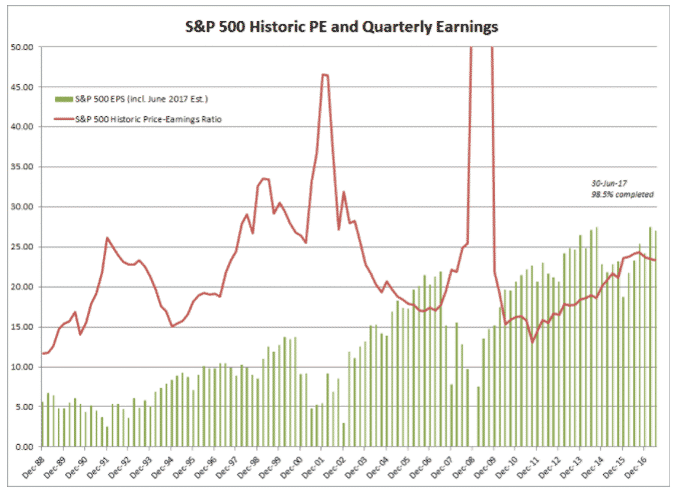

There’s been a lot of talk lately about valuations, particularly the Shiller CAPE Ratio which recently just hit a level only seen at the height of the Great Depression and the Tech Bubble.

So, should we be worried?

As long as earnings keep rising, probably not.

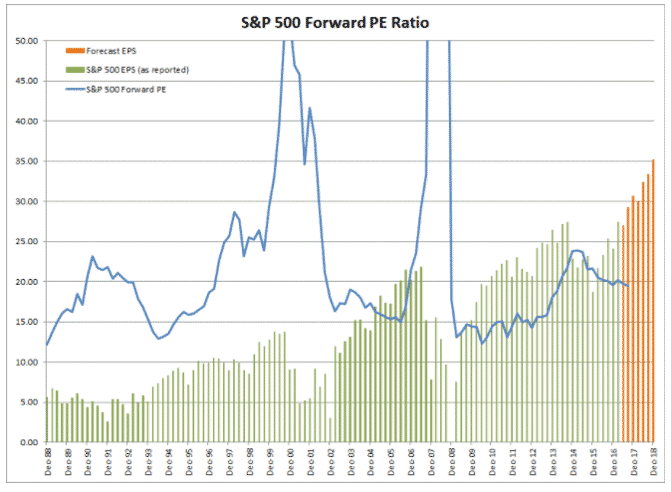

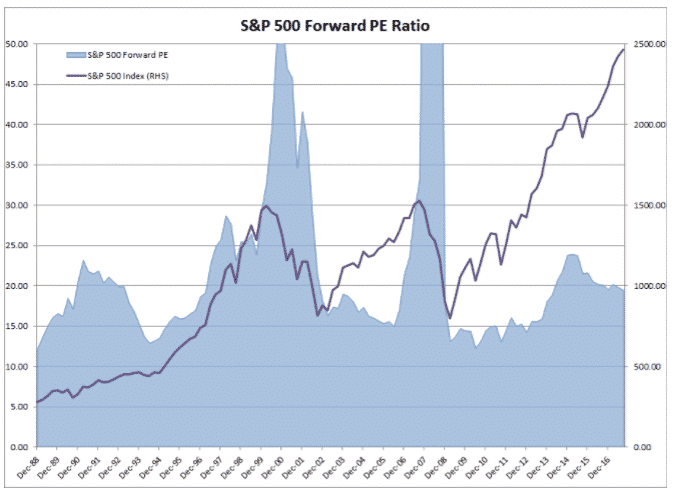

Stock prices rise when earnings rise. Sometimes stock prices get ahead of earnings and there is perhaps a case to argue that has occurred recently.

But, earnings estimates going forward are generally pretty positive.

The following charts come care of Colin Twiggs, and show that if earnings meet expectations moving forward, that will bring the PE Ratio down to more reasonable levels.

Only time will tell.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.