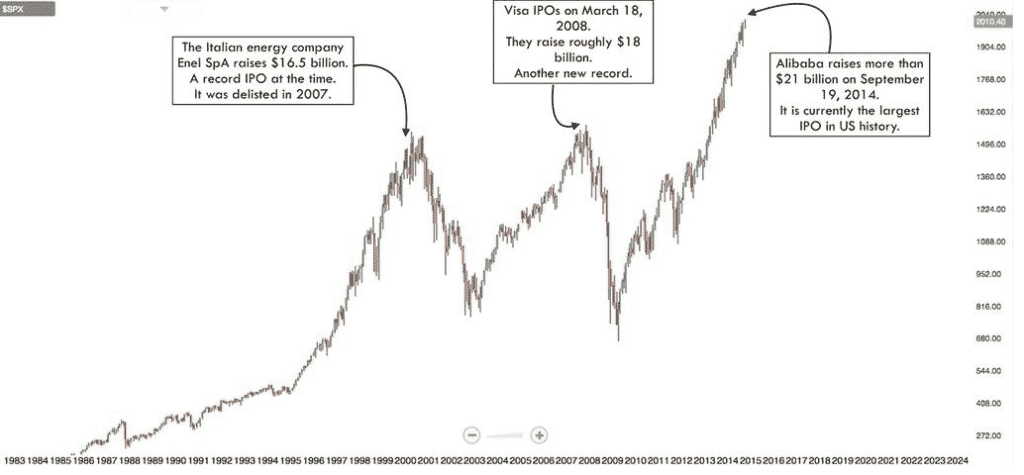

Currently we have dismal breadth, a seasonally weak time of year and a failed breakout in the S&P 500. All this spells trouble in my opinion. Now, I know we’re in a record breaking bull market, and that every 2-3% sell off for the last year has been bought furiously, but this time I feel is a little different due to the factors mentioned above. Not only that, we also had the largest IPO in US history on Friday with Alibaba listing. The stock was bid up to $100, WAY above the initial offering price of $68, then promptly sold back down to under $90.

All of this wreaks of a lack of enthusiasm for stock at these levels. Half of the Nasdaq stocks are already in a bear market. The latest leg of the rally has been led by fewer and fewer stocks, with small caps getting crushed.

Check out the below chart on some of the biggest IPO’s in recent history. This year has also marked the highest number of IPO’s, taking us back to levels not seen since….. you guessed it 2000 and 2007.

In this video, Ari Wald of Oppenheimer talks about the lack of participation by small cap stocks in the latest leg of the rally. Couldn’t agree more Ari.

http://video.cnbc.com/gallery/?video=3000312844

Hopefully you took my advice from a few weeks ago and starting picking up some cheap OTM puts in advance of this sell off.

Hi, Gavin

Do you think the indexes markets are going to crash like in 2008?

I think mostly the markets undergoing minor correction as most hedge funds, institutional investors trying to rotate their stocks fund holding around from different sectors or bonds markets.

The bond markets also affected and sell off together with some stocks.

The Caliper incident had caused a lot of their had been liquidated from hedge fund and go to the stocks and option markets.

So we shall see the stocks and options markets are very active for the coming months.

I prefer to buy or long on debit spread for those minor correction , can you recommend which strike or delta spread to long for RUT, SPX and NDX indexes.

Thanks.

Hi Lawrence,

No I don’t think we will see another 2008 style crash, this should just be a minor correction in the 5-10% range. We’re still in a bull market for now.

When trading long options or buying spreads, I look around delta 70 so you are not paying too much for time premium and also get a decent move in the option if the underlying moves.

HI Gav,

I agree we have makings of some decent volatility for a change. Ari’s S&P chart with the 120 dma was interesting. Every bottom nailed the line. In June I set up the “Vega” hedge per your post and could not be more pleased with it’s performance. Along the way learned more about using VXX to finance long SPY puts. At times like these it is a marvel to watch those spy puts come back to life. Still holding the Jun 15 186 SPY puts using the beta weighting approach your friend advised and the portfolio is now fully hedged at 15% of the original cost due to the financing strategies using calendars on the SPY and long puts on the VXX. Another up cycle and I own them for nothing. Yes there will be another up cycle as the inmates remain in charge. Have a wonderful day.

Hi Mel, great to hear from you mate. Glad to hear the trading is going well and that the strategy is working out. I agree, I think there will be another move up as well, have to see how long this sell off lasts, but if the last 6 months is anything to go by, it won’t last long.