Today, we’re going to talk about options max pain theory. This is a great theory for traders who feel that large institutions are manipulating stock prices.

The Max Pain Theory claims that as option expiration approaches, stock prices will tend to get pushed toward the price at which the greatest number of options in terms of dollar value will expire worthless.

In other words, as expiration approaches, stock prices will gravitate toward the price that will cause both call and put buyers the most pain, since their options would expire worthless at that max pain price.

Thus, max pain is the price at which option holders would lose the most money and option writers or sellers would profit the most.

Remember that large institutions are generally net sellers of options, so they stand to make the most from a stock pinning the “Max Pain” strike.

This is generally going to be the strike price with the greatest number of open contracts. Max pain is only a theory and can’t be relied on to work all of the time.

However, the Max Pain Theory is supported by the fact that there are very large institutional option sellers who may have the ability to manipulate stock prices.

It is possible that they will push a stock price toward the max pain point so that their option writing trades will benefit the most.

When expiration is near and a stock price gravitates toward the max pain price, some people will say that it is being pegged or pinned.

It is difficult to prove whether max pain pinning is real or coincidental, but stock and option traders can still benefit from being aware of max pain, especially when the option expiration dates are near.

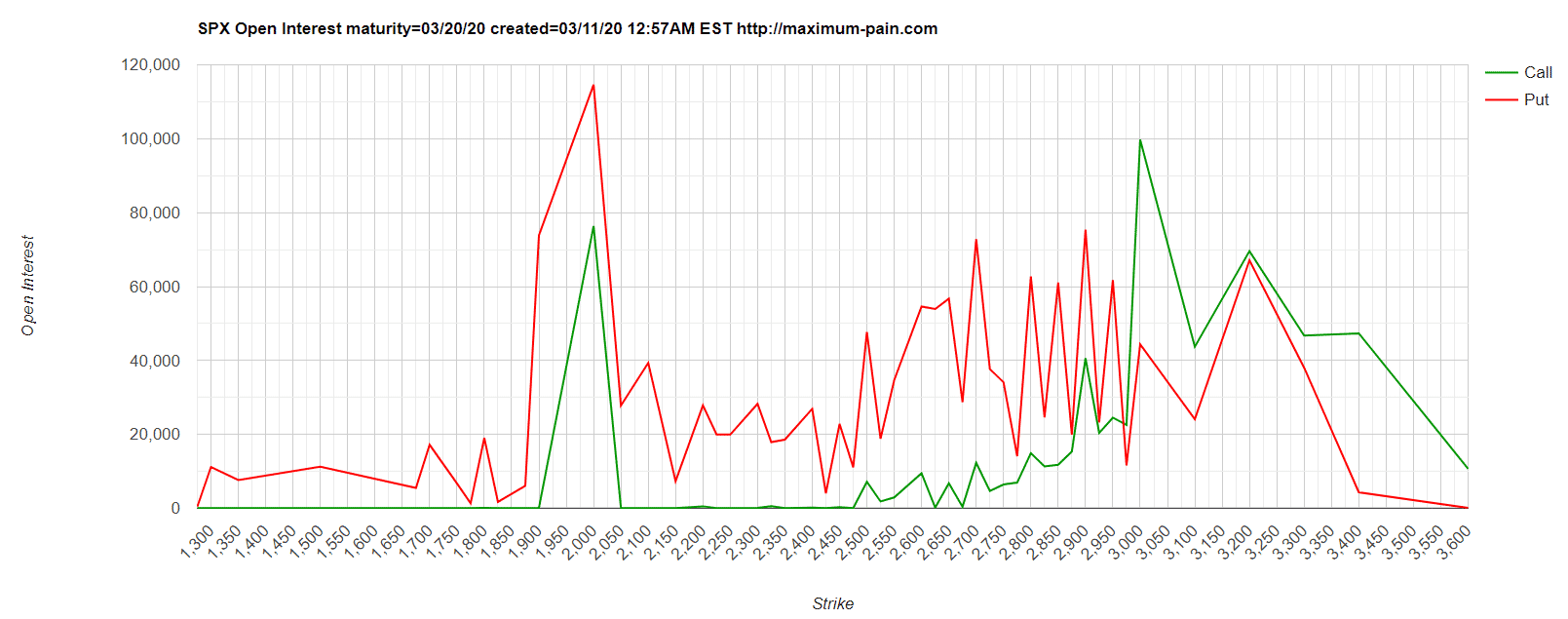

Below you can see an example of the March 20th option expiration showing the open interest at various strikes. This data was as of March 10th.

As you would expect, there is a large amount of open contracts at the nice round numbers of 2000 and 3000. There is also quite a lot of open contracts at the 3200 strike.

This data is readily available on any stock or index for free from the website maximum-pain.com

In this example, the S&P 500 closed at 2304.92 on March 20th. While this wasn’t a pain of maximum pain, it was very close to a nice round number and no doubt caused some trades some pain.

Personally, I’ve never placed a single trade based on options max pain theory. I’m not saying it doesn’t work, it probably just needs a bit more research and backtesting which I have not done at this stage.

Some traders will swear by this method, but you’ll want to do your own research before trying anything out for yourself.

I would be interested to hear from anyone who has traded based on this theory.

So the next time you see the price of a stock magically or magnetically moving toward a round number in the final hour before option expiration, just remember the words “max pain.”

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thank you, learnt something new!

Interesting. What would be an example of using this for a trade?

Let’s say the max pain for SPY is 470 for November expiration, you could place a butterfly at that strike assuming the price might settle there on expiration day.

Could a Calendar spread take advantage of Max Pain Theory?

Yep, for sure.

Which is better? Weekly or Monthly expiration if you decide to trade based on this theory

I wouldn’t say one is better than the other. It depends on your trading style.