Stocks have gone on a massive run since bottoming on February 5th. SPX is up a massive 97 points in 7 trading days and RUT is up 63 point or 5.86%.

After such a strong run, stocks are due for a pause, but there is also the potential for momentum to push them 2-3% higher over the next week.

This is an ideal time to trade a very cheap directional butterfly. This is a low risk, high reward play. It’s a great way to play a further rise in the market without risking much capital at all. Here’s how you set up the trade:

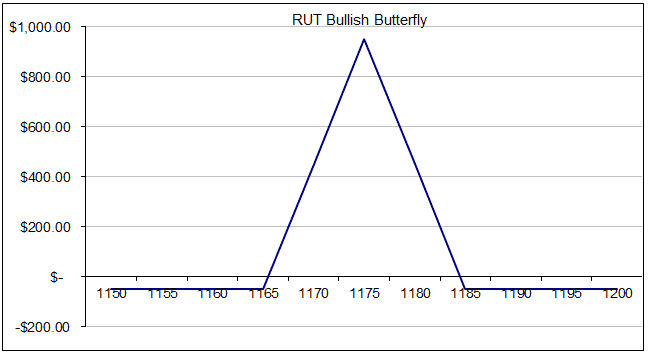

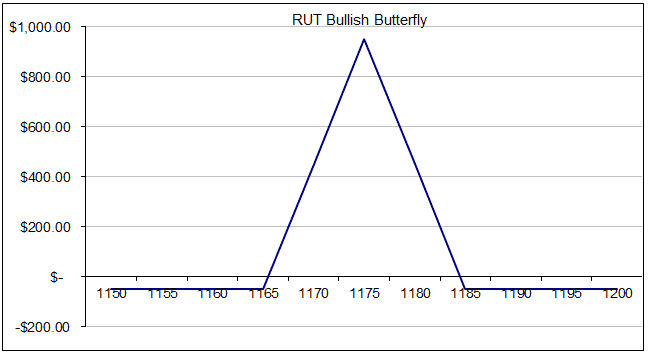

Trade: RUT Bullish Butterfly

Date: February 14, 2014

Current Price: $1146

Trade Set Up:

Buy 2 RUT Feb 20th, 1165 calls @ $1.40

Sell 4 RUT Feb 20th, 1175 calls @ $0.55

Buy 2 RUT Feb 20th, 1185 calls @ $0.30

Premium: $50 Net Debit.

Max Potential Profit: $950.

For less than the cost of dinner for two, you could potentially make enough for a nice weekend away to somewhere exotic!

Check out my new book to learn more about butterfly spread such as this. Topics covered include:

– How to Successfully Leg Into a Butterfly

– Adjusting Butterfly Trades

– Butterflies and the Greeks

– How to Pick Entry and Exit Signals

– Using Directional Butterflies for Low Risk High Reward Trades

– Using Bearish Butterflies for Any Market Environment

– Why Broken Wing Butterflies are the “One-Size Fits All” Strategy