What are e mini S&P 500 futures?

Well, they are probably the single most important contact in the financial world.

So, what are they and why are they so important?

Contents

Introduction

Let’s start with the S&P 500 index.

The S&P 500 index measures the strength of 500 of the largest cap stocks in the United States.

Chosen by rating agency Standard and Poor’s and weighted by market cap.

This index is arguably the single most followed index in the world.

As the U.S is by far the world’s largest and most influential market, an index of 500 of its largest stocks is an exceptionally good barometer for how the United States and therefore world markets are performing.

E-Mini S&P 500 Futures

The E-mini S&P 500 futures are contracts that allow traders to speculate on the future price of the S&P 500 index.

Each E-mini contract has the right to buy 50 times the S&P 500 price at its future expiration date.

Currently the S&P 500 index is at 4,000, so one S&P 500 e-mini contract would be worth approximately $200,000.

So how popular are these contracts?

Let’s have a look.

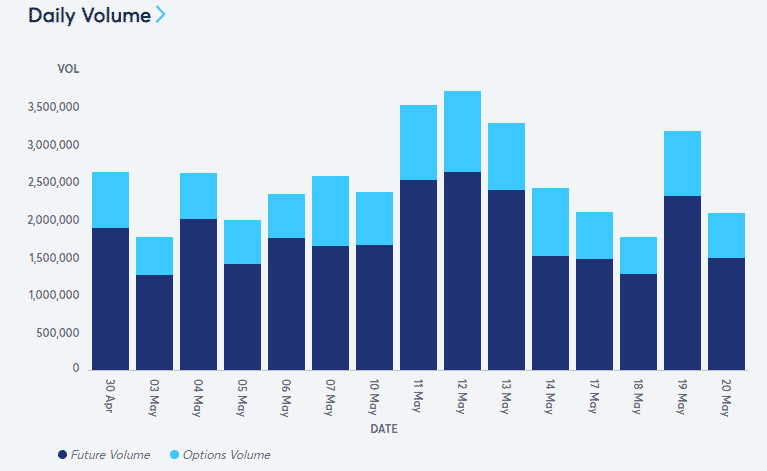

Source: CME Group

Here is a snapshot of the daily volume for the E-mini S&P futures.

We can see that the futures trade almost 1.5 million contracts a day.

While that volume may not seem large compared to some ETFs, remember that each contract is worth $200,000.

That is around 300 billion dollars being traded every single day!

How Do E-Mini S&P 500 Futures Work?

So how do these contracts work?

If a trader buys an E-mini future, they have the obligation to buy the S&P 500 index at the expiration of the contract.

Despite this, the statement is somewhat deceiving.

The investor does not receive the index directly, nor do they receive all 500 stocks in their portfolio.

These E-mini futures are cash settled.

Meaning the investor will gain or lose the amount their future contract has changed till the point of expiration.

At that point, the future will cease to exist.

In addition, the investor does not need to hold the contract till expiration and can trade it as frequently as they would like.

This makes the process remarkably simple.

These contracts can allow for significant leverage, often more than 1000%, making them great tools for hedging and speculation.

Investors, both long and short, simply need to post collateral to make sure they can cover any losses they might incur as the index price changes.

Hours of Trading

Unlike the U.S stock market which trades 9:30 am to 4 pm Monday to Friday, Futures trade almost all the time.

E-mini futures can be traded Sunday to Friday from 6 PM to 5 PM. As such, even if you have no interest in directly trading them, having an idea of what the market will do tomorrow is valuable.

This is especially the case over weekends when a lot of news comes out or special events such as the U.S Presidential Elections.

Some novice investors will often guess how the market will open the following day, not even aware the E-mini futures are trading and already predicting the market open.

So, if you want a best guess tonight on where the market will open tomorrow, just look at the e-mini S&P futures on Bloomberg, Finviz or Yahoo Finance.

Simply search up S&P e-mini futures or Ticker ES.

If your friend still says the opposite to what the futures say, bet on it!

Conversely if you believe the market will open in the other direction, trade it!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.