Looking at a long butterfly trade idea today based on the teachings of Jeff Augen. I was lucky enough to attend a webinar run by Jeff this week and it was very interesting indeed. Aside from the fact that the guy is incredibly detailed in his analysis and has clearly spent years (maybe even decades) researching the options markets, he seems like he sleeps about 3 hours a night and the rest of the time is either running or neck deep in spreadsheets and numbers. My kind of guy!

I wish I had a copy of some of the data he presented but the premise revolves around the fact that market makers start taking down their volatility estimates around Thursday lunchtime to take into account the time decay that will occur over the weekend. This is something I hope you are all aware of already. I know a lot of beginner traders think they can sell options on a Friday and hold over the weekend to take advantage of the time decay, but trust me when I say the market makers have been in this game a lot longer and are well aware of this. They start dropping option premiums on Thursday to try and beat the option sellers to the punch.

Jeff has been trading long butterflys using the weekly options on the day they are released (Thursday) and then selling them the next day (Friday) or early the following week (Monday or Tuesday). The rationale behind this is that the time decay starts to kick in on Thursday afternoon and also that big movements in the stock do not affect these trades as much over the first few days of their life (Thursday and Friday of the current week) as they do over the last few days (Thursday and Friday of the next week).

So today, I decided to give one of these trades a try with a small position size just to follow along and see how it turned out. A couple of things that Jeff indicated were important for the trade:

- Try and open the butterfly with the mid-point close to the current price

- Don’t open on a Thursday if there is a big data point coming out on the Friday (ADP Employment, GDP etc.)

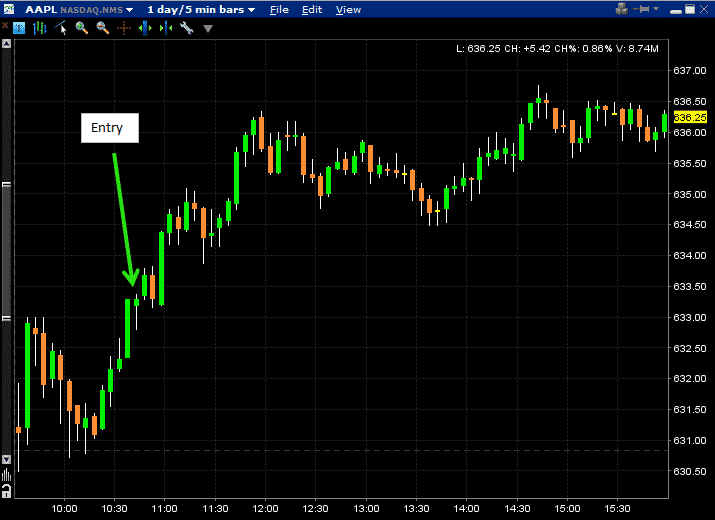

- Wait for prices to settle down after the first 30-60 minutes of trading on Thursday before entering

I opened the following trade at 10:41am this morning:

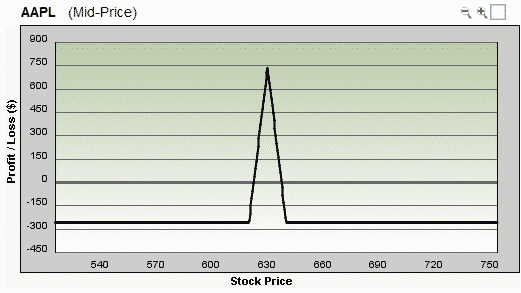

The cost of the trade was $2.55 or $255, and the potential max profit is $745 if AAPL closes at 630 on the 24th. This is shown in the profit diagram below.

Now let’s take a look at the price of the spread throughout the course of the day and compare it will the price of AAPL. As you can see, it wasn’t the perfect time to enter the trade as AAPL was trading at $633, so a little bit above the ideal $630 point. Also, after I entered the trade, AAPL continued to rally (moving further away from $630) for the remainder of the day. What is interesting though is that despite this fact, the value of the butterfly didn’t change that much throughout the course of the day and finished at $2.43. I would say that is a very small loss considering the move from $633 to $636.

The other point to not is that it the ideal time to enter that trade was around midday when AAPL was trading around $636.20 and the butterfly dropped to $2.20. AAPL ended the day at almost exactly the same point, yet the spread has increased from $2.20 to $2.43, a gain of 10% over the course of 4 hours on a stock that essentially didn’t move.

I hope you find this trade idea as interesting as I do, I’m intrigued to see how it plays out tomorrow. The ideal scenario would be for AAPL to drop down to $630 but I don’t really see that happening. In any case, it will be interesting to see how the relationship between AAPL stock and the butterfly progresses.

I would love to hear what you think about this strategy, let me know in the comments below.

Happy trading!

Thanks for sharing. Let us know how it goes.

What books?

They are listed above, but Trading Options at Expiration covers some of the stuff talked about in this post.

if you take slippage and comission into account. i dont see how you can make profits in friday. maybe if you sell mon-tue. Seems interesting

Interesting idea. How does this compare with selling an iron condor in the same timeframe?

Another idea would be when the stock is between strikes like this example, maybe try a 625/630/635/640 fly?

I like the idea but this was probably not the week to try it for several reasons:

1. Apple is on a huge bull run right now, so Fridays are not normal (recent fridays have been surprisingly green). (iphone 5 on Sept 12 and itv rumours in the fall and iPad mini possibly sept 12 are driving it up like crazy)

2. Apple paid out the dividend on Thursday so people may have been reinvesting it on Friday as a result of the first point. I actually sold a put on Thursday in anticipation of the stock climbing as a result of the divvy payout and because this run will likely last to around Sept 5th.

Apple pain (see http://aaplpain.com/?page_id=8) was at 630 for puts and 650 for calls this week. By the end of Thursday, with Apple at 640, 630 and 650 were equidistant from the closing price.

To run this strategy with a higher success rate, I would wait for a few things to line up:

1. Apple goes back to it’s pattern of being up on Monday and Tuesday, and then being stuck on Wednesday and Thursday with no movement which usually leads to no movement on Friday as well.

2. Aaplpain has open interest at the call and put level within one or two strikes of each other, or else the current price is way closer to one of the highest OI levels.

I think I will try this strategy in the future. There have been a lot of weeks like point 1 above where the closing price on Friday was very obvious on a Wednesday. If Apple goes back to that pattern again this year, this could work, however, the bull run could last for awhile if iTv gets announced this fall.

Jeff Augen is actually SELLING the butterfly not buying, the risk graph is upside down like a V with wings

Yes, he does both.