Calendar spreads are essentially volatility trades. You’re buying the back-month volatility and selling the front month volatility.

The issue with this is that most of the time, markets are in what is called Contango, where back month volatility is higher than front month. So, you end up buying expensive volatility and selling cheap volatility.

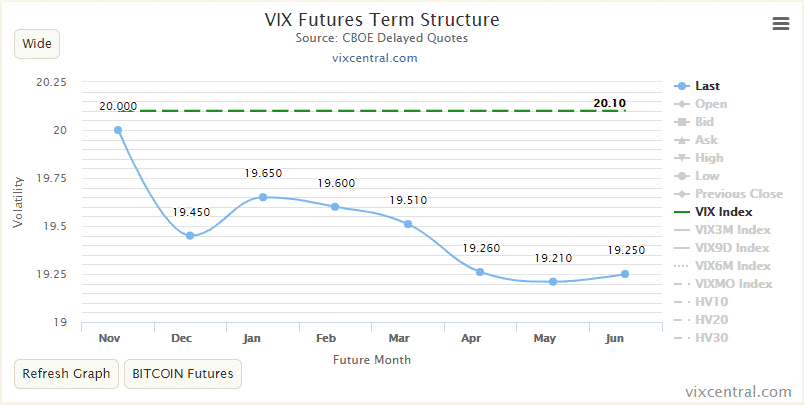

Here you can see the VIX futures curve from September 20th, right before the correction. Anyone trading calendar spreads would have been buying expensive and selling cheap.

Compare that to October 10th when the curve was well and truly in Backwardation.

Traders entering a calendar spread on this date would have been buying cheap longer-term volatility and selling expensive near-term volatility.

Let’s look at how a sample trade might have been constructed using SPY options.

Date: October 10th, 2018

SPY Price: $280.57

Trade Set Up:

Sell 2 SPY October 19th, 280 calls @ $3.92, IV=20.8%

Buy 2 SPY Nov 16th, 280 calls @ $6.60, IV=17.9%

Premium: $ 536 Net Debit.

Notice that the IV we are selling is 20.80% but the IV we are buying is 17.90%. Let’s see how the trade worked out.

The day before expiration, SPY was trading at 276.31. The October $280 calls were trading for $0.19 and the November calls were trading for $3.50.

The front-month calls that were sold had declined completely while the back-month calls had only lost less than half their value.

The trade was up around $125 or around 23%.

So, how does the current situation look? We’re in to backwardation again, but it’s not as extreme as it was in mid-October.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.