Divergences in the market can be a powerful tool, but the really important ones can be hard to spot. Carter Worth is someone I have followed for a long time. His analysis has been spot on in the past. I remember in March 2009 he called the bottom due to a divergence he was seeing – semiconductors had rebounded before the overall market.

This time he’s back with another divergence, the safe sectors of healthcare and consumer staples are diverging from energy and materials. So much money has been flowing into safe haven stocks and this divergence is pretty scary to me. Check out Carter’s analysis below, it’s only a 3 minute video.

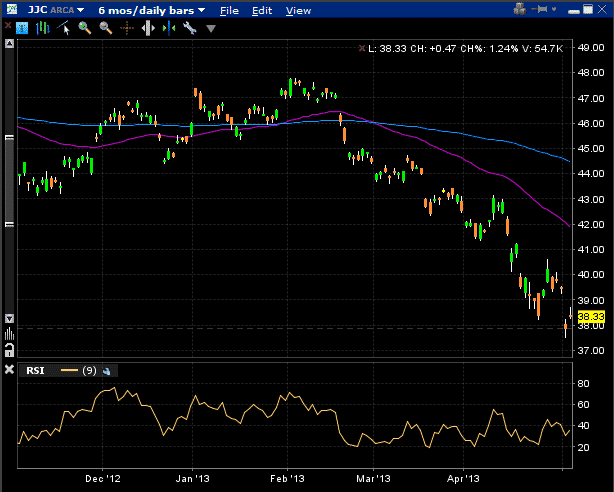

The other thing that has me concerned is “Dr. Copper”. Copper has long been a reliable leading indicator of market direction.

This 6 month chart of JJC does not fill me with confidence at all.

The average daily range of the market has really been picking up lately and we have seen a couple of mini intra-day flash crashes. I feel like a much bigger move may be on the horizon. There are certainly a few things going on that don’t exactly scream “all-time highs”.

Well this article was pretty poorly timed. haha. I still think a big correction is coming, but it may not happen for another 4-5 weeks.

I certainly hope so, Gavin…

Marc

Stocks that are making all time new highs are dangerous to short. Of course one of the new highs will be the top but which one?