Check The Answers and Tally Your Score?

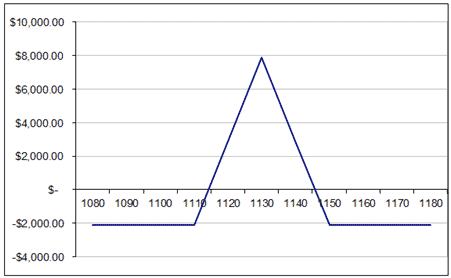

Q1. Which of the following two positions has higher gamma risk?

Current Price: $1130

Trade Details: RUT 15 Day Call Butterfly Spread

Buy 5 RUT June 12th $1110 calls @ $31.00

Sell 10 RUT June 12th $1130 calls @ $16.90

Buy 5 RUT June 12th $1150 calls @ $7.00

Premium: $2,000 Net Debit

Current Price: $1130

Trade Details: RUT 50 Day Call Butterfly Spread

Buy 5 RUT July 17th $1110 calls @ $42.50

Sell 10 RUT July 17th $1130 calls @ $28.90

Buy 5 RUT July 17th $1150 calls @ $17.90

Premium: $1,300 Net Debit

Answer:

The first position, the June 12th butterfly has a higher gamma risk.

Shorted dated options have a higher gamma exposure than longer dated options. You can read more here: https://optionstradingiq.com/gamma-risk-explained/

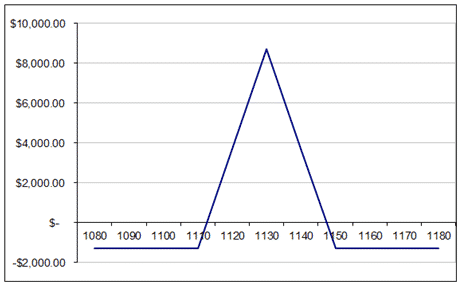

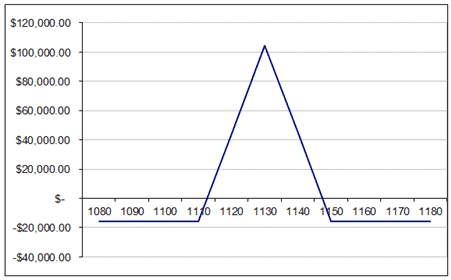

Q2. Which of the following two positions has a higher gamma risk?

Current Price: $1130

Trade Details: RUT 50Day Call Butterfly Spread

Buy 60 RUT July 17th $1110 calls @ $42.50

Sell 120 RUT July 17th $1130 calls @ $28.90

Buy 60 RUT July 17th $1150 calls @ $17.90

Premium: $15,600 Net Debit

Current Price: $1130

Trade Details: RUT 50 Day Iron Condor

Buy 10 RUT July 17th $1000 puts @ $3.20

Sell 10 RUT July 17th $1020 puts @ $4.20

Sell 10 RUT July 17th $1210 calls @ $2.25

Buy 10 RUT July 17th $1230 calls @ $0.95

Premium: $2,300 Net Credit. $17,700 Capital at Risk

Answer:

The first image (butterfly spread) has a higher gamma risk than the second picture (iron condor).

Generally speaking, positions with a tent shaped profit graph will have higher gamma risk than positions with a flat payoff graph, given the same expiry date.

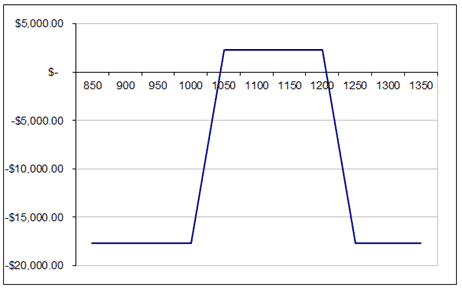

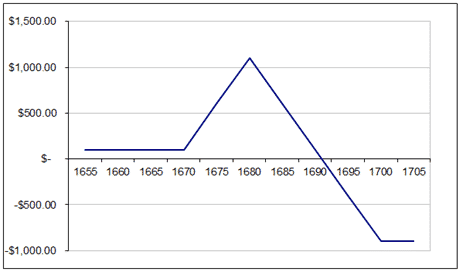

Q3. What is this strategy called?

Answer:

This strategy is called a broken wing butterfly and is commonly used by professional traders.

It is sometimes referred to as a skip strike butterfly because of the way the trade is set up. A regular butterfly has the bought options an equal distance from the sold options, whereas a broken wing butterfly will skip a strike on one side of the trade. This reduces the cost and in some cases will actually result in a net credit, meaning you can use it as an income trade. The above broken wing butterfly is set like this for example:

Buy 1 SPX Aug 15th $1670 call @ $9.85

Sell 2 SPX Aug 15th $1680 calls @ $7.25

Buy 1 SPX Aug 15th $1700 call @ $3.65

Notice that we skipped over the 1690 strike and instead bought the 1700 call.

You can learn more about broken wing butterflies here: https://optionstradingiq.com/butterfly-course-part-7-broken-wing-butterflies-one-size-fits-all/

Q4. In which of the following scenarios can European options be exercised early:

– A dividend is payable

– There is a stock split

– Bankruptcy

– None of the above

Answer:

European options can never be exercised early. In the US only index options are European style so there are no dividends, stock splits or bankruptcy. If you got this question wrong, I suggest you read this article which explains some of the key points regarding index options.

https://optionstradingiq.com/index-options-vs-etf-options/

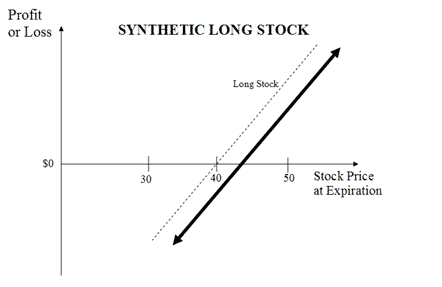

Q5. Buying an at-the-money call and selling an at-the-money put is equivalent to:

– Long stock

– Long straddle

– Short stock

Answer:

Buying an at-the-money call and selling an at-the-money put is equivalent to being long the stock as you can see below:

Q6. You are short a naked 1140 RUT call that you sold for $2.00. The call expires on Thursday June 19th. On Thursday, RUT closes at 1145. On Friday, RUT opens at 1148.

How much did you lose on the trade?

Answer:

This was a bit of a trick question. We cannot calculate the amount of gain or loss on the trade without the index settlement value. The index settlement value can be different to both the Thursday closing price and the Friday opening price.

The calculation for the settlement price is based on the opening price of each individual component in the index on the Friday morning. This is not the actual opening price of the index and can sometimes vary widely from the opening index price. You can learn more about the process here as well as see past examples:

https://optionstradingiq.com/how-does-index-options-settlement-work/

Settlement prices for index options are published on the CBOE website here:

http://www.cboe.com/data/Settlement.aspx

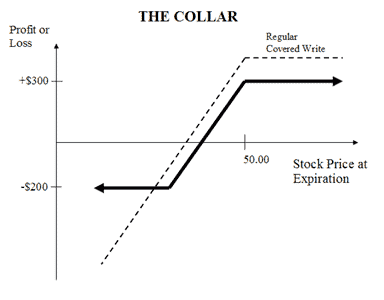

Q7. What is the following strategy called?

– Long 100 shares, Short 1 OTM call, Long 1 OTM put

Answer:

This strategy is called a collar and has a payoff diagram that look like this:

A collar is basically a covered call position with an out-of-the-money put to protect the downside.

Q8. Selling 3 delta iron condors is an attractive risk/return proposition?

– True

– False

Answer:

False. A 3 delta iron condor is not an attractive risk/return proposition. It is equivalent to picking up pennies in front of a steamroller. It may work for a while, but then when it doesn’t you will get absolutely flattened. Trading 10 delta iron condors provides a much better risk/return profile.

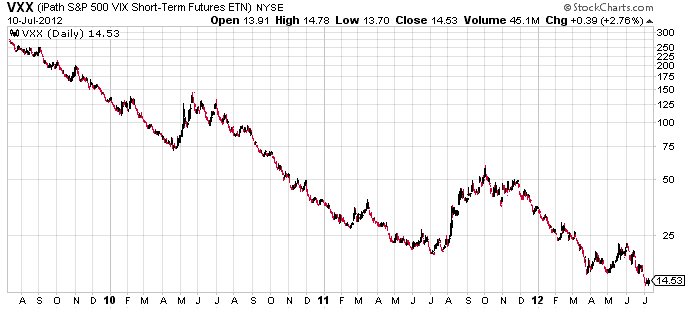

Q9. Buying and holding VXX is an excellent way to protect against a market crash

– True

– False

Answer:

False. It’s true that VXX will perform well during a market crash, but buying and holding VXX over the long term is a terrible idea. Just look at the below price chart. Even the term sheet for the product says, “If you hold your ETN as a long-term investment, it is likely that you will lose all or a substantial portion of your investment.” Wow, sounds great, where do I sign up!!

Q10. List the relevant volatility index for the following products

– RUT

– SPX

– NDX

– AAPL

– GLD

Answer:

VIX is commonly referred to as the volatility index and while it is based on the S&P 500, it does give a good view of overall market volatility. However, each of the above instruments has their own volatility index. These are:

RUT – RVX: Russell 2000 Volatility Index

SPX – VIX: S&P 500 Volatility Index

NDX – VXN: Nasdaq 100 Volatility Index

AAPL – VXAPL: Equity VIX on Apple

GLD – GVZ: Gold ETF Volatility Index

You can see more volatility indexes on the CBOE website at http://www.cboe.com/products/Cash-SettledIndexOptions.aspx#Volatility

Tally Your Score:

Give yourself 1 point per correct answer.

0-2 Back to the drawing board Chief, you’ve got a long road ahead.

3-5 You know enough to be a danger to yourself. Tread carefully.

6-8 Very good young padawan, but much to learn you still have.

9-10 Congrats! You are ready to make it as a professional option trader.