This trade idea comes courtesy of CMLViz and their Trade Machine®.

The idea is a new and, in some ways, improved version of a pre-earnings momentum strategy. This goes beyond just naked long a call, and gives the opportunity for two shots at momentum with one trade.

Pre-earnings momentum trades are one of my favorite trades from the Trade Machine®.

PREFACE

This custom strategy has shown higher win rates per stock across the constituents of the Nasdaq 100 over the last 10-, 5-, 3-, 2-, and 1-year than the straight down the middle bullish momentum call. Let’s take a look at the pattern in Autodesk.

Further, if this initial custom strategy fails due to lack of bullish momentum in the stock, it has a second chance built in without making another trade — let the short-term leg expire, and keep holding the longer dated leg. Let’s see it in action.

LOGIC

The goal is to create a portfolio of option trading backtests with alerts attached to them, so we don’t have to watch the market all day, but rather Trade Machine is the work horse to notify when the ideas become actionable.

Finding these patterns in Autodesk Inc should be straight forward. The next earnings date for ADSK is unverified, with an estimate of 8-22-2019. While that date is not good enough to trade off of, it gives us an idea that two-weeks before then should be in early August.

THE CUSTOM BULLISH PRE-EARNINGS TRIGGER IN AUTODESK INC

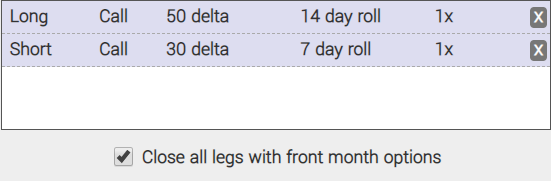

We will examine the outcome of going long an at-the-money (strike price is set to the 50 delta) call option that has 14-days to expiry, and short an out-of-the-money (strike price set to the 30 delta) call option with 7-days to expiry. But we do all this starting 14-days before-earnings with the additional following rules:

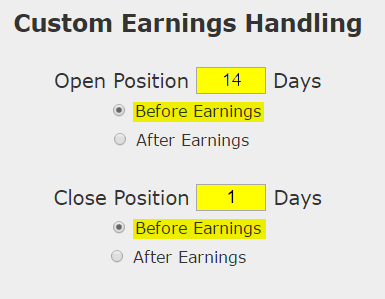

CUSTOM EARNINGS TIMING

This call time spread opens 14 calendar days before earnings:

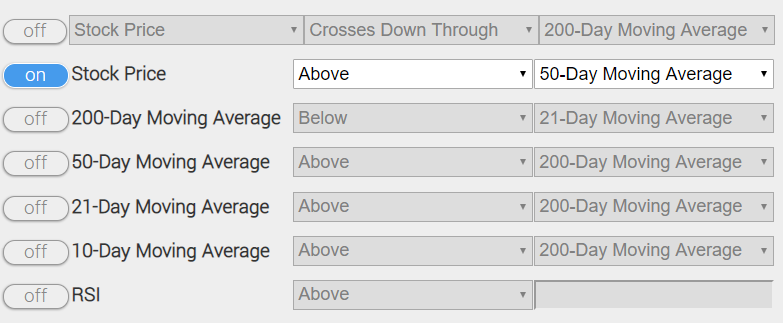

* Use a technical trigger to start the trade, if and only if these specific items are met.

* The stock price is above the 50-day simple moving average:

Here it is in an image from Trade Machine — only focus on the settings where the filter is turned to “on.”:

You can set an alert in Trade Machine®, which will track all of these moving parts for you, and message you when it triggers. In fact, you can do this with a portfolio of stocks for a portfolio of bearish and bearish triggers. Let Trade Machine do the work for you — there’s no need to stare at the screen.

Finally, here is how the custom strategy looks in Trade Machine:

Again, the set-up is opening the at the money call option that is closest to 14-days to expiry (but expires after the earnings date) and selling the out of the money call option that is closest to 7-days to expiry (but expires before the earnings date).

This entire trade closes after the 7-day options expire as it has been backtested.

OPTION BACKTESTER RESULTS – TECHNICAL ANALYSIS

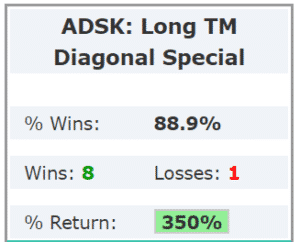

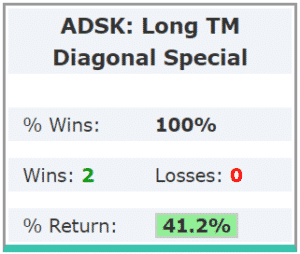

Here are the results over the last three-years in Autodesk Inc:

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

This entire trade closes after the 7-day options expire as it has been backtested. But, there is an opportunity, if the trade fails, to hold the longer dated calls right up to the day of earnings and sell it right before, for those that want to take a second swing at the bullish pattern.

CHECKING THE MOVING AVERAGES

You can check to see the values of all the moving averages discussed above with real-time daily prices, including live after hours prices, for ADSK by viewing the Pivot Points tab on CMLviz.

BACK-TESTING TECHNICAL ANALYSIS

Results from the last six-months are provided below as well:

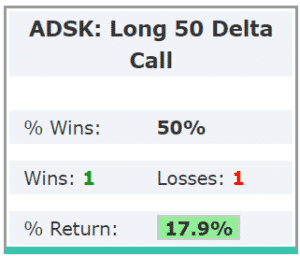

See how this calendar call spread compares to just the naked long call:

CMLVIZ TRIAL

Unfortunately, CMLviz doesn’t offer a free trial, but the product is seriously so good that I want you to try it out.

If you go through my affiliate link, you can purchase the software for $109 per month instead of $199.

Also, if you do sign up, just send me proof of payment and I will refund you the first months payment, that way you effectively get a free 1 month trial. How good does that sound?

Trade safe!