Warren Buffett is one of the world’s most famous investors and the 3rd richest man in America according to the Forbes 400 list of wealthiest individuals.

He was born in Omaha, Nebraska on August 30, 1930, and has been nicknamed as the ‘Oracle of Omaha’ due to his incredible investment track record.

He has been the Chairman of the Board and Chief Executive Officer of Berkshire Hathaway for more than 40 years and he has been acquiring different businesses since he took charge of the company.

Berkshire grew over time by using its insurance business as a vehicle that provided interest-free cash flow, known as ‘float’, which is the money that the insurance business holds temporarily until claims are filed against the insurance policies it issues.

Buffett’s investment philosophy initially concentrated around businesses that were undervalued by the market based on a disparity in their net book value vs. their market value, but it has evolved towards long-term value investing.

He evaluates and identifies businesses with strong competitive advantages that are fairly valued or undervalued by the market and take long positions on them.

Access the Top 5 Tools for Option Traders

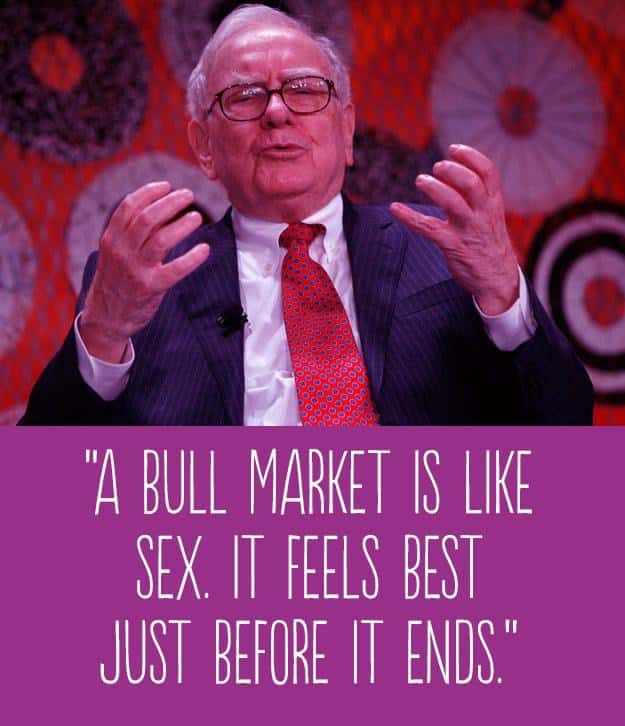

These are 10 of the most popular quotes from the ‘Oracle of Omaha’:

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”

“Price is what you pay. Value is what you get.”

“Never invest in a business you cannot understand.”

“It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

“The stock market is designed to transfer money from the active to the patient.”

“Our favorite holding period is forever.”

“The business schools reward difficult complex behavior more than simple behavior, but simple behavior is more effective.”

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

“Honesty is a very expensive gift. Don’t expect it from cheap people.”

“If a business does well, the stock eventually follows.”

You would do well to follow this advice, although it’s easier said than done!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.