Welcome to Module 2 of the Options Trading IQ Iron Condor Course.

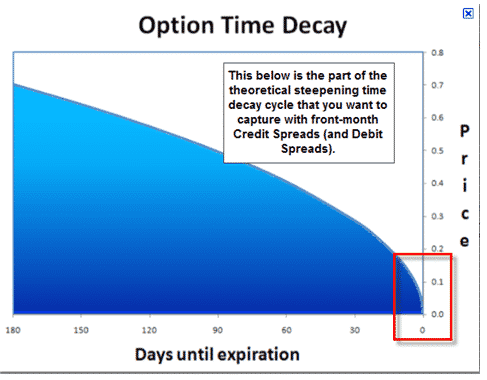

Options are a wasting asset and they begin to lose value as their life cycle decreases.

This time decay is known as theta.

Time decay is constant, but speeds up as the option approaches its expiration date.

We can see this in the diagram below.

If the underlying does not move, an at the money option will slowly loose its value at an increasing pace until it expires worthless.

By selling options, iron condor traders take advantage of this time decay or theta. Despite this, it is not without risks. While this trade is long theta and makes money

when nothing happens, it is also short gamma. Gamma expresses the risk of a large move in the underlying and is the opposite of theta.

So Why Should I Make Money?

Trading iron condors is a lot like acting as an insurance company – we receive a premium for being the selling of the insurance.

In most cases nothing happens, and we simply get to pocket the premium.

Despite this we are on the hook in the event of a large market move.

While a large payout (loss) may not sound good to you, generally iron condors are a very profitable option strategy. This is because, like insurance, options are usually overpriced.

There are ways to protect yourself and also hedge away some of the risks, which we will discuss in Part 3 of the course.

Some of the key advantages of trading iron condors include:

NON-DIRECTIONAL – The best thing about trading Iron Condors is that you don’t have to be correct on the direction of the market.

Trading directionally is difficult because it is easy to succumb to individual biases and rely on information that is already public and priced in.

In contrast Iron Condors can be traded with no directional view, allowing the investor to trade off data and not hunches.

CONSISTENT MONTHLY INCOME – Iron Condors, when done correctly, provide a consistent monthly income.

This is because like an insurance company the most common scenario is simply collecting the premium.

While payouts do occur, over the long run an insurance provider will always be compensated for the insurance they provide.

AVOIDS OVERTRADING – Another thing I really like about Iron Condors is you only need to place a few trades every month.

I have struggled with overtrading in the past, which is something that diminishes returns for a lot of traders. Iron Condors are almost like “set and forget” trades.

This is because they often don’t require any further action once the trade is placed.

I actually find Iron Condors very boring, and I have to remind myself occasionally that I don’t need to trade every day, or even every week for that matter.

LESS STRESS – In my experience, fewer trades means less stress. Yes, large market crashes will cause you some stress with your Iron Condors.

Despite this, unlike other volatility strategies like a short strangle the risk is defined with Iron Condors.

Therefore, even if the trade moves against you still have a threshold for maximum risk, allowing you to sleep easy

EASY TO MANAGE – Despite having multiple legs Iron Condors are actually a pretty simple strategy to manage.

Upcoming Modules will show how It’s easy to set up your trading rules for entry, exit and adjustment based on predefined criteria.

What are the Risks of Iron Condors?

In Module 3 of the course we will discuss the risks of iron condors and how you can manage them.