Today I want to evaluate a trade idea put forward by Jeff from The Option Guru. The idea is that you use an OTM put calendar spread as a relatively cheap way to gain some protection from a market decline.

Jeff’s instrument of choice is QQQ, but you can use any other index or ETF you prefer. QQQ closed on Friday at $66.68 and Jeff is setting up a put calendar spread with a strike of 60 as follows:

Buy 2 Jan 2013 QQQ $60 Puts @ $0.73

Sell 2 Nov 2012 QQQ $60 Puts @ $0.16

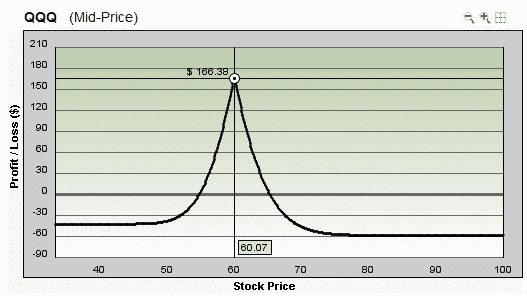

Net cost = $114 plus commissions. Here’s how the trade looks at expiration:

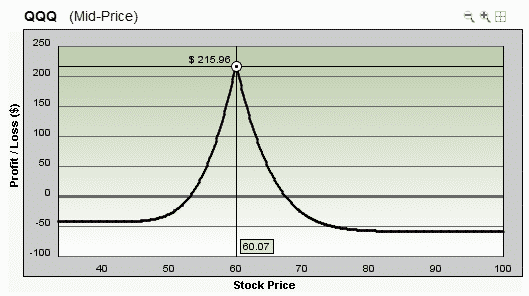

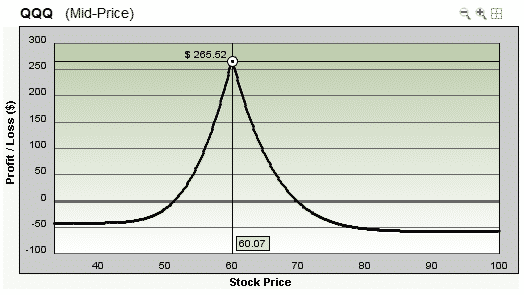

On this trade, your maximum risk is only $114 so it’s a nice way to gain some downside exposure for a very cheap price. The beauty of using OTM put calendars to hedge downside risks, is that they are both short Delta and long Vega. Generally when the market declines, volatility will increase so you get a double benefit from any selloff. The two diagrams below show how this spread would perform given a 5% and 10% rise in volatility, which would be fairly reasonable if the market dropped 10% from here.

A standard calendar spread would have the strikes in adjacent months, but by spacing them out to 2 months, Jeff has significantly increased his long Vega. The trade off is that he has more capital at risk.

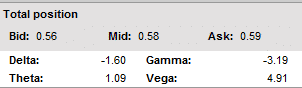

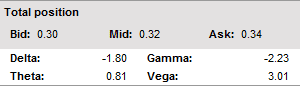

You can see above that the November – January spread has a -1.60 delta versus -1.80 for the November – December trade, so fairly similar there. The January trade has a much higher Vega however (4.91 v 3.01), but the trade off is that the spread costs more ($0.59 v $0.34).

All in all an interesting trade if you feel like you need some protection against a market decline. Position sizing would be the key thing with this trade and you would want to check it against your overall portfolio Greeks to make sure you where happy with it. Good luck with the trade Jeff.

There is a question below in the comments about why you wouldn’t just buy puts if you thought the market would decline. It’s an excellent question, so I wanted to address it by adding some info here in the post.

Marc is absolutely correct, you could purchase puts and benefit from a market decline. Let’s say you just buy the January $60 put, if the market does tank you would be laughing and would do much better than the calendar spread. However, there are a few disadvantages to this in my opinion, those being:

1. You’re delta is -15.80, so if you are wrong and the market rallies hard this week you are going to lose a lot more. The calendar spread is much more forgiving if you are wrong.

2. You’re Vega is also much higher at about +8.3, so again if you are wrong and the market rallies, you are getting hit with a double whammy as vol would probably fall with a rally.

3. You’re short Theta so as each day passes your position is gradually eroding from time decay. The calendar spread is positive Theta, so it actually gains value as the days pass.

4. Finally, it costs more. The short option on the calendar spread helps reduce the cost of the long option meaning you have less capital at risk.

I’m not saying either strategy is right or wrong, it depends on your market opinion and risk tolerance. Thanks for your question Marc!

Thanks for your question Marc. I’ve added my thoughts into the post above.

EXCELLENT!

Cheers LenS

Very instructive. Thanks for the instructive article!

Hi Gavin, I have just across your site and it has lots of good learning!

With Calendar Spreads, where do you put it with regards to your Bull Put Spread? Do you lie it over with the same strike as the short put of your Bull Put Spread? or just a bit higher?

Joe

Hi Joe, apologies for the delayed response. Yeah I like to put it at the same strike or slightly higher. Depends on the market and where you want your greeks to be. I’ve also seen other people add an ATM calendar in a ratio of 1 calendar for every 10 condors. Try it out and see what you think.

Hello Gavin,

Yes, but…

The calendar is only good for an extremely narrow price range, therefore, it has an extremely limited usefulness. Honestly, it is not a good hedge, in most cases. These are very good hedges for limited down moves…better than what I am about to describe, in some cases.

Try this on for size: Use the 5-8 days to expiration Weekly Put options as a hedge.For a micro fee, you get explosive gamma, vega, delta if the market falls; if it goes nowhere or goes up, you lose a minimal amount. If the underlying falls, it does all the right hedging for you; if it rises, well, you lose your short-term car insurance. And, it can be at a cheaper cost than the calendar!

I remember telling the ToS “expert” after his long speech (in San Diego) about calendar spreads as a hedge for his iron condors, the above, and, he didn’t have an answer/quickly moved to the next topic. LOL.

From my experience, the 5-8 weekly long put is going to be completely wrong 50% of the time, I can grab some money back 25% of the time (but still a loss), and 25% of the time it has given me profits, protecting the underlying nicely for pennies on the dollar.

Regards,

Marc

Net cost = $108 plus commissions

How do you come up with $108 ?

I got $114

Fixed. thanks Joe.