Condors and butterflies are more similar than they look.

Is price is breaking out of your iron condor?

Change it to a broken wing butterfly and let price move in one direction as much as it wants.

Let’s learn how.

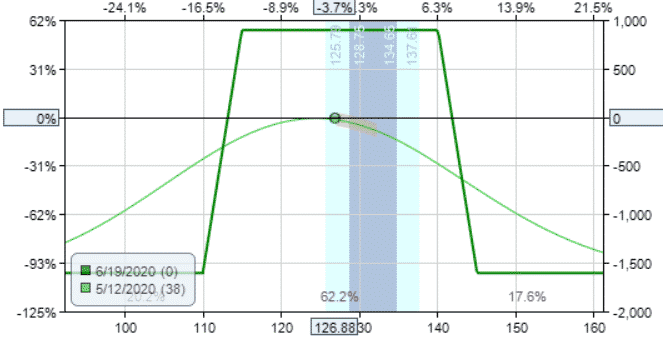

Suppose an investor had initiated an iron condor on IWM on May 12

Date: May 12, 2020

Price: $126.88

Buy 5 IWM June 19th 110 put @ $1.97

Sell 5 IWM June 19th 115 put @ $2.98

Sell 5 IWM June 19th 140 call @ $1.36

Buy 5 IWM June 19th 145 call @ $0.58

Credit: $1.79/share

Max profit: $179 x 5 = $895

Max risk: $500 x 5 – $895 = $1605

Risk/Reward: 2.79

Take profit level: 50% x $895 = $448

Stop loss level: 75% x $895 = $672

Because the probability of profit on this condor is a bit lower than the usual high-probability condors, the investor set a lower stop loss level than usual in order to maintain positive expectancy.

Shortly after, the investor goes on vacation, but was smart enough to set an alert when the price reaches within 3% of the short strikes — that is when price is greater than $136 and price less than $118.

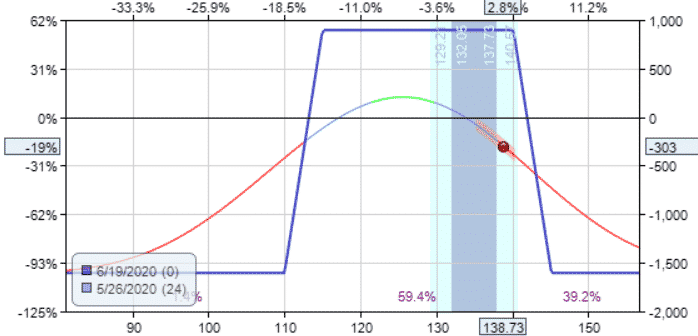

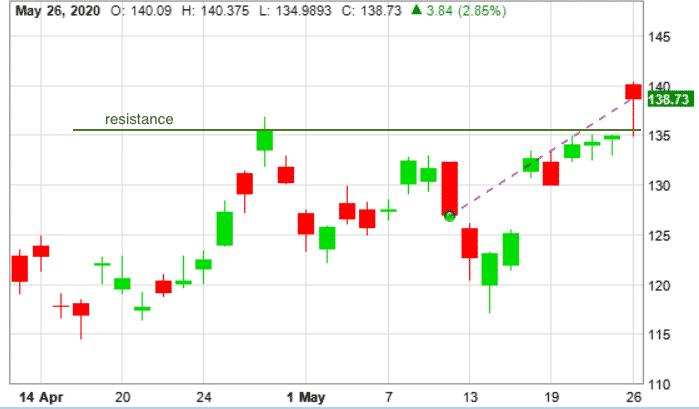

The price alert triggered when IWM closed at 138.73 on May 26 with the payout diagram looking like this:

Had the investor not been on vacation and been able to monitor the delta of the short strike, the adjustment might have been made earlier.

The candlestick chart looks very bullish with a bottoming tail hammer candle that broke resistance.

The investor’s sentiment has changed.

IWM no longer appears range-bound as it had when the trade started. He wants to change the trade to a slightly bullish directional strategy.

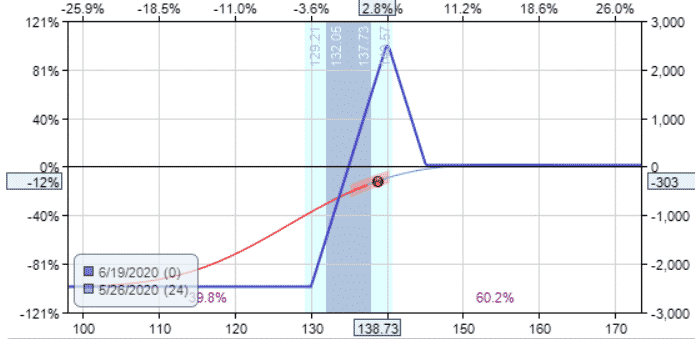

For such situations, the iron condor can be converted to a bullish broken wing butterfly with no risk on the upside by the following:

Sell to close 5 IWM June 19th 110 put @ $0.30

Buy to close 5 IWM June 19th 115 put @ $0.51

Buy to open 5 IWM June 19th 130 put @ $2.46

Sell to open 5 IWM June 19th 140 put @ $5.94

Credit: $3.27/share

Addition credit received for adjustment: $327 x 5 = $1635

The resulting position post-adjustment is

Long 5 IWM June 19th 130 put

Short 5 IWM June 19th 140 put

Short 5 IWM June 19th 140 call

Long 5 IWM June 19th 145 call

Max risk on downside: –$5000 + $1635 + $895 = –$2470

Profit on upside: –$2500 + $1635 + $895 = $30

Assuming that the increased max risk is within the investor’s allowable risk per trade rules, the investor continues to manage the trade as a broken wing.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.