Trading index options into the settlement can be a tricky endeavour especially for those who have never done it before and have failed to understand the rules associated with settlement.

According to the Chicago Mercantile Exchange index options are cash settled and exercise will result in the change of funds on the business day following expiration.

“The exercise-settlement value, is calculated using the opening sales price in the primary market of each component security on the last business day before the expiration date. The exercise-settlement amount is equal to the difference between the exercise-settlement value and the exercise price of the option, multiplied by $100.” (source CME)

You can track the settlement price of the major indices using the following ticker symbols – SET for SPX, RLS for RUT and NDS for NDX.

Unfortunately, the settlement price determined on Friday is often different from the closing price on the index on Thursday when the market closes, which presents a risk to the investor holding the option into the settlement period.

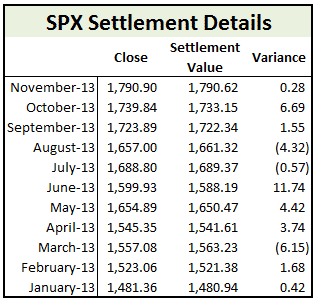

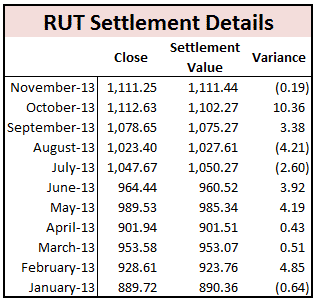

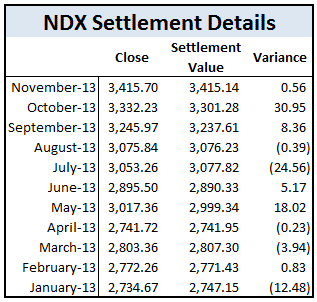

You can see from the tables below that the index settlement value per the CBOE is different from the closing price on the Thursday before expiration.

You can see that if you were short the 3060 July calls in NDX, you might have been forgiven for thinking these options were fine and about to expire worthless.

However, as you can see, the index settlement value was 3077.82, so if you have been in for a very nasty surprise if you were not aware of how and when the settlement value is calculated.

The calculation for the index is based on the opening price. On the Friday morning, the opening price of each individual component of the index is determined.

Most stocks open at the bell but there will always be lagers based on a number of reasons.

For example if specific news on a security is pending the stock prices opening will be delayed.

The calculation for the settlement price is based on the opening price of each individual component in the index.

This is not the actual opening price of the index which could make it difficult to hedge. Since some stocks will open at different times, the theoretical opening price can only be calculated once all the stock records an opening.

There can be situations where the opening theoretical index price will be higher or lower than the actual index price.

Many times the settlement price, which is created from the theoretical opening price, will be different from the closing price on the prior day (even with fluctuations that occur in the futures market).

The difference can make it very difficult to hedge your exposure.

An in the money option could turn into an out of the money option or vice versa. Understanding these issues will allow an investor to avoid falling victim to a settlement price calculation that goes against them.

Settlement price for SPX is usually announced near 1PM Eastern Time, but it can be delayed. The settlement prices of other indexes usually are not published until after the market closes for the day.

So is it better to close position prior to settlement to prevent this uncertainty? I understand the article, but what is your advice for people facing this situation. Take the chance or just close position? Thanks.

Hi pm,

It depends on a few factors, namely risk tolerance, how close to your strikes the position is and your positions size.

Personally I don’t like taking close to the money options in to settlement.

When short options, I like to have them closed out around a week from expiry unless they are are a good distance out of the money.

Why to use AM options when we can use PM options (weekly/Qtrly/Monthly)?

Wouldn’t it be wise to use weekly options even if they are 1 month out or 2 month out to avoid overnight risk?

Besides, if we do trade AM options then we cannot close it on the morning of that last day of expiration as the SET value is not calculated until 30-45mins after the open by which time we might incur significant loss, Isn’t it?

Your thoughts please!

Yes you can do that. Typically I am out of all positions before the last week. Too much risk in that last week.