It may not feel like it, but the S&P 500 is only down 4.34% for the year. Hardly disastrous, but on a closing basis we are now 13.43% off the highs set in September.

A correction is typically defined as a 10% drop for a stock or an index from a recent peak, while a bear market is a 20%-plus decrease.

Perhaps the reason this correction feels worse is the number of individual stocks that are already in a bear market. Before yesterday’s brutal action, there were already 53% of stocks in the S&P 500 that were more than 20% off their highs.

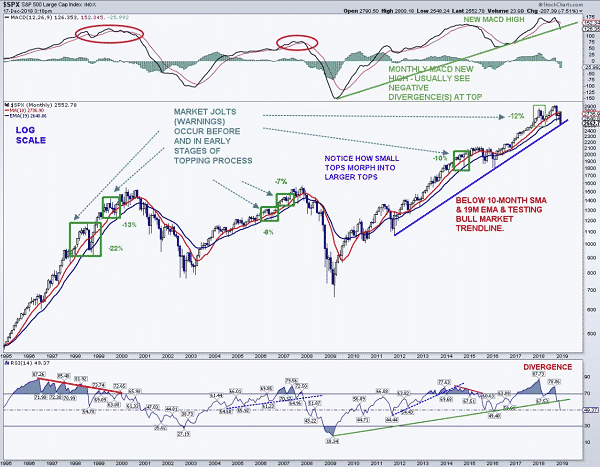

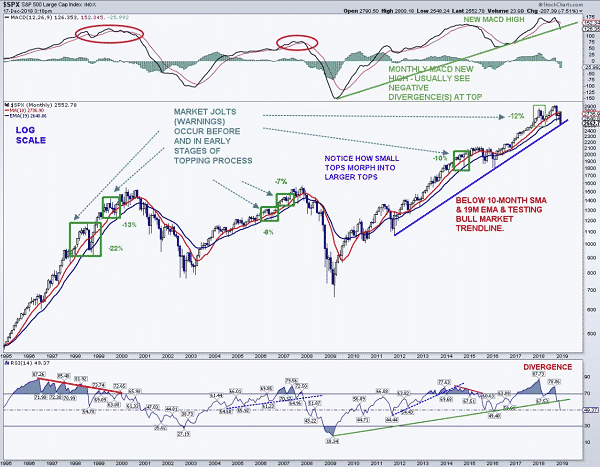

In October, I pointed out a nasty long-term divergence which appears to still be impacting the market.

Like 2015, we are already in a “stealth bear market” where the indexes might not be in bear market territory, but most stocks are.

Whether the indexes follow those stocks in to a bear market remains to be seen, and bulls really need the market to find support at these crucial levels.

Mark Arbeter shares some excellent charts today on Twitter which I’m re-posting below. You can see what I mean when I talk about “crucial levels”.

It’s clear that bulls need to defend these level, otherwise we could easily see a drop to the 2015 highs of 2135. That would imply a further 16% downside from here, for a total decline of 27.40%.

It’s clear that bulls need to defend these level, otherwise we could easily see a drop to the 2015 highs of 2135. That would imply a further 16% downside from here, for a total decline of 27.40%.

Not saying that’s going to happen as no one can predict the future, but there isn’t a whole lot of chart support on the S&P 500 from 2500 down to 2135.

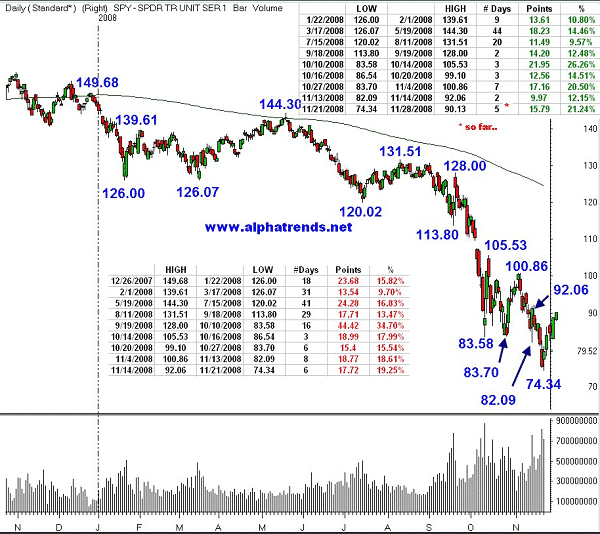

Brian Shannon also reminds us that some of the best rallies can come during bear markets. During the last bear market, we saw nine rallies of more than 9.5% and three greater than 20%.

Good luck out there traders, this is a very different market to what we have seen in the last few years.

Access the Top 5 Tools for Option Traders

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.