Investing for dividends is one of the best strategies you can follow as a long term investor. In the never ending search for yield, is there more that we can be doing to increase our returns? Absolutely! Covered calls are a great tool to add to any dividend investors’ arsenal.

A covered call is when an investor sells a call option over a stock that they own, i.e. the call option is “covered” rather than being “naked” (selling options naked is a stupendously bad idea unless you are VERY experienced). Investopedia’s explanation of a naked option is:

Naked trading is considered very risky since losses can be significant. An options trader could sell, for example, call options with a strike price of $10. If the stock’s price rises to $20 or $30 on good news, and the option is naked (the seller does not own the underlying stock). He or she would be required to buy the specified number of shares at the current price, and sell them to the option buyer for the $10, resulting in a significant loss.

So, naked options are a bad idea, but covered calls are much less risky as the investor is “covered” by the shares that they own. By selling a call option, the stock owner receives a payment from the option buyer, known as a “premium”. This premium is yours to keep as a covered call seller, not matter what happens to the underlying stock. This premium effectively increases the yield that you receive from dividends. In return for receiving this premium, the stock owner is foregoing the right to any capital appreciation above the strike price. So, this is the trade off, you forgo future capital appreciation in return for receiving a cash payment today.

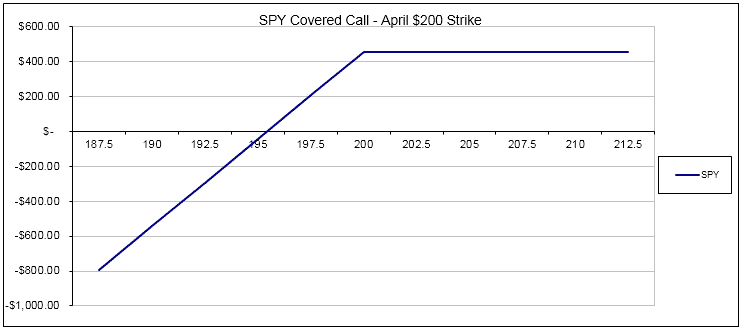

The below payoff diagram of a covered call compared to a long stock position shows a couple of key differences. Firstly, the breakeven price is lower on a covered call at $29 rather than $30 and secondly gains are capped above $32. As mentioned earlier, with covered calls, you are foregoing the price rise above a certain point in return for receiving the premium income from selling the call option.

Covered calls are a great strategy for stocks that the investor expects to remain steady or appreciate slightly. For this reason it is best to choose relatively stable stocks with a low beta (a measure of how much a stock moves in relation to the overall market). High flying tech stocks or a recent IPO would not be good candidates.

Hopefully you can see that the covered call strategy will outperform a pure stock position in flat, falling or slightly rising market environments. In strong bull markets, covered calls will underperform as the upside gains of stock ownership are capped. For this reason, it is not a good idea to start selling covered calls at the start of a strong bull market (e.g. April 2009).

Now that we know a little bit about covered calls, let’s look at how dividend investors can apply it to their portfolios. Dividend investors can “supercharge” their dividend income by selling covered calls.

It’s sometimes easier to understand using a real life example. For this strategy I like to use large multinational corporations with low volatility. That means stocks in the consumer staples and utilities sectors are good candidates. Some of my favorites are KO and JNJ.

In June 2012, KO was trading at $75.50 and was paying roughly $2.04 per year in dividends for a yield of 2.70%. Not bad, but let’s see how much extra yield we can gain by selling covered calls. Here’s an example of how you could set up a covered call:

Buy 100 KO shares @ $75.50 = $7,550

Sell 1 KO November 16th $77.50 call @ $1.98 = $198

Total outlay: $7,352 ($7,550 less $198)

Breakeven Price: $73.52 ($75.50 less $1.98)

Maximum Gain: $398 ($200 from stock appreciation and $198 option premium)

Maximum Gain percentage: 5.41% or 12.75% p.a.

You can see from the payoff diagram below (Fig. 3) that the maximum gain on this trade is $398 which is the difference between the purchase price ($75.50) and the strike price ($77.50) plus the premium received ($198).

In addition to this, you still receive dividends during the life of this trade, so you would still receive the $51 dividend due in September. And the best part of all? If KO finishes below $77.50 when the call option expires, you get to repeat the process all over again by selling another call option.

If KO is above $77.50 at expiry, it’s not such a bad thing as it means you’ve made your maximum profit. In this case, your 100 shares of KO will be “called away” and you will sell them for $77.50 no matter how far above $77.50 KO is currently trading. You can then choose to start the process over again, if you think KO is still a worthy covered call candidate. Or, you can look around for another stock that might make for a good covered call trade.

So there you have a brief introduction into the world of options and more specifically covered calls. Covered calls are the most popular option trading strategy and can significantly increase the income you receive from your stock portfolio. Thanks for reading, and please feel free to share this article on Twitter or Facebook if you found it useful.

Readers, what’s your take? Do you use Covered Calls as part of your investing strategy?