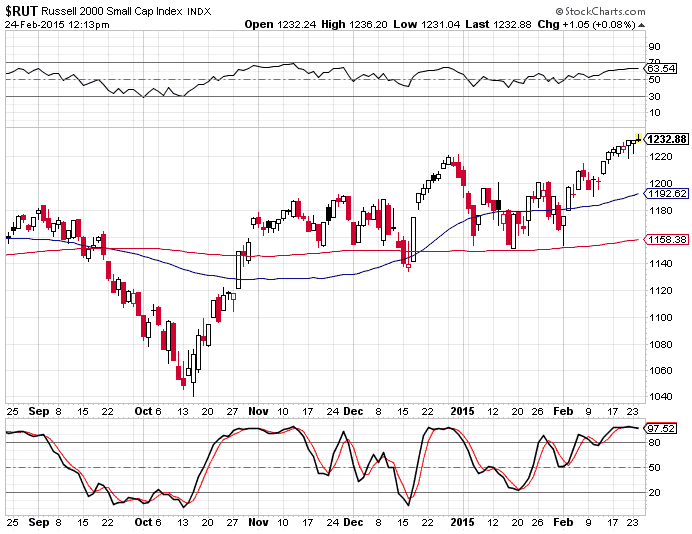

Small caps have finally broken out from their resistance level with RUT so far holding on to the important 1220 level.

Bullish momentum may carry the index another 2-3% higher, but that should be about it. RUT has rallied from 1153 to 1232 for a gain of 6.85% in the last 16 trading days.

For traders that think this rally might have another small leg up, a bullish butterfly could make sense. 1250 seems like a logical target and a nice round number for the small caps to aim for.

On the chart, RSI is not yet at an overbought extreme, currently sitting at 63.54 with plenty of room to move higher. Stochastics are starting to look a little top heavy though.

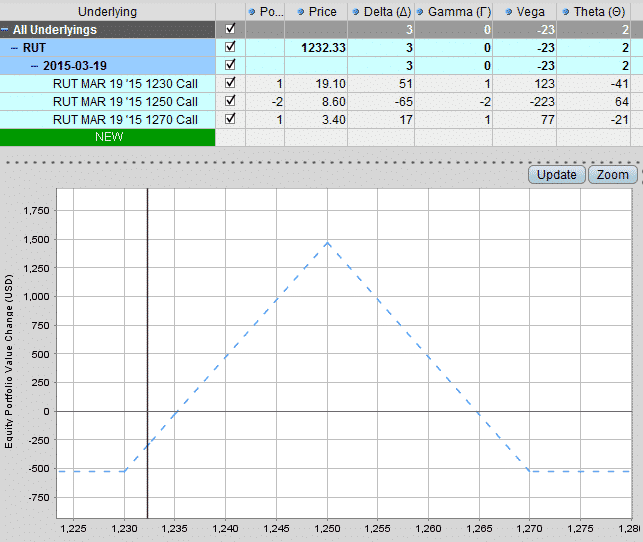

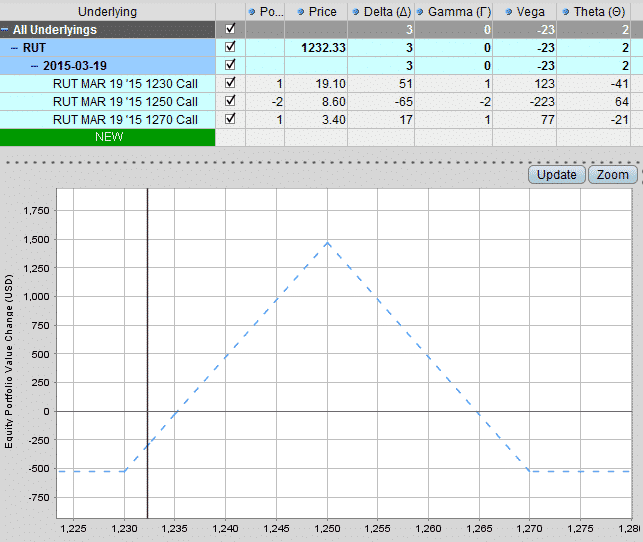

A bullish butterfly could involve buying 1 March 19th 1230 calls, selling 2 of the 1250 calls and buying 1 of the 1270 calls.

Currently the net cost of this trade is around $500, and that is the maximum the trade would lose if it doesn’t work out.

The potential return is $1,500, offering a nice 3-1 risk/reward ratio.

If RUT fell below 1220 on a closing basis, this trade could be closed early with minimal damage.

Disclosure: I currently have positions open in $RUT

This article first appeared on See It Market