Bootcamp Day 1 – Greeks and Greek Ratios

Bootcamp Day 2 – Technical Analysis

Bootcamp Day 3 – Options Portfolio Management

Well, well, well. We covered a lot of detail yesterday, did it all sink in? If not, drop me a line and I can clarify any questions you have.

In yesterday’s article, we looked at how to manage a portfolio of options trades. We delved even deeper in to the Greeks, Greeks ratio and the important Delta Dollars metric.

Today is day 4 of our 5 day bootcamp and we’re going to look at how to adjust trades that get in to trouble.

Getting good at adjustments is one of the most important skills you can develop as an option trader.

We’re going to look at a typical iron condor that has seen the market rally and is putting the call side under pressure. This is a pretty common situation that many traders have faced over the last 6-7 year bull market run.

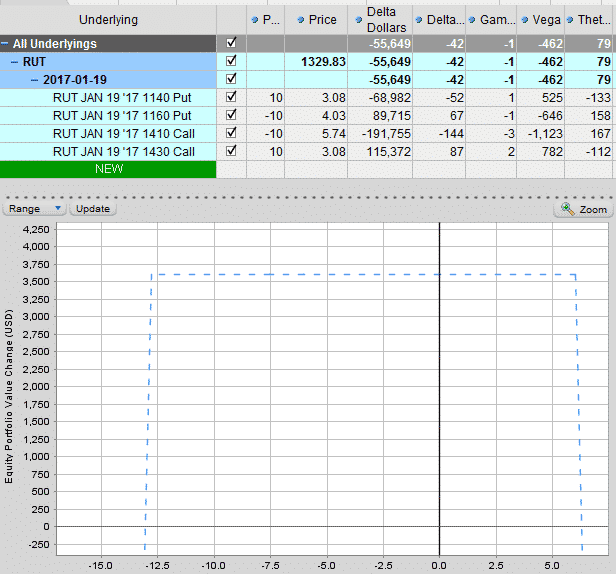

This trade was entered when the RUT was about 1280. It has since rallied 50 points to 1330 in a short space of time. Ouchy!

Take a look at that Delta/Theta ratio, it’s at 50%, so we definitely need to do something with this trade.

I’m going to list out 10 potential adjustment strategies that could be used and then I’ll look at a couple of them in detail.

- Rolling the non-threatened side closer to the money

- Adding contracts to the non-threatened side

- Adding a debit spread to create a “cat ear”

- Adding a debit spread to create a larger profit zone

- Adding a long call in the next expiry month, same strike as the short calls

- Adding a long call in the next expiry month, same strike as the long calls

- Adding a call calendar spread centred at the short call strike

- Adding a call butterfly centred at the short call strike

- Rolling up both the put spreads and calls spreads up

- Rolling the calls up and out to the next expiry month

If some of that sounds confusing, don’t worry, I’ll be going through these techniques in much more detail shortly.

For now, my analysis of the market tells me that the RUT is likely to trade sideways to slightly higher over the next couple of weeks. We’ve had a really strong run up so I don’t expect prices to rise too much further, but they could gain another 3-4%.

I also don’t expect a sharp pullback. Momentum has been really strong and any selloffs are likely to be bid back up pretty quickly.

The first adjustment we will look at is #2 Adding contracts to the non-threatened side.

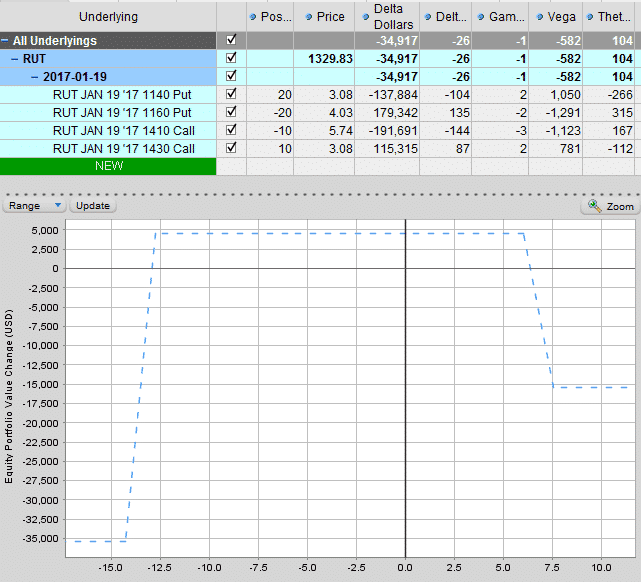

When I start an iron condor, I like to keep some dry powder for adjustments. In this case, I started with only a half allocation. Now that the trade needs adjusting, I can go to a full allocation on the put side and add 10 more contracts and leave the calls as they are. This increases capital at risk on the downside, but gets our Delta and Delta/Theta Ratio back to a more reasonable level.

Vega has increased from -462 to -582 and Theta has also increased from 79 to 104.

By selling another 10 put credit spreads, we have increased the profit potential by $950.

We could have also sold the second lot of 10 put spreads closer to the market if we were supremely confident that the market would not fall too far. This would bring Delta down even further and increase the amount of premium we receive.

- PROS

- Delta is significantly reduced

- More income potential in the trade

- CONS

- Capital at risk on the downside has doubled

- Higher Vega exposure (although Vega/Theta ratio has been reduced slightly)

- When to Use?

- Early on in the trade as you are building up to your full allocation

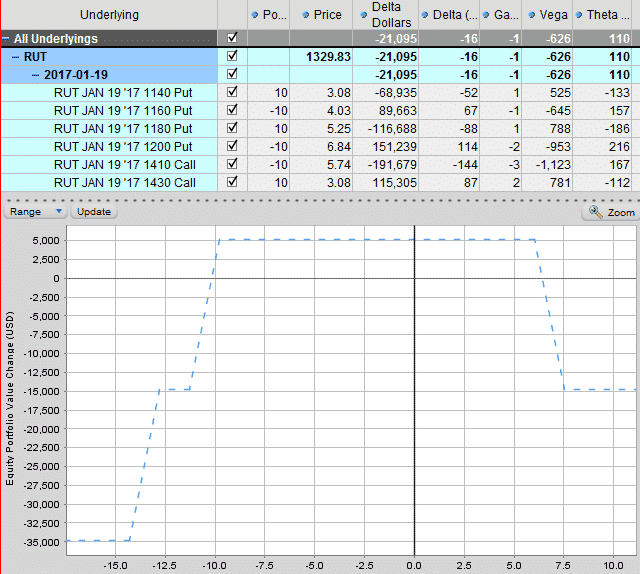

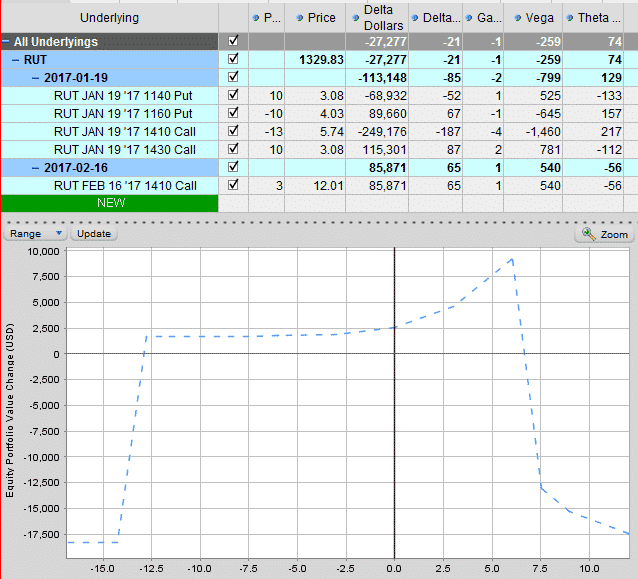

The second adjustment we will look at is #7 Adding a call calendar spread centred at the short call strike

Adding some calendar spreads around the short call strike reduces Delta, reduces Vega and can increase Theta so this can be an attractive adjustment technique. The downside is that the income potential on the downside is greatly reduced.

When using this technique I usually use a ratio of 2-3 calendar spreads for every 10 iron condors.

Delta has been cut in half from -42 down to -21 so our directional exposure is greatly reduced.

This strategy can pay off handsomely if the market slowly rallies up in to the calendar spread area.

- PROS

- Very nice profit zone if the market continues to trend higher

- Cuts Delta and Vega exposure while also increasing Theta (potentially)

- CONS

- Can be expensive and cut into the income if the market reverses

- When to Use?

- If you think the stock or index will finish around the short strike

- When volatility is low and you are expecting and increase

There you go, a couple of adjustment ideas that perhaps you hadn’t thought about. Shoot me a replay email and let me know what you think about these strategies.

You can also review this document to see all 10 adjustments strategies in action.

Happy trading!

Gav.