Finally we get some selling and a (albeit small) spike in volatility! Woo hoo! By the way, for those of you who asked, no I was not serious about re-mortgaging my house last week. I guess I must have flunked out of sarcasm school.

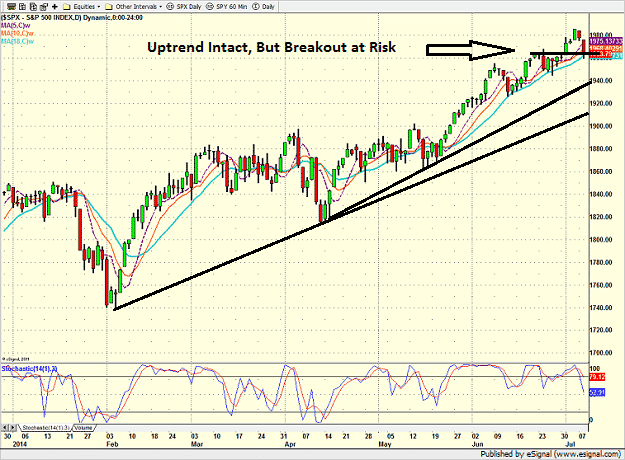

Anyway, back to the selling. Is this the correction we’ve all been waiting for, or another mild 2-3% pullback that will get snapped up quicker than you can say “QE3, QE3, QE3”?

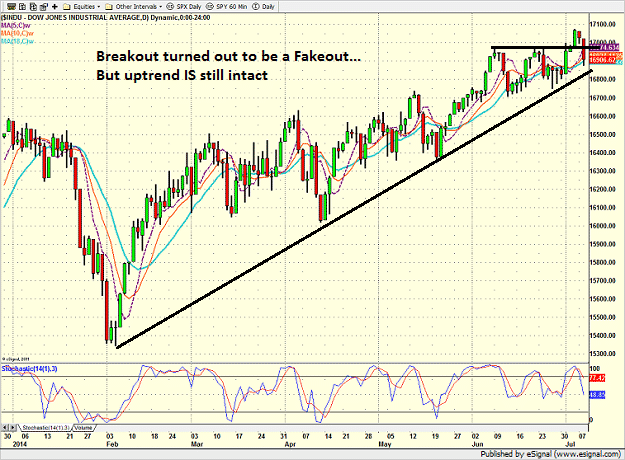

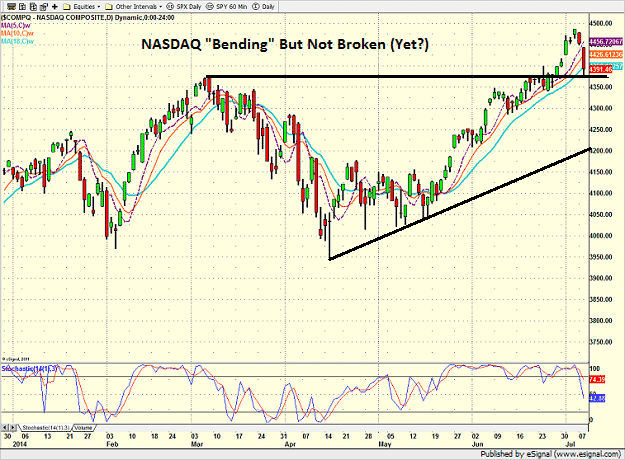

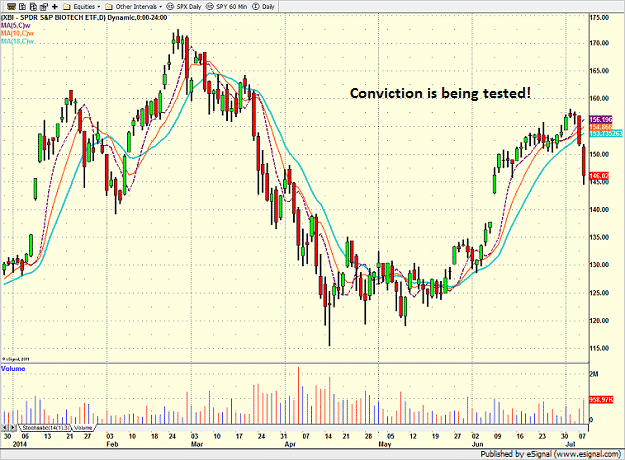

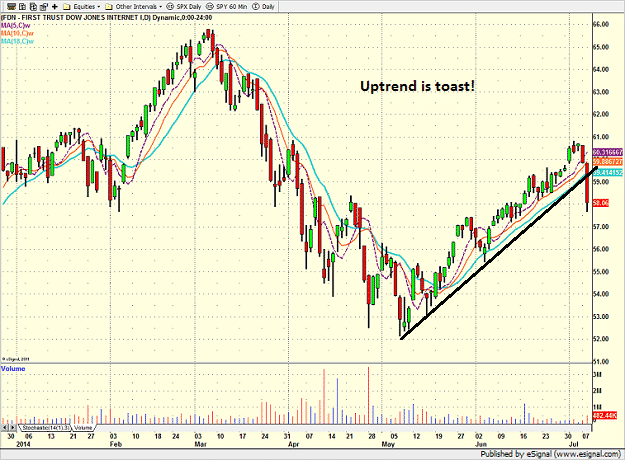

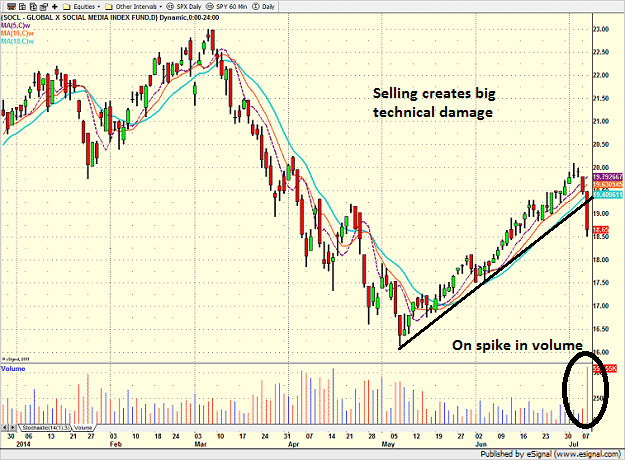

Let’s look at some charts:

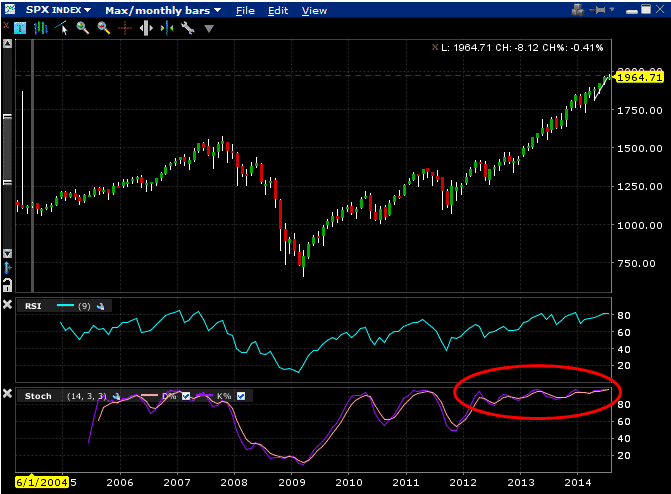

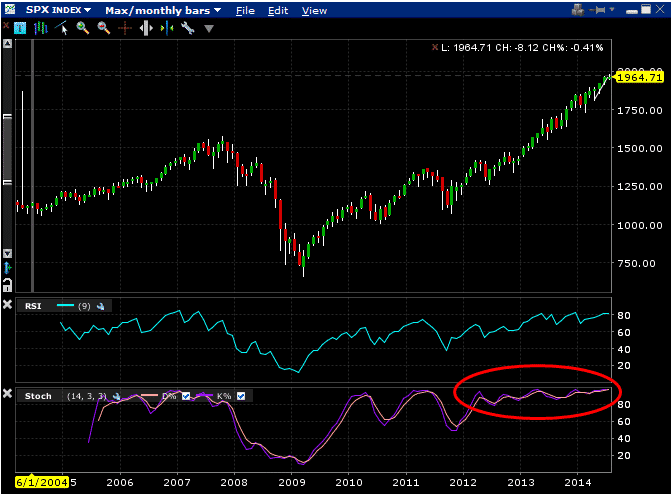

The first one which has concerned me for a while is the monthly charts of the indexes. SPX is massively overbought on a long term timeframe. Yes, the uptrend is still intact for now, but would you really want to get aggressively long here??

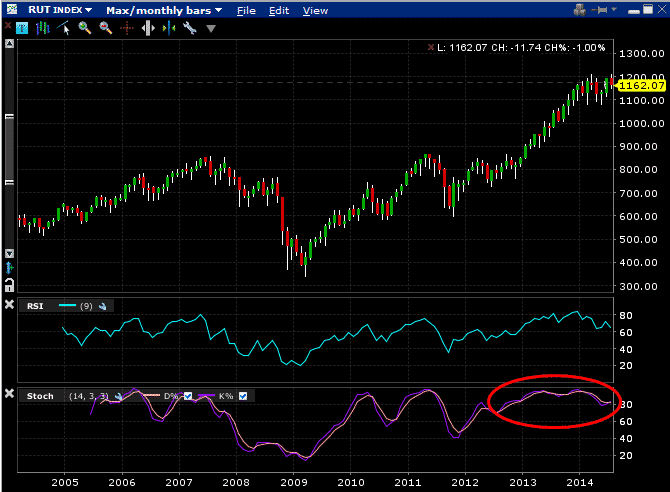

RUT is also very overbought and the action is looking a little toppy, pretty similar to October 2007 to be honest. After the second top in October, RUT dropped from 852 to 643, a drop of 25%. A 25% drop in RUT from the recent high of 1213 would put RUT at 909.75. Wowser, 909.75 by October, could that really happen? Maybe. Remember we are coming into a very weak seasonal time of year. Also on the RUT monthly chart, notice how we have not had an RSI reading below 36 since September 2011. Something to think about.

There were some great charts posted on Benzinga today which I will re-publish below. They are pretty self-explanatory. Notice that biotechs, internet and social media stocks are getting crushed. Those were the leaders of this latest rally, so perhaps they will lead the blue chips lower this time around.

Check back over the weekend and I will post some trade ideas for the next few weeks of trading.

Plenty of red… but… this has been a weak hands rally (rinsed and repeated). By now the bears have lost the will to follow through, and until there is real confirmation – market volume, volatility again over 15-17 and a refusal of the ‘mo mo’ stocks to bounce like super balls, its hard to have any confidence that its time to sell.