend following, these day traders are expecting the prevailing trend to change and as such will buy stocks they feel have fallen too far and sell stocks that have risen too far.

RANGE TRADING

These traders looks for stocks that are range bound and identify support and resistance levels at which to buy (in the case of support) or sell (resistance). Range traders will also look for “breakouts” where a stock that has been trading in a range pops above resistance or drops below support. The idea here is that once the support or resistance is broken, the stock will continue in the direction until it find new support and resistance levels.

SCALPING

Scalping was originally referred to as spread trading and is a style where traders take advantage of small gaps created by the bid-ask spread. Scalping is a quick fire trading method where positions are entered and closed within minutes or even seconds.

TRADING THE NEWS

Some traders will enter positions before a significant news item such as an earnings announcement in the hope of making large profits in a small amount of time following the announcement. Some traders will also enter trades just after the news announcement in the hope that the market will agree with their opinion on whether the news was good or bad. News announcements usually result in significant volatility on a stock in a short period of time.

PRICE ACTION

These traders try to keep things simple and rely on price movement and chart patterns when determining when to make a day trade.

COMPUTERIZED TRADING

It was estimated that in 2005 nearly one-third of all trading on the US markets were made by automated trading methods and computers. These computer programs use automated algorithms and high-frequency trading in order to make profits. Some people blamed automated trading for the “flash crash” that occurred in May 2010 when the Dow Jones dropped around 10% in a matter of 30 minutes.

These are the main methods for day trading online, but in order to be profitable, you need to try and follow these day trading tips:

- You need to use a system or process that has been proven to work

- You should paper trade your strategy before going live

- You need to be incredibly disciplined

- You need to have adequate capital

- You need to trade an appropriate position size

- You need to have very good money management and risk management rules

Recently I have been delving a bit more into the world of day trading with some success. My criteria for entering a day trade are as follows:

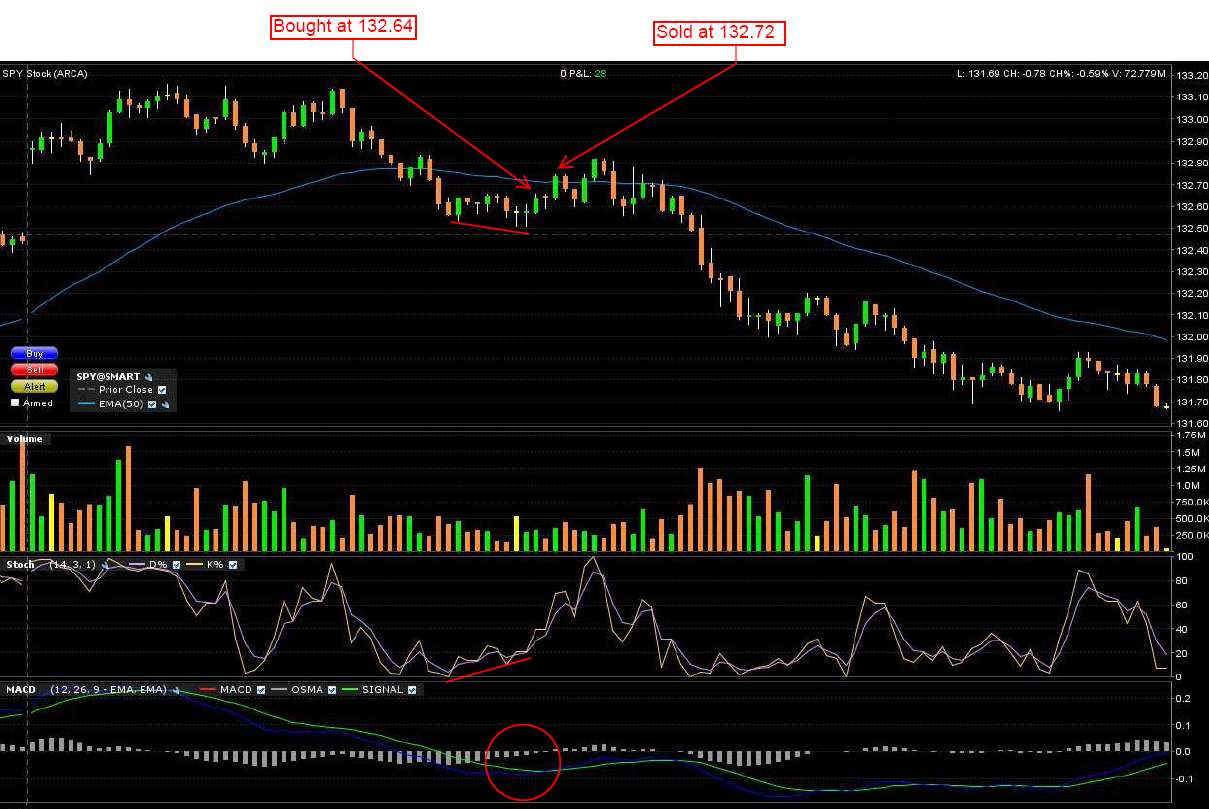

1) There must be divergence. i.e. the stock price makes a lower low while the stochastic indicator makes a higher low. Or conversely, price makes a higher high while the indicator makes a lower high

2) MACD must be signaling a trend change

3) I cut my losses as soon as the price drop below the recent low (when long), or above the recent high (when short)

Here is an example of a trade I made today. As you can see on the picture, there is a clear case of divergence. The red line at the top shows the price making a lower low and the second red line shows the indicator making a higher low. The red circle at the bottom show the MACD switching from a sell signal to a buy signal. Today was a significant down day (as of writing the SPY is -1.11%), but as you can see, I was still able to make a small profit on the long side by following my trading rules. I took my profits quickly on this trade as there has been a distinct bearish tone all day with oil trading up around $106 and the unrest in the Middle East. I didn’t time the exact bottom or the exact top, but I was in and out of the trade within 3 minutes.

So there you have a brief explanation of what is stock market day trading as well as a real life day trading example. Has anyone tried their hand at day trading and if so, what strategies / rules do you use?

Happy Trading!

Hi, I am using Fibonacci “ambush” pullbacks to enter SPY trades (calls and puts).

Hi Djohnsonhot, can you explain what you mean by “ambush” pullbacks?

http://kurtosistrading.com/blogspot/wp-content/uploads/2009/06/gc090625.png

The above link shows the setup: I use Custom FIB setups learned from a guy named Dave Halsey (Emini Addict)….it works.

Let’s say we are long: you draw a fib retracement setup from the last swing low to last swing high on a day chart first…then drill down to 15min charts and you are looking for a retracement to the 50% line to HOLD, and absolutely NOT to break the 61.8% line. On longer timeframes, such as a day chart, the break of a 61.8% line can cause the algo’s to revert to a short setup until the opposite occurs.

I have attached an Intel chart example….Intel is in a short trend until the 61.8% line is broken….the -23.6% is the TARGET of the short and profits MAY be taken there.

If price action pushes or blasts lower than the 61.8% line, then the next fib may be drawn from a LOW touch above to the latest low….another short pattern arises.

I have studied this setup for 9 months and I use it for equities and Futures. I am watching several Equities now to hold: AXP, CSTR, KFT, KKR, KO, LINE, MMM, MO, NLY, PEP, POT and WMT.

I have been trading equities and options, as well as futures (latter unsuccessfully recently due to this CHOP) since the 90’s.

Brilliant. thanks.