Bootcamp Day 1 – Greeks and Greek Ratios

Bootcamp Day 2 – Technical Analysis

Bootcamp Day 3 – Options Portfolio Management

Bootcamp Day 4 – Adjustment Techniques

We covered a lot so far in our bootcamp and today we’re going to have some fun!

We’ll take a look at some advanced strategies, tricks and techniques.

Should be fun! You ready to rock and roll?

IRON CONDOR HEDGING

Anyone who has traded an Iron Condor will know that one of the worst things that can happen, is for the stock to make a big move in the first few days of the trade.

An Iron Condor is a neutral trade and a big move early in the trade means the position is underwater from the start and you end up fighting the trade for the next few weeks.

We can hedge some of that risk, by adding some Long Strangles.

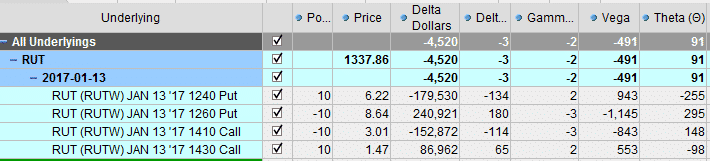

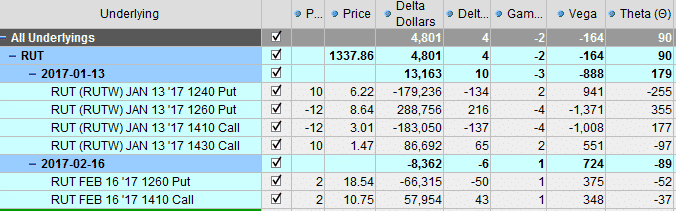

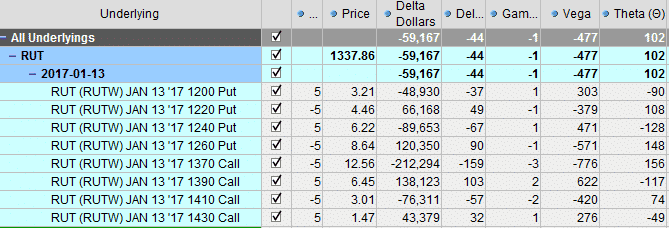

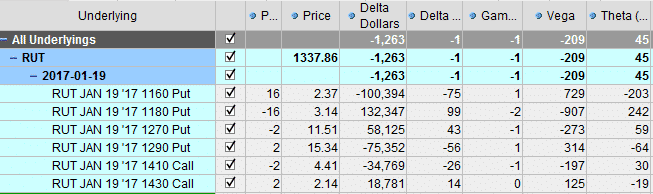

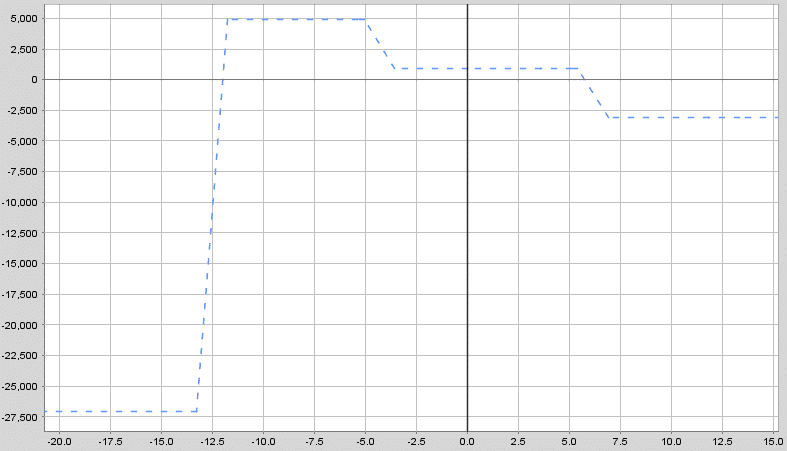

Here we have a typical 1 month Iron Condor. Notice the Negative Vega. Also, the purple line below shows the position in 3 days time. If the market makes a 3% move either way, the trade is down around between $1,000 and $1,500. And this is without taking into account any changes in volatility.

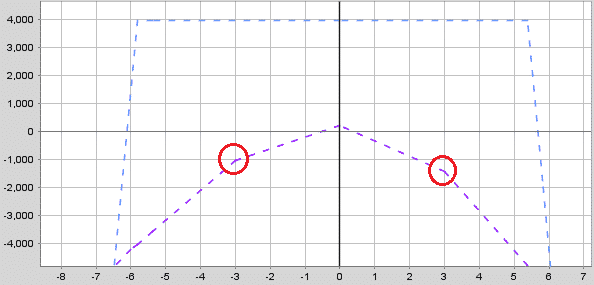

In order to hedge the risk of a big move early in the trade, we can add some Long Strangles.

We want to go further out in time to minimize the impact of time decay.

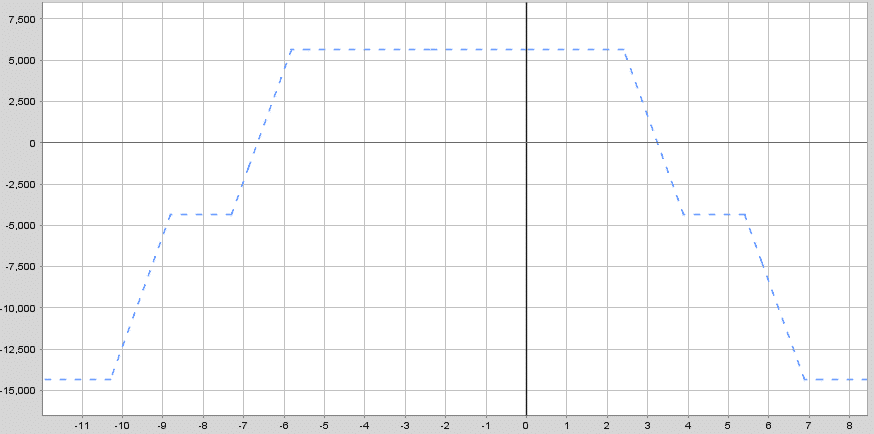

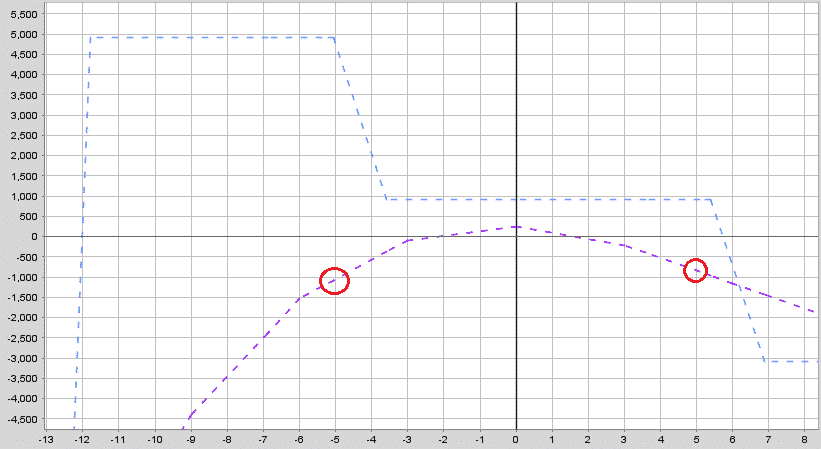

Notice that Delta and Gamma are the same, but Vega has come down significantly. The trade off is that we are giving up a little bit of Theta.

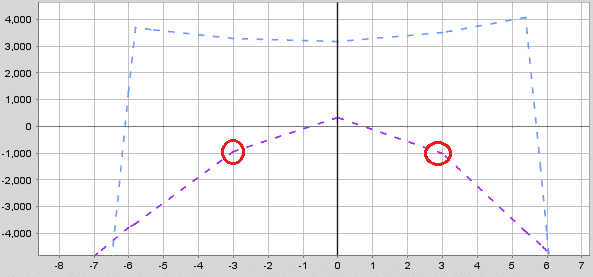

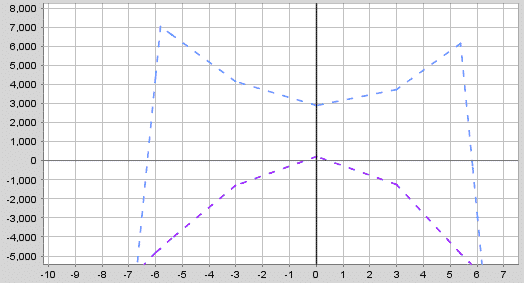

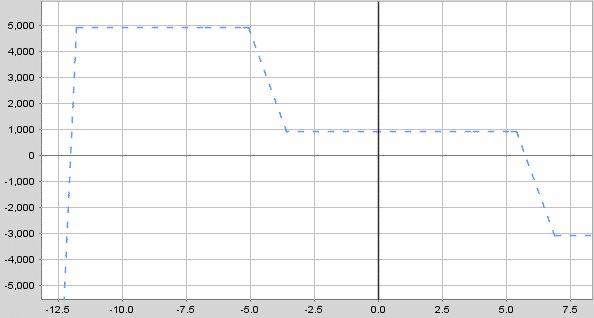

The new diagram looks like this. Note that if RUT makes a big move, the losses will be slightly less by having the hedge.

The new diagram looks like this. Note that if RUT makes a big move, the losses will be slightly less by having the hedge.

Note that, if volatility rises, the hedge will perform better than what is shown below.

To avoid the effects of time decay, I usually close the hedge after about 3-5 days.

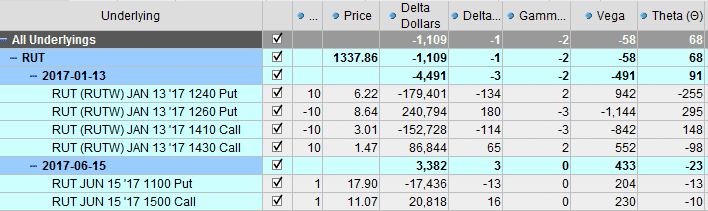

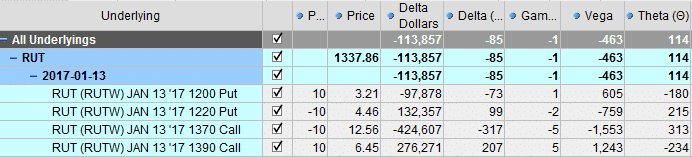

Another method for hedging some of the Vega risk in an Iron Condor is to add a couple of calendar spreads around the short strikes.

In this example, Vega has come down from -491 to -164 without giving up any Theta.

IRON CONDOR LAYERING

Another advanced technique is called layering. Let’s take a look at another Iron Condor that has gotten in to trouble on the call side. Just look at the Delta and also the Delta/Theta ratio!

Instead of going in to the trade with a full allocation of 10 contracts, this trader could have started with 5 contracts and then added another 5 after the market had moved.

While this trade is still under pressure, it is under much less pressure than the initial trade.

IRON TRAPDOOR

I’ve developed a strategy I call an Iron Trapdoor which I tend to prefer over Iron Condors these days.

The trade is designed to handle fast rising markets better than a condor.

With stocks generally rising over the last few years, a lot of people have had trouble with the call side of their Condors.

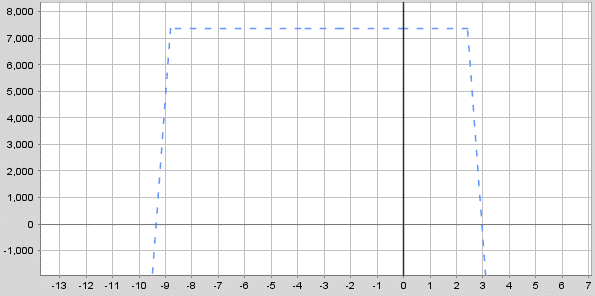

The Iron Trapdoor handles strong up moves much better than a Condor.

It also required less management and adjustments than an Iron Condor.

And here’s a zoomed out version so you can see the full capital at risk.

Compared with the Iron Condor, this position can withstand a 5% move before the $1,000 loss level is reached.

WEEKLY DIAGONAL SPREADS

A strategy that I like to use then a stock or index has made an extreme move up is a weekly diagonal spread.

The beauty of this trade is that it has the potential to make money if the stock goes up or down, depending on the timing.

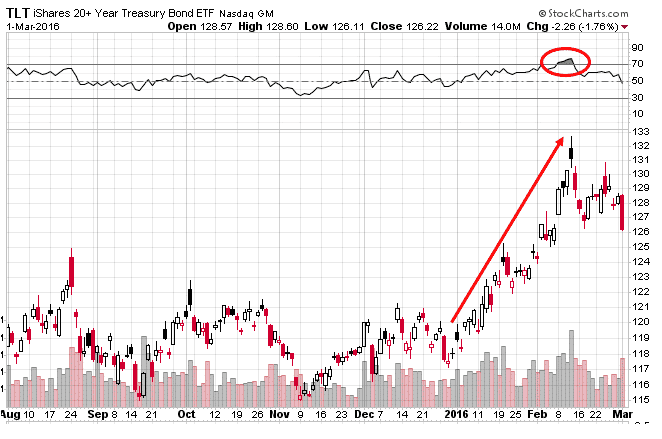

In Feb 2016, TLT had experienced a massive run up over the course of 6 weeks.

My theory was that the stock could potentially drift a little higher, or pullback. The chances of a further large rally were small.

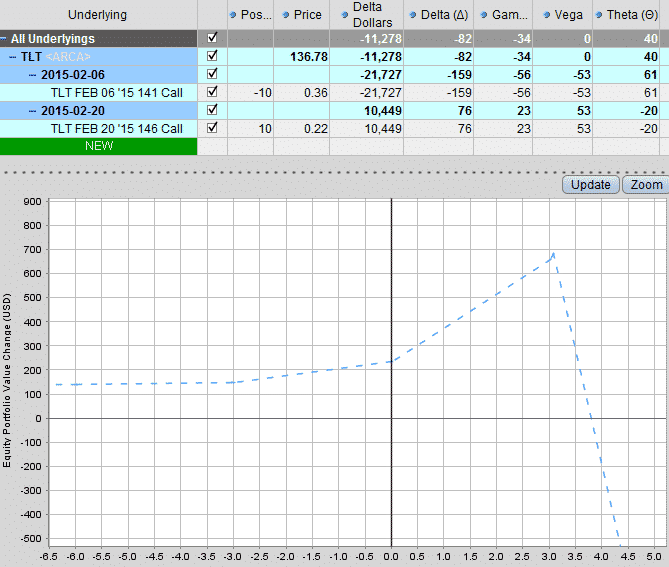

Here’s the trade. Capital at risk was around $5,000. Income potential on the downside was 2.8% with the chance of higher profits if TLT moved 1-2% higher over the next week.

TLT ending up dropping and I let the trade expire worthless for a 2.8% gain.

What do you think of these strategies and techniques? Let me know in the comments below.

Well, that’s it for the 5 day bootcamp, it’s been a blast, I hope you’ve enjoyed it and learned a lot!

Let’s recap some of the things we’ve learnt during this bootcamp.

- Greeks – Delta Dollars, Greek Ratios

- Technical Analysis – Using Multiple Timeframes, Moving Averages, Divergence

- Portfolio Management – Trade Small or Trade Big, Diversification, Managing by the Greeks

- Adjustment Techniques – 10 Ideas for Adjusting Iron Condors

- Advanced Options Trading – Iron Condor Hedging, Layering, Iron Trapdoor, Weekly Diagonals

Hope you learned a lot over the last 5 days. I’ll be covering all this stuff in a lot more detail over the next few months so you will get plenty of chances to review.

Of course, if you have any questions, just drop me a line anytime, I love hearing from my readers.

Trade safe!

Gav.