There has been a lot of talk lately about AAPL and how it is becoming the new Microsoft. I’m not here to argue about AAPL’s corporate strategy and latest innovations (or lack thereof).

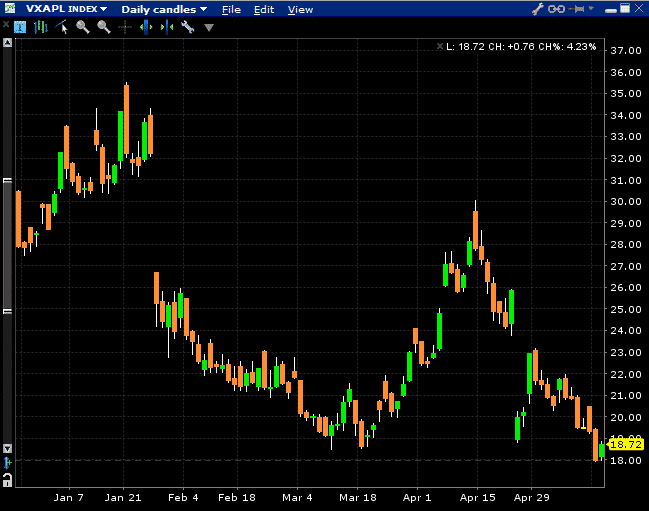

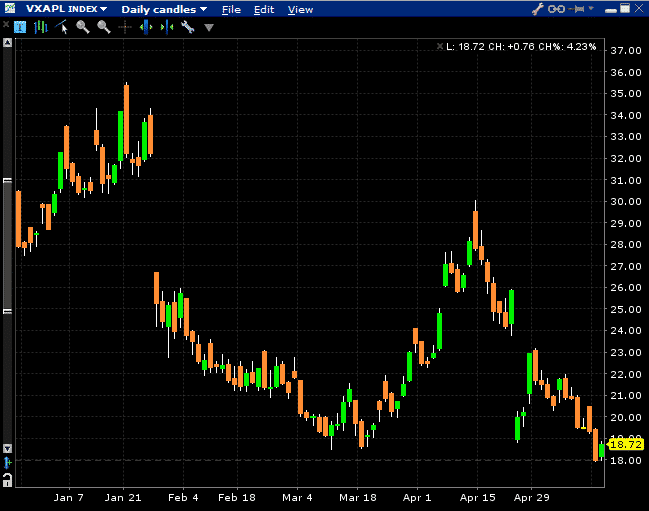

What I would like to talk about is AAPL’s implied volatility which has been steadily tanking over the last few weeks. Yesterday’s close at 17.96 was the first time VXAPL had breached 18.

Despite the benign nature of VXAPL lately, I would be very careful with short volatility trades here. Look for long volatility trades instead like calendars, diagonals and their respective double varieties.

Keep an eye out for earnings which are slated for July 21st and also be aware of the 7-1 stock split that is occurring on June 2nd, as these could have an impact on the stock.