The last few months have been absolutely incredible for short volatility traders with ETP’s such as VXX down 43.40% for the year, UVXY down 70% and SVXY up 65%. Truly amazing, but is the trade now getting a bit crowded?

With VIX down around 10, it’s hard to imagine volatility going anywhere but higher from here.

With that in mind, here are a couple of charts I’m watching:

Click Here For My Top 5 Technical Indicators

VXX Short Interest

One of the most crowded trades going around? Possibly, and it could get very, very messy when it unwinds.

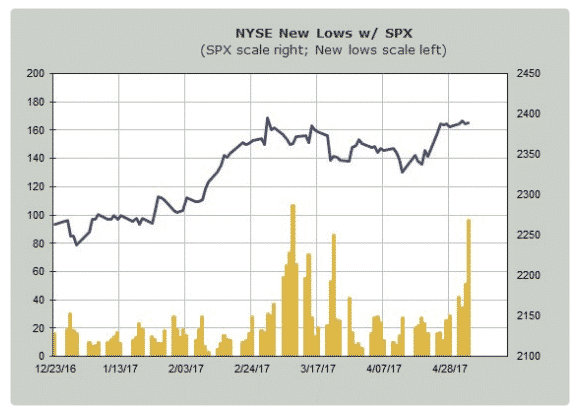

SPX New Lows

With markets pushing to new highs, the number of stocks hitting new lows is increasing. This can be a concern as the market is being led by a few select stocks (AAPL, AMZN etc.) which could be hiding some broader underlying weakness.

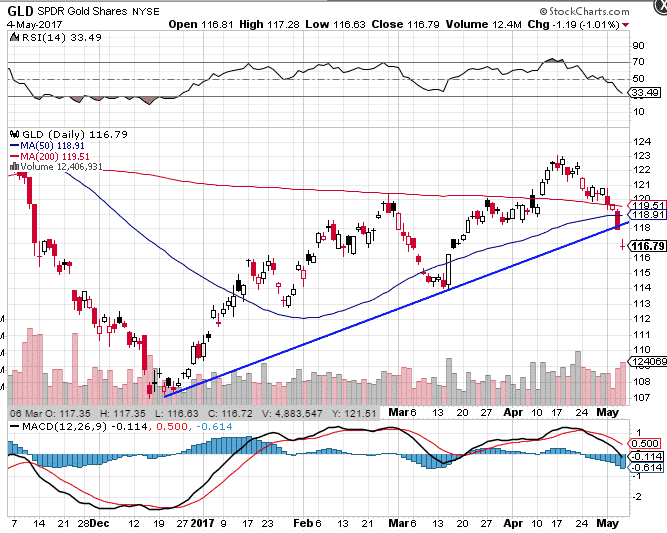

GLD Breaks Key Support

Some concern here for the gold bugs especially considering the USD has been weakening. Breaking through key support could see further downside in the precious metal.

Register For 10x Your Options Trading

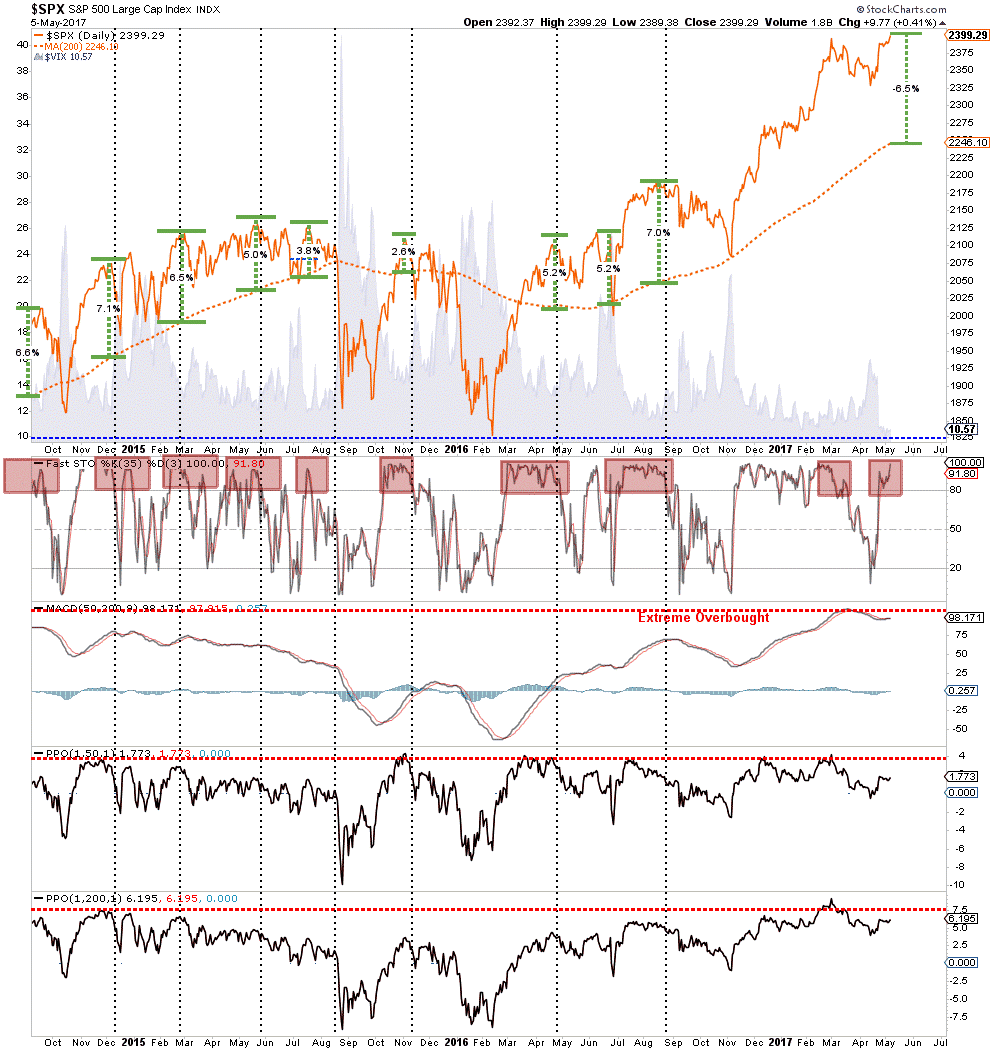

S&P 500 Distance From 200 Day Moving Average

Things look pretty extended on the below chart and we are as far above the 200 day moving average as we have seen in recent times. At some point, the 200 will be tested, mark my words.

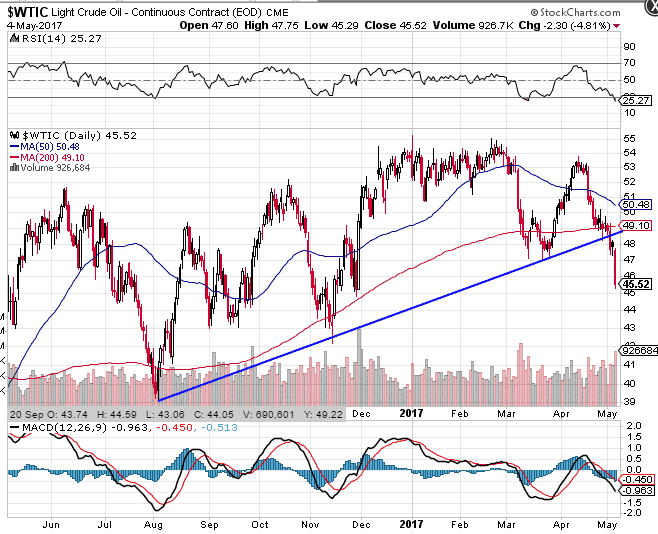

Crude Oil Also Breaks Support

Like gold, crude oil is also breaking key support. Could this be a sign the global economy is slowing?

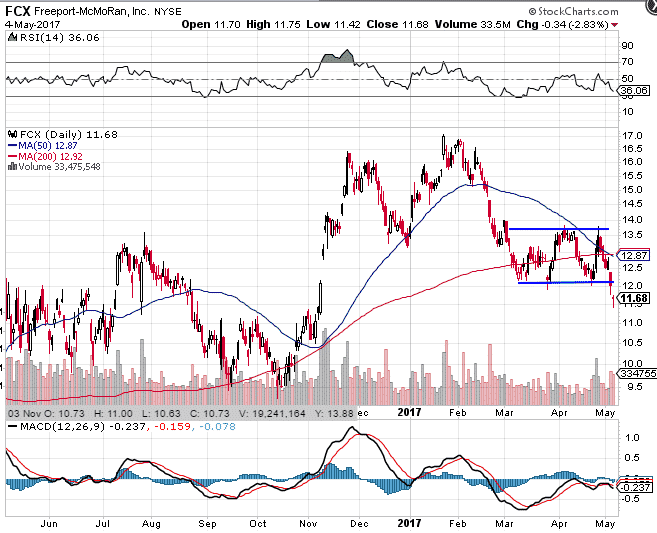

FCX Breaking Down

Another potential warning sign with this major mining stock also breaking down.

Sample Iron Condor Trading Plan

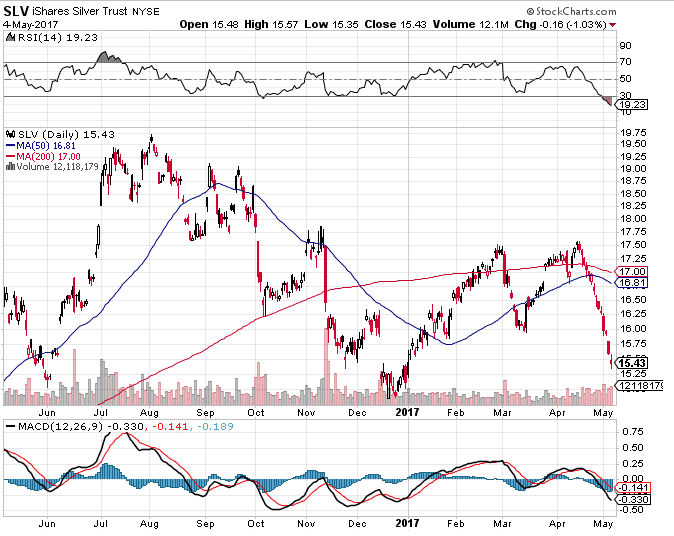

Silver Down 14 Day in a Row

A painful move for anyone that was long. After 14 down days in a row, you have to wonder how much downside there is left. Longer term, this chart looks bearish but we may get an oversold bounce shortly.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

We have been anticipating a downfall for a long time, and thats not happening which is incredible. I would like to buy some long term puts in SPY say sometime in 2018 and sell short term puts to reduce our cost basis, but the way the market has been going, there has not been a downturn