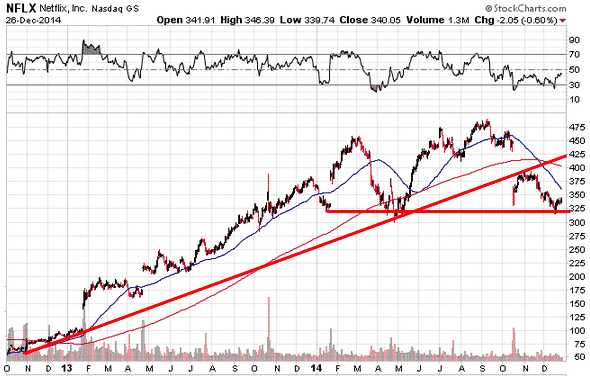

In a recent video posted on CNBC, renowned technician Carter Worth made a case for further downside in NFLX. Worth’s analysis stems from 3 main factors pertinent to the current chart.

- NFLX recently broke below the long term trendline

- A head and shoulders top pattern appears to be nearing completion

- In October, NFLX had their first earnings miss in well over a year and the stock was heavily punished

You can see in the chart above that the $320-$325 level is crucial support. If that level breaks, we could easily see $275 of $250 pretty quickly. NLFX options are expensive, and buying puts outright can be a recipe for disaster. However a cheap way to gain exposure to a NFLX downward move would be to buy a directional butterfly.

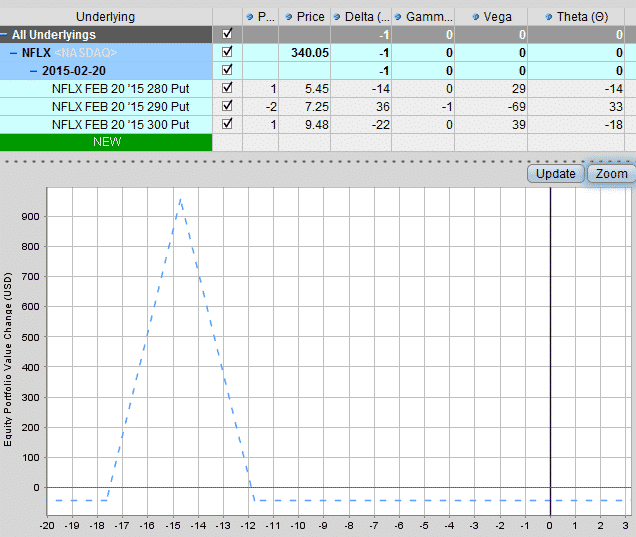

Worth’s target for the stock is $290 by around February or March. Assuming your price target is similar you can pick up a very cheap put butterfly centered at $290.

You can get in to the trade for $50-$100 and the profit potential is up to $950. It’s a bit of a lottery ticket as you need the stock to drop around 15% by expiry, but with earnings on January 20th, perhaps that will be the catalyst for the next big move lower.