Twitter, Inc. is the holding company of the popular social media platform “Twitter”. It was founded by Jack Dorsey, Biz Stone, Noah Glass, and Evan Williams in 2006 and it has more than 35 offices worldwide, and over 4,500 employees.

Twitter tracks the growth of its social media platform and its earning generation capacity through a metric called “monetizable daily active usage”, or mDAU, which only accounts for users who are actively browsing and interacting on the platform. As of the latest quarter (Q3, 2019), Twitter had an mDAU of 145 million users, which represents a quarter-to-quarter growth of 4.3% and a year-on-year growth of 17%. The mDAU figure for the U.S. grew by 1 million compared to Q2 2019, and international mDAU increased by 5 million quarter-to-quarter as well.

The company reported a total of $824 million in Net Revenues during Q3 2019 comprised of $121 million in data licensing and other services, and $702 million in revenues from advertising. Data licensing and other revenues grew 12% over the last 12 months and total U.S. revenues increased by 10%, with international revenues increasing by 7% TTM.

Join the 5 Day Options Trading Bootcamp.

Twitter’s Net Income fell to $37 million, taking a 95.3% nosedive compared to the same period last year when it reported a Net Income of $789. Earnings per Share (EPS) ended up at $0.05.

The company attributed this downfall to multiple platform bugs that they are currently working to fix, but they warned investors that these “headwinds” will probably affect the next quarter and early 2020 results as well.

Investors are nervous about the decision to ban political ads on the platform and the stock was recently downgraded to neutral by Goldman Sachs.

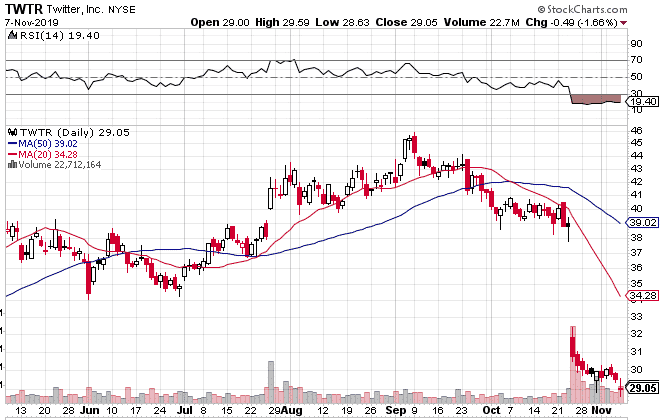

The stock is down 36.64% since hitting a high of $45.85 in early September. RSI has been sitting in the red zone since the disastrous earnings call and currently sits at 19.40.

For contrarians willing to bet the company will turn around, bull put spreads provide a good risk/reward opportunity.

Going out to June 2020 gives the company plenty of time to turn things around. A June 19th, 2020 Bull put spread using the $25-$20 strikes is currently trading around $1.26 with maximum risk of $3.74.

If the spread expires worthless, the return on capital is 33.69% in a little over 7 months. That represents a 54.89% return per annum with a 13.94% margin for error.

Do your own due diligence before making any trading decisions and trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.