It would take a brave man to bet against stocks smashing out all-time highs every day, but let me play devil’s advocate for a minute.

While it’s hard to argue with the performance on stocks as one of the major risk assets this year, commodities are seriously underperforming. The S&P 500 began the year at 1,848.36 and is now trading 11.89% higher at 2,068.22.

The CRB Commodity Index on the other hand started the year at 280.17 and is now trading 4.90% lower at 266.44. The Commodity Index has been beaten up in the last 6 months and is down 14.86% from the high set mid-year. It is currently nearly 30% down from the post-crash high of 370.56 set in 2011. So commodities are well and truly in a bear market.

Commodities prices are generally a good indicator of economic activity. When activity picks up, demand for commodities increases in order to build new houses and infrastructure projects.

So what we are seeing is a massive divergence in the performance of one risk asset in relation to another.

Stocks are being driven higher but share buybacks, central bank stimulus and cost cutting whereas commodities are being driven lower in part by reduced demand.

In the past, stocks and commodities have tended to move in a reasonably similar pattern. The correlation is not 100% by any means, but history suggests that the two will not continue to diverge indefinitely.

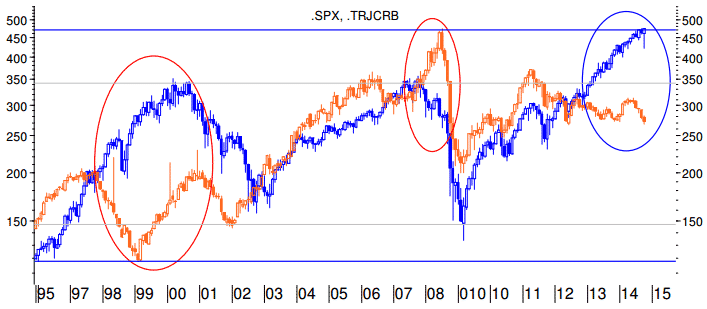

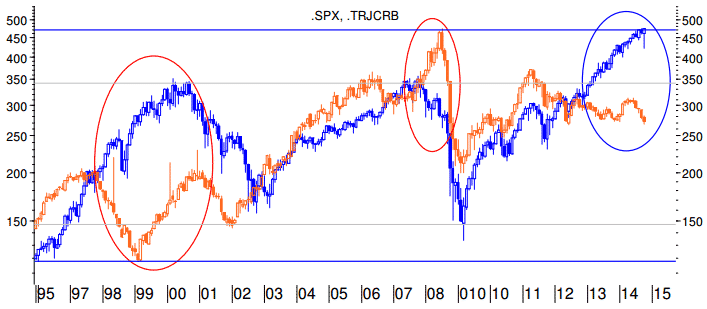

In the chart below posted by Abigail Doolittle of Peak Theories, you can see there have been two prior periods in the past 20 years when stocks and commodities have diverged. Both ended with the two coming back together.

Chart Credit: Peak Theories

The first divergence in 1998 took until late 2002 to be resolved.

The second divergence in 2008 was resolved in much quicker fashion.

Current prices have been diverging since late 2012. At some point the two will converge, either in the form of higher commodity prices or lower stock prices. That divergence may come in the next few months, or it could take another year or two to play out. No one knows, but when it does occur make sure you are not the one left holding the bag.