Bootcamp Day 1 – Greeks and Greek Ratios

Bootcamp Day 2 – Technical Analysis

Day 3 of Bootcamp and today we’re going to be talking about Options Portfolio Management.

We’ll cover Diversification, Portfolio Allocation and Managing by the Greeks.

There are two schools of thought when it comes to Options Portfolio Management.

- Trade Small, Trade Often

- Trade Big, Trade Less

Both are valid strategies and have pros and cons associated with each. There’s no right or wrong answer and it comes down to personal preference.

Trade Small, Trade Often is the Mantra of the Tasty Trade network. One thing to keep in mind is that by encouraging people to trade more, they are exposing those traders to higher fees, which is good for ToS!

Trading small and having a large number of trades provides diversification. However, be careful! 20 different trades will all perform fairly similar in the event of a market panic.

In that case, you will be madly rushing trying to close or adjust 20 trades.

TRADE BIG, TRADE LESS

Instead of having twenty $2,000 trades on individual stocks, why not have one trade on an index worth $40,000 and watch it like a hawk?

The twenty trades mentioned previously are going to perform pretty similarly anyway.

Personally, I prefer to trade bigger and have less trades. Less trades means less commissions, less monitoring and easier adjustments.

Something in the middle could work also. Say, five to ten trades risking $4,000 to $8,000.

You need to figure out what works for you, but hopefully this has given you some food for thought.

DIVERSIFICATION

Diversification can be tough if you’re just trading iron condors. I mean how different is an AAPL condor going to be from a FB condor or even an SPY condor?

There are four main ways to diversify an options portfolio

- Different asset classes (SPY, GLD, TLT, USO etc.)

- Different geographic regions (SPY, EEM, FXI)

- Different trading strategies (short vega, long vega etc.)

- Different timing on trade entries (day 1, 3, 5, 8 etc.)

It is very hard to diversify your exposure when trading individual stocks. Most stocks will have a Beta very close to the S&P 500.

ETF’s like GLD, TLT and USO will have a much greater Beta differential and in some cases even have negative Beta so this can help you diversify more than trading SPY, AAPL and FB.

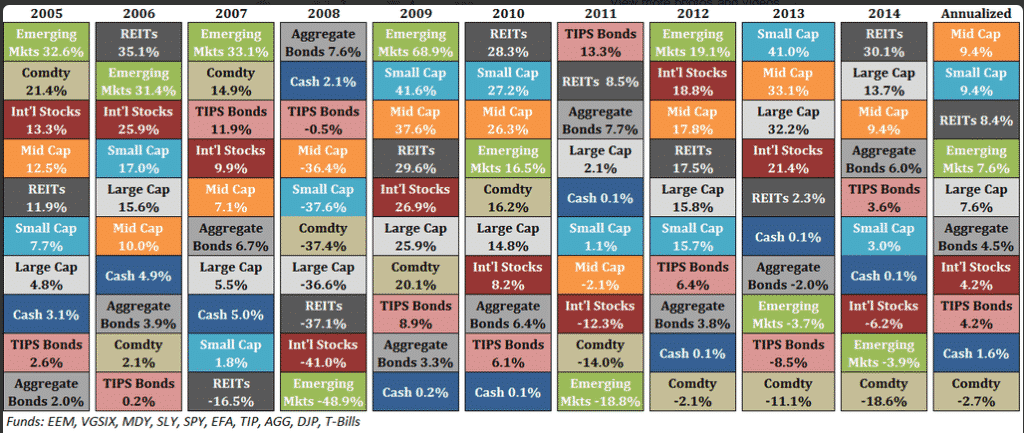

You can see that in any year you can have a wide variety of returns across different asset classes and regions.

Diversification with options can also come in the form of different trading strategies. You really don’t want to be a one trick pony in this game.

Not every year will be a great year for iron condor traders.

It pays to have around 4-5 core strategies that you are proficient in that will perform differently depending on the market environment.

Iron condors perform well when stocks trade sideways. They get hurt when there is a volatility spike or a sustained rally.

It makes sense to diversify a portfolio containing mostly iron condors, by adding some long Vega trades.

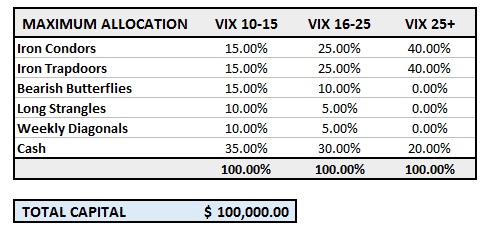

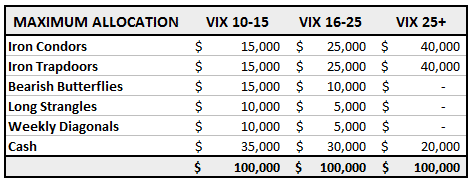

Here is an example of how you might allocate a portfolio of option trades depending on the level of market volatility. You want to be skewed towards short Vega trades when volatility is high.

The final diversification method we’ll talk about is diversifying through trade timing.

Let’s say you have $20,000 to allocate to iron condors for the month.

You enter the trade on the 1st of the month and the next day the market tanks. Not ideal!

A way to spread the risk is to enter four $5,000 trades over the course of the week. Entering trades on the 1st, 2nd, 4th and 5th can help spread the risk.

You may end up with different strikes for each condor, so you also need a method to monitor and manage them.

The other way to diversify through timing is to spread out the expiry dates.

Instead of allocating all $20,000 to 30 day condors, you could allocate $10,000 to the front month and $10,000 to a 60 day condor.

The 60 day condor has lower gamma and will not move as quickly as the 30 day condor.

When a market move comes, you may only have to adjust the 30 day trade.

PRO TIP #1

Making money in the market is actually pretty easy.

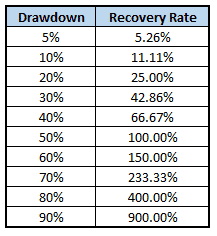

Where the challenge comes, is avoiding big losses.

Big losses will kill your portfolio. Cut losses before they get out of control.

MANAGING BY THE GREEKS

We talked earlier about allocating trades based on the level of volatility. This can help diversify your exposure to volatility, but there are many factors affecting how an options portfolio will perform.

Managing by the greeks means using multiple strategies to keep the Greeks within a certain range individually, and also in relation to each other.

For example, by keeping Delta low in relation to Theta, we can ensure that time decay is more of a driving force in the portfolio compared to Delta.

A good rule of thumb is to keep Delta to less than 20% to 30% of Theta.

This makes sense for RUT, but it doesn’t work for every instrument.

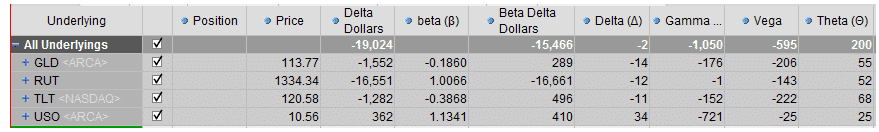

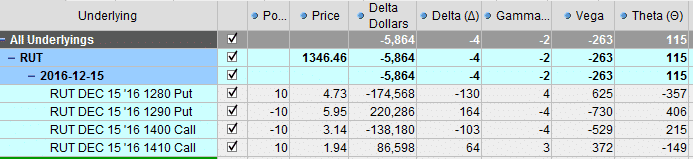

This trade looks good. Delta is less than 4% of Theta and Vega is only 250% of Theta. Those are nice looking greeks.

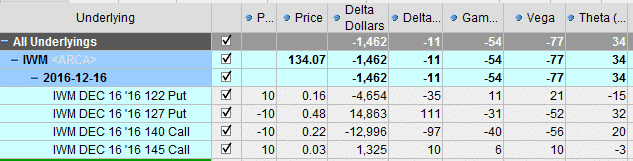

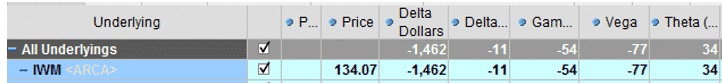

Let’s compare the RUT trade with an iron condor on IWM. Notice that the trade is pretty neutral, but the Delta / Theta ratio is at 30%, much higher than in RUT. Why the difference?

The key is to normalize delta by using Delta Dollars.

Delta Dollars is simply the Delta value x the stock or index price.

IWM -10.9 x 134.07 = -$1,462

This is the dollar exposure you have to the direction of IWM. Roughly speaking, if IWM goes up by 1% this trade will lose 1% x $1,462 = $14.62

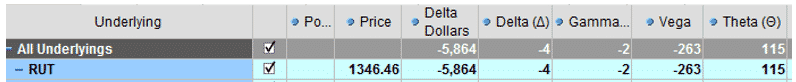

RUT -4.35 x 1346.46 = -$5,864

If RUT goes up by 1%, this trade will lose 1% x $5,864 = $58. * Assuming no change in volatility and time to expiry.

To normalize Delta, we can use Delta Dollars and a factor of $1,000.

RUT normalized Delta / Theta Ratio -5.864 / 115 = 5.10%

IWM normalized Delta / Theta Ratio -1.462 / 34 = 4.30%

IWM normalized Delta / Theta Ratio -1.462 / 34 = 4.30%

PRO TIP #2

Keeping your normalized Delta / Theta ratio below 20-30% will hold you in good stead and help prevent big losses.

Once that ratio gets above those levels, losses can accelerate really, really quickly if the market continues to move against you.

BETA DELTA DOLLARS

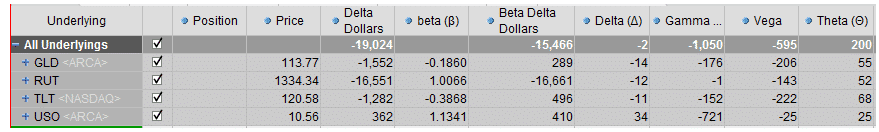

If you want to really take things to the next level, you can also look at Beta Delta Dollars.

Here, we’re just taking the Delta Dollar amount and multiplying by the beta. This gives us our general market exposure.

As GLD and TLT have negative beta, a negative Delta Dollar value actually means they will lose money if stocks fall (generally speaking).

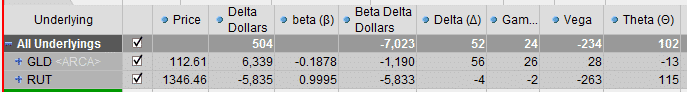

Looking at the below simple portfolio, you might think that you have very little directional risk, given that overall Delta Dollars is near zero.

Looking at the below simple portfolio, you might think that you have very little directional risk, given that overall Delta Dollars is near zero.

However, that is not the case. s gold tends to move in the opposite direction to stocks, the Beta Weighted Delta Dollars is actually negative for both positions.

Theoretically, both positions will lose money if stocks rally.

That’s it for today guys, stay tuned tomorrow when we’ll be looking at Adjustment Techniques.

Trade safe!

Gav.