Welcome to Part 1 of the Options Trading IQ Iron Condor Course.

The Iron Condor is an income strategy that profits if the underlying stock or index stays within a certain range over the life of the trade.

Over the course of any trade, stocks can move one of five ways:

Up a lot

Up a little

Sideways

Down a little

Down a lot

Stock investors make money in the first two of the above five scenarios.

Simply put, if you buy a stock, you only make money when the share price increases.

Conversely Iron Condors can make money regardless of stock direction.

This is so long as the stock stays rangebound.

They will make money in the middle 3 situations.

An Iron Condor is actually a combination of a Bull Put Spread and a Bear Call Spread.

What Is An Iron Condor?

An Iron Condor is actually a combination of two trades. A Bull Put Spread and a Bear Call Spread.

BULL PUT SPREAD

The Bull Put Spread strategy involves selling a put option and buying another put option with a lower strike price in the same expiry month.

As the name suggests, this is a bullish option strategy.

Your outlook on the underlying stock is neutral to slightly bullish. Let’s looks at an example:

ABC stock is trading at $47.50 in September.

A trader thinks that ABC will not fall below $45 before October options expiration.

He enters a Bull Put spread by selling an October $45 put for $2 and buying an October $40 put for $1.

The net premium received in the traders account is $100 ($1 x 100 shares per contract).

The maximum risk on the trade is $400 ($5 difference in strike prices, less $1 premium received times 100)

At expiry, if ABC finishes above $45, the trader keeps the $100 premium for a return of 25% on capital at risk.

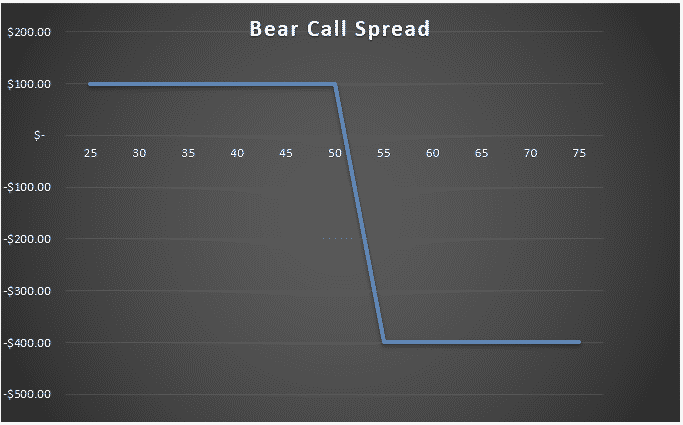

BEAR CALL SPREAD

The Bear Call Spread strategy involves selling a call option and buying another call option with a higher strike price in the same expiry month.

This is a bearish option strategy.

Your outlook on the underlying stock is neutral to slightly bearish. Let’s looks at an example:

ABC stock is trading at $47.50 in September.

A trader thinks that ABC will not rise above $50 before October options expiration.

He enters a Bear Call spread by selling an October $50 call for $2 and buying an October $55 call for $1.

The net premium received in the traders account is $100 ($1 x 100 shares per contract).

The maximum risk on the trade is $400 ($5 difference in strike prices, less $1 premium received times 100)

At expiry, if ABC finishes below $50, the trader keeps the $100 premium for a return of 25% on capital at risk.

PUTTING IT ALL TOGETHER

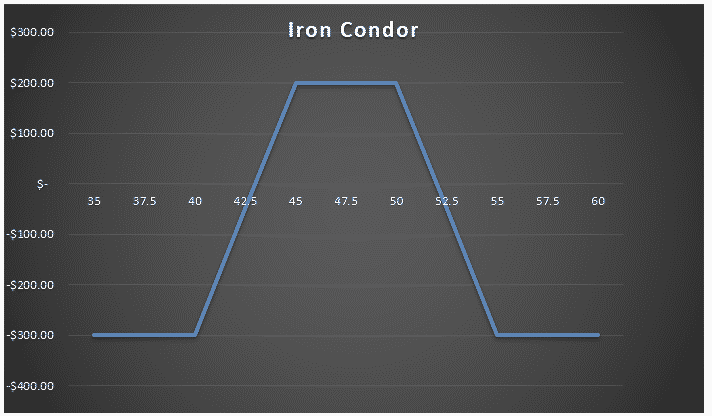

Placing the above two trades together creates and Iron Condor.

In this example, the trader is betting that ABC will stay somewhere between $45 and $50 between now and October expiration.

If that occurs, the trader keeps the total $200 in premium.

One advantage of Iron Condors is that you can essentially receive double the income for the same amount of risk.

If you place the Bull Put Spread or Bear Call Spread in isolation, the maximum risk would be $400.

If you placed both at the same time to create an Iron Condor, your capital at risk slightly less because of the 2 lots of premium you are bringing in.

Let’s look at the details of an Iron Condor using the above examples:

Maximum Profit = $200

Maximum Loss = $300

Potential Return = 66.67%

That’s it for today. In Module 2 we’ll look at the philosophy behind trading iron condors.

Have a great day!